Ruchi Agrawal Moneycontrol Research

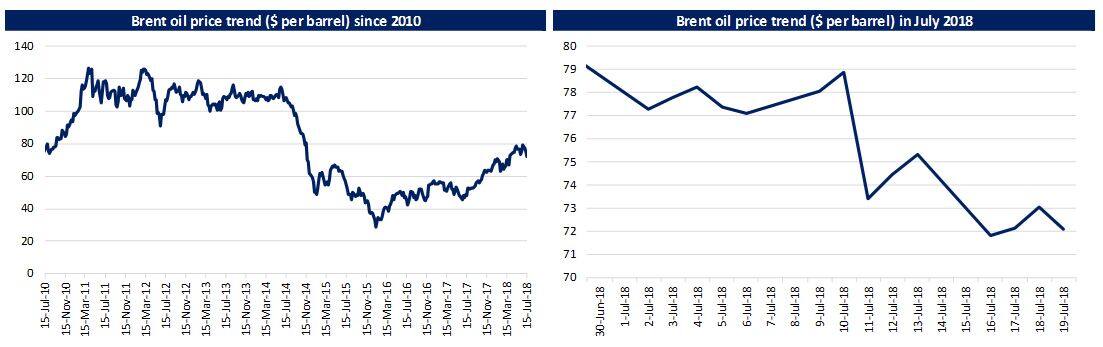

Amid changing global market dynamics, crude oil prices have been on a trampoline lately. The price corrected almost 10 percent in the last 7 days touching $72 per barrel from the highs of $80 per barrel a few days back. Thereafter, there was some uptick in prices. The volatility shows how quickly sentiments change in the market with changing geopolitical dynamics. We take a closer look at various factors that are contributing to the volatility.

Softening of the US' stand on Iranian sanction

The last few months saw the US President Donald Trump's mood swings dictate the global geopolitical scenario bringing in immense volatility. While he repeatedly criticised the Organisation of the Petroleum Exporting Countries (OPEC) for supercilious oil prices, the US' stance on Iranian sanctions also partly led to the oil price surge. This was followed by what seemed to be softening of the stance with opening up of the possibility of negotiations on a case-by-case basis.

The expectation of probable softening of stance and lower-than-expected cut in Iranian barrels from the market cooled off the boiling crude.

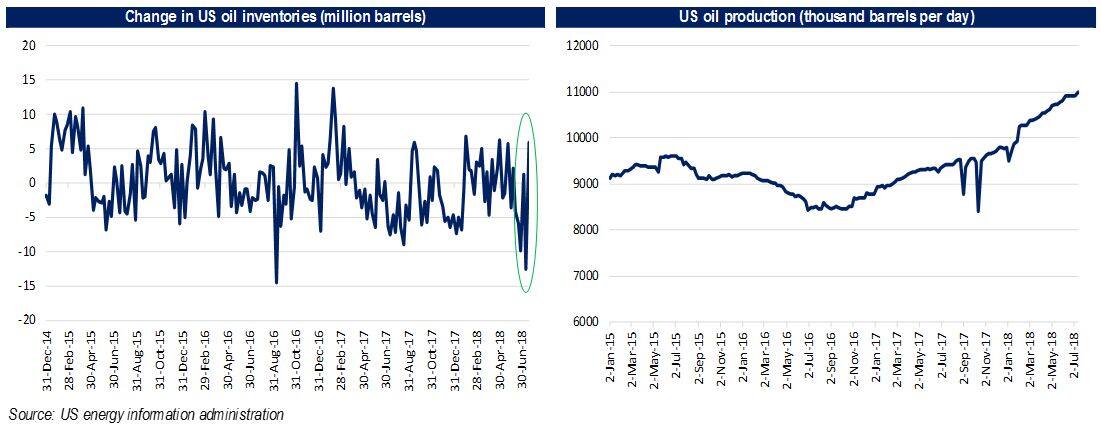

US oil inventories and production

A surprise uptick in the US oil inventories last week coupled with the gradual increase in the US oil production in the last few months was another reason for the softening crude prices. Production from seven major US shale oil formations is expected to rise by 143,000 barrels per day (bpd) to a record 7.47 million bpd in August. This could ease some portion of the supply side pressure.

Indication on the US tapping the strategic petroleum reserves

The US is considering teaming up with other Western countries to simultaneously release emergency oil stock. They are reviewing options ranging from a 5 to 30 million barrels release from its strategic oil reserve to cool pump prices. This is ahead of the congressional elections in November, which coincides with the timeline when sanctions on Iran are due to snap back. Although this move is not imminent, it is seen as a tactic to increase pressure on OPEC to pump more oil.

Production woes reemerge in Venezuela

Amidst tight political and economic environment, two of Venezuela’s four crude upgraders go under maintenance in the upcoming weeks, triggering further disruptions in supply from the country. These units have the ability to process a combined 700,000 barrels per day and are used to prepare extra-heavy oil for export.

Military clashes in Libya

Libya saw military clashes in June and early July, which impacted its production in these months. The output from the countries Sharara field fell by 125,000 bpd following the attacks. While the situation was coming under control, last week saw disruptions on crude oil loading at Zawiya port. With the continued stressed environment, it is difficult to predict future supplies from here.

Russia and Saudi Arabia's assurance of uptick in supply faces hurdles

With continued production disruption and constraints in partner OPEC countries, Saudi Arabia and Russia that initially assured the markets of higher supply in coming months hit limitations. While Russia managed to increase the production, Saudi production is expected to stay flat in August. Moreover, there have been news about attacks on Saudi Aramco refineries by Yemen’s Houthi groups, disrupting production.

India’s stance on crude

In a rare move, India last week took a stance of warning the OPEC nations of the continuous increase in the prices and indicated exploring alternate sources of oil. While it is difficult to quantify the impact, but continued criticism by countries builds pressure on OPEC to increase production.

Outlook

The softening prices came as a relief for Indian oil refiners, with the expectation of some cushion on the margins. Indian oil refiners have been witnessing growing pressure and public criticism over margins and surging prices of motor fuels in the retail markets. A sustained softening of the crude prices could mean improvement of the GRMs of refining segment.

However, the volatility in the crude prices has been immense and is expected to continue. Though we believe that very high levels of crude are not sustainable as more and more producers get on board the supply ship, the upcoming irregularities due to the hurricane season in the US, and an uptick in demand due in winters are something that would dictate the contours of prices in future.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.