If 2023 was about policy announcements in the renewable and new energy sectors, 2024 would be about implementing them.

The country will also press the accelerator on coal fired capacity addition next year since India’s peak electricity demand is likely to touch 256.5 gigawatt (GW) in 2024 from a record high of 240 GW in 2023. In 2024, government estimates suggest the country is likely to add at least 20 GW of new coal fired capacity, for which the Union government has proposed to impose a lower Renewable Generation Obligation of 6-10 percent on new coal and lignite power plants, instead of 40 percent notified in March.

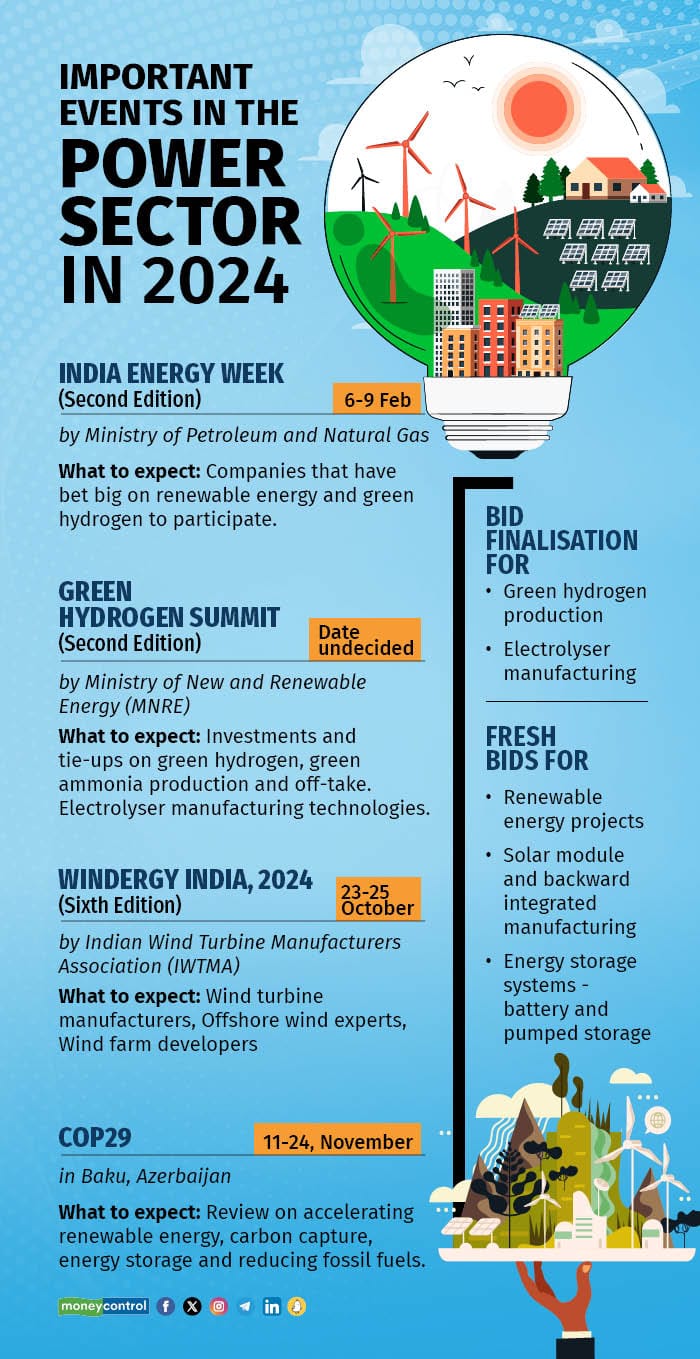

Power sector events planned in 2024 so far.

Power sector events planned in 2024 so far.In the renewable energy (RE) sector, the government in 2023 announced policies ranging from withdrawing reverse bidding for wind energy projects to rules for the lease of seabed for offshore wind. It expanded the scope of its solar parks scheme to cover wind energy.

Here are the top things to watch out for in the power sector in 2024:

RE capacity: In 2023, RE capacity addition of around 20 GW is estimated, while the target is adding at least 25 GW in 2024, including 8 MW of wind energy, according to Ministry of New and Renewable Energy (MNRE) officials. In 2023, the government announced a major policy to boost wherein four CPSUs — NTPC, NHPC, SJVN and SECI — were tasked with bidding for RE projects totalling 50 GW every year. Work on tenders that were floated in 2023 will begin in 2024. Besides, several private RE projects are also likely to be developed. Work for Khavda RE Park, the world’s largest, will be in full swing.

Solar manufacturing: As of 2023, solar manufacturing capacities of at least 40 GW were operationalised. In 2024, the government aims to take this up to 50 GW at least. Several solar cell and module facilities by private players such as Tata Power and Adani are likely to increase production.

Pumped storage projects: The government this year came out with guidelines for pumped storage projects. Accordingly, NTPC is planning to add 14,000 MW, while NHPC has been asked to explore capacities worth 22,000 MW. A host of private players including Tata Power, Torrent Power and Greenko are eyeing the segment. Battery storage systems are also likely to see more project announcements.

Hydropower projects: The 2,000 MW Subansiri Lower project, under construction in Arunachal Pradesh and Assam, is likely to be fully commissioned by December 2024. Besides, two units of the delayed Parbati-II project in Himachal Pradesh will start operations in April. The fate of the Tapovan Vishnugad project, stalled due to the land subsidence in Joshimath, is also likely to be decided by the courts in 2024. A few other smaller projects are also likely to be commissioned.

Green Hydrogen: In 2024, one can expect mandates for hard-to-abate sectors such as refineries to adopt green hydrogen production. Work on creating facilities for GH2 production as well as electrolyser manufacturing will also begin since MNRE recently received bids for green hydrogen production and electrolyser manufacturing from companies such as Reliance Industries, Adani Group, Jindal India, L&T and BHEL.

Green Energy Corridors: Feasibility studies for important green energy corridors such as the one planned between Leh and Kaithal will be undertaken in 2024. Construction of a few other GECs in states such as Tamil Nadu, Gujarat, Karnataka and Rajasthan are likely to be completed.

Industry OutlookPratik Agarwal, MD, Sterlite Power:

Strong policy support and reducing the cost of battery storage and pumped hydro development will enable supply of renewable power “on demand” as per the load profile of consumers or discoms, at prices beating new thermal power.

Hitesh Doshi, CMD, Waaree Group and President, All Indian Solar Manufacturers Association:

Our key expectations revolve around the continued evolution of regulatory frameworks, particularly in the context of the dynamic landscape shaped by the Basic Customs Duty, Approved List of Models and Manufacturers, and Production-Linked Incentives (PLI).

In the year ahead, we anticipate heightened focus on technological advancements and adoption of innovative practices.

Rohit Bajaj, ED - Business Development, Strategy and Regulatory Affairs, Indian Energy Exchange:

In 2023, the introduction of General Network Access Regulations and the implementation of the Indian Electricity Grid Code proved to be pivotal for power exchanges. These regulatory frameworks not only resolved challenges but also facilitated seamless access to the transmission system, regardless of the type of Power Purchase Agreements in place.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.