Billionaire Anil Agarwal’s commodities giant has slashed net debt by $2 billion in the current financial year as it seeks to soothe investor concern over its liquidity and ability to repay upcoming obligations.

Vedanta Resources Ltd. has achieved half of its three-year planned reduction commitment of $4 billion in the first year, the London-based company said in an exchange filing. It will continue to deleverage from net debt of $7.7 billion in the next two financial years, it said.

Surging interest rates globally have intensified pressure on low-rated borrowers with heavy debt loads like Vedanta, and concerns about a global slowdown have also weighed on the commodities firm. S&P Global Ratings last week flagged the company’s debt scores may “come under pressure” if it’s unable to raise $2 billion and/or sell its international zinc assets.

In the absence of a significant fundraising, Vedanta Resources will be left with very little cash, the assessor said, adding that external funding is “critical” for debt maturities after September.

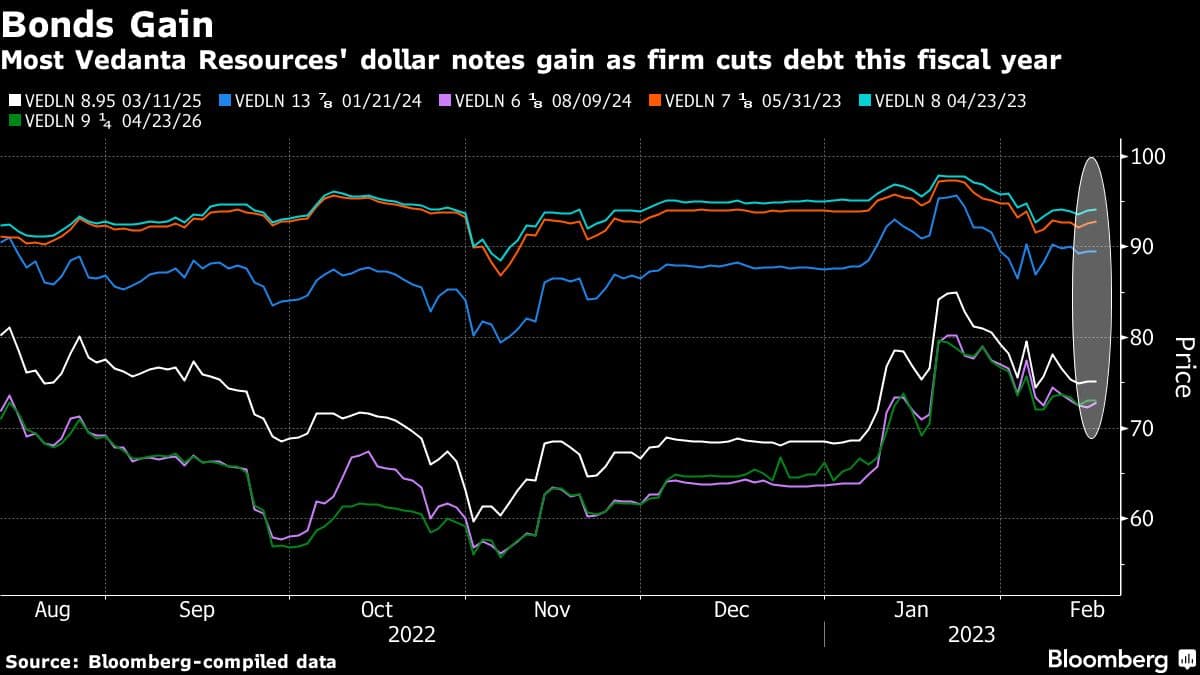

Investors cheered the progress in debt payment with an uptick in most of the the company’s outstanding dollar bonds on Wednesday.

However, the company’s affirmation of plans to raise new borrowings may not fully counter market-access concerns, according to Bloomberg Intelligence analysts Mary Ellen Olson and Sheenu Gupta.

“Timely concrete progress needs to be made to soothe negative rating pressure,” they wrote in a report.

The company plans to cover half of next financial year’s liquidity requirements internally and the rest through refinancing, according to the statement. The commodities firm is delivering healthy cash flows powered by robust Indian consumption, it said.

See also: Adani Group Touts Cash Reserves in Bid to Calm Investors

Vedanta Resources’ next phase of growth will be fueled by its associated companies’ investments into semiconductors, display glass, renewables, optical fiber and transmissions, the company said in the statement.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.