Porter, a logistics management startup backed by Sequoia and Tiger Global, has partnered with a few insurance firms and non-banking financial companies (NBFCs) to offer short-term loans and vehicle insurance to its driver partners.

“Every vehicle owner needs vehicle insurance each year and we realised that these drivers partners don't have access to formal capital for amounts like Rs 10,000 or Rs 15,000 per month, that’s when we decided to facilitate ease of financing and insurance through our platform,” Pranav Goel, co-founder, and chief executive officer at Porter, said in an interaction with Moneycontrol.

The main challenge is that banks and NBFCs do not have enough data to do background checks to offer loans. However, Porter’s platform generates a lot of earnings data that helps NBFCs to underwrite loans, Goel said.

For insurance and short-term loans, Porter has tied up with insurtech firms Zopper and Assuretech and with NBFCs like KarmaLife and LenDenclub, Goel said.

“Not everything is monetized. Some ecosystem play within the insurance segment is monetized and we take a small percentage as commission. However, the rest is basically to help our delivery partners access capital or avail other services at a lower cost,” he said.

The firm is also planning to get into the secondhand vehicle facilitation market to offer finance options for trucks and light commercial vehicles (LCVs).

“There is a big demand for secondhand vehicles. But there is discovery, access and financing problem for secondhand vehicles and we are very keenly exploring this segment,” Goel said.

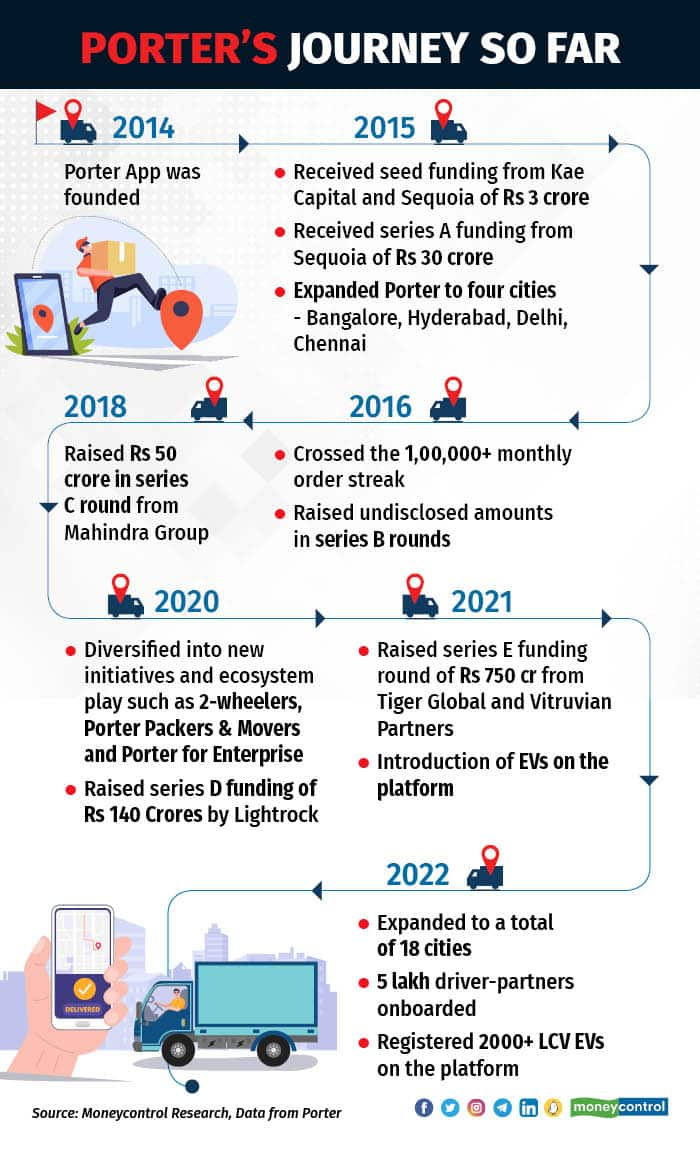

Founded in 2014 by three IIT graduates Pranav Goel, Uttam Digga and Vikas Chaudhary, the company seeks to eliminate the inefficiencies existing in the intra-city logistics market for retail, SME and enterprise consumers with the use of its technology platform.

Business expansion

Porter, which started with services in Bengaluru, Hyderabad, Delhi and Chennai, is planning to touch around 35 cities by 2025. It currently offers two-wheeler, tempo and LCV services to carry goods within cities or same-day intercity logistic services.

The vehicles are available on-demand for retail, SME and large enterprise consumers. “Around 80 percent of business comes from SMEs, 15 percent is consumers and 5 percent enterprise clients,” Goel said.

Porter is also in discussion with various stakeholders and governments to introduce commercial auto services that can help carry loads between 100-200 kg of goods.

“The project we are working on now is finding the right vehicle category that can solve 100-200 kg movement problem…passenger autos can solve but regulations do not allow this. So we are trying to talk to the government,” Goel said.

Around 10 percent of Porter’s revenues come from new cities including Pune, Surat, Kolkata, Jaipur, Lucknow, Kochi, and Nagpur, and the rest from its existing cities like Bengaluru. The firm is also entering cities in the south including Vishakapatnam in the next few months.

The company would continue to hire in the next financial year.

“We are still hiring across segments like product, tech and customer support. We are around 2,600 employees and we will add up another 20 percent,” Goel added.

Transitioning to EVs

By keeping its services on-demand and thereby reducing dry runs and empty returns of vehicles, Porter is saving on cost and helping cut carbon emissions.

“We are saving around 50 crore kilometres annually of empty routes, which leads to cutting around 8 crore kg of carbon emissions. Now, all of this puts less pressure on urban infrastructure as well,” Goel added.

The company is also slowly transitioning to electric vehicles (EVs), especially in the three-wheeler category.

“Transition to EVs is still a little nascent but we have on board around 3,500 EVs across cities, largely Delhi and Bangalore. We have EV presence in other large metros as well,” Goel said.

The only risk that the driver has is he's still not sure how the performance of an EV will stack up over time.

“A vehicle should be in the business for at least 8-10 years to make sense. That period is not available in the market yet, which is a challenge,” Goel said, adding that EVs are costlier but the savings will eventually compensate for the higher cost of the vehicle.

Revenue and path to profitability

Porter’s business was severely hit during the pandemic as it reported a loss of Rs 104 crore in FY20 even as revenue doubled to Rs 274 crore, according to the company’s RoC filings.

However, Goel said the firm is on track to clock revenue of around Rs 2,000 crore in FY23.

“FY25 is when we will be breaking even and turning profitable. In FY23 we will end up doing revenue of close to Rs 2,000 odd crore, which will double in FY24. We would have spent close to Rs 200 crore as investment and next year this number will come down,” Goel said.

He said the firm is well-capitalised and will not be raising any round of funding for the next two years.

In October 2021, Porter raised close to Rs 750 crore from Tiger Global, Vitruvian Partners, Sequoia Capital and Lightrock India in a series E funding round. The company was valued at close to $500 million.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.