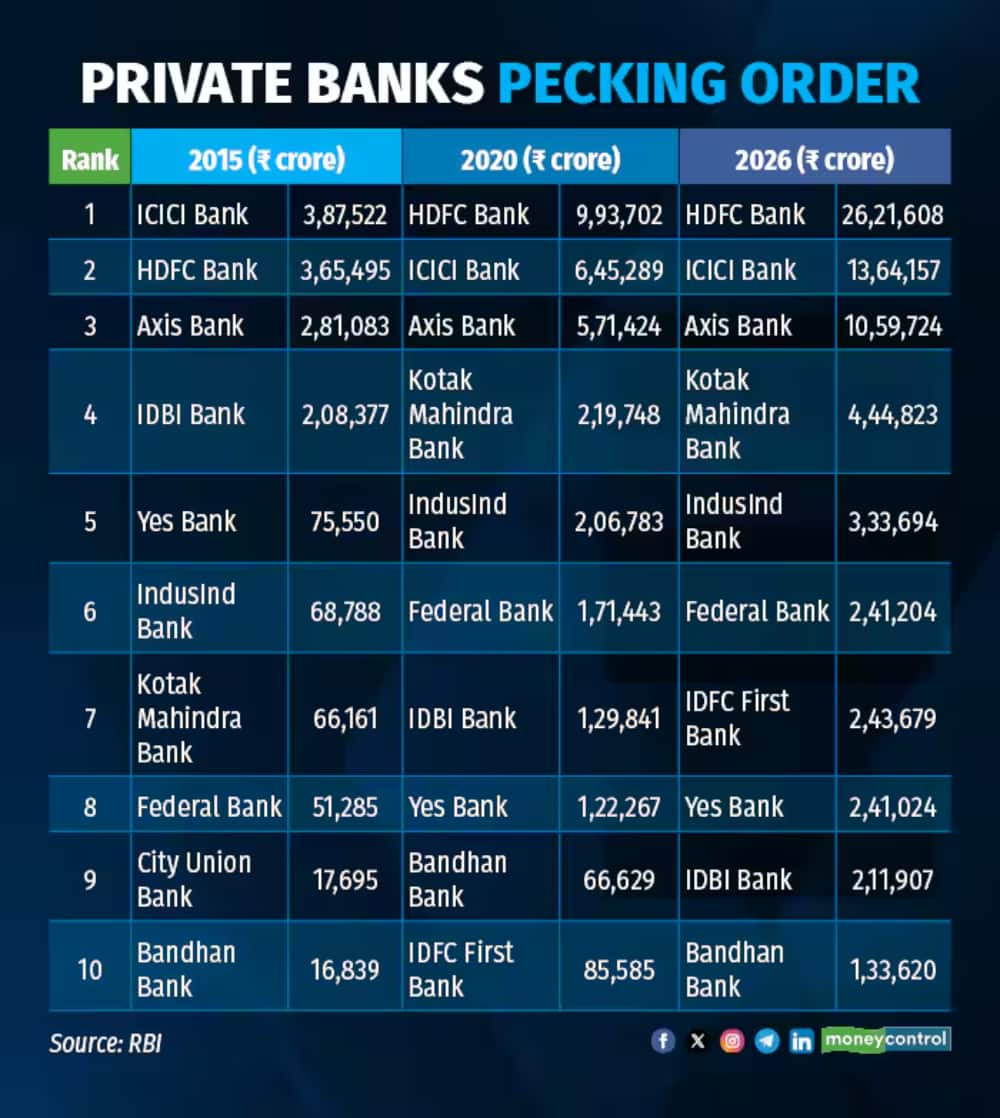

The past decade has shown that while India’s banking pecking order at the top and bottom positions have largely remained stable, the battle lines in the middle have been anything but steady. The contest to be the country’s largest mid-sized bank has intensified, with Kotak pulling ahead, IDBI and Yes Bank trading fortunes, and Federal Bank quietly making to the sixth position.

As seen in the graphic, it is here, below the top three, that the real story of change has unfolded.

The pecking order of private banks in the last one decade

The pecking order of private banks in the last one decade

Top ranker among the mid-sized banks

The headline act in the mid-tier has been Kotak Mahindra Bank. In 2015, Kotak was still building scale, ranking seventh with advances of just over Rs 66,000 crore. Its transformation, however, was rapid. Within five years, it leapfrogged several competitors to take the fourth position, with a loan book of Rs 2.19 lakh crore. By June 2026, Kotak had consolidated its lead among mid-sized lenders with advances of Rs 4.45 lakh crore, cementing its status as the clear fourth position after the big three.

However, not all stories in the mid-sized segment have been of steady ascent, with IDBI Bank’s journey showing vulnerabilities. Though not yet a private sector bank back in 2015, it ranked fourth, ahead of Kotak, with a loan book of Rs 2.08 lakh crore. But the years that followed were difficult, as asset quality issues and governance challenges forced the bank to scale back. By 2020, when it formally got reclassified as a private bank, it had slipped to seventh place, with advances shrinking to Rs 1.29 lakh crore. Yet, in a convincing recovery story, IDBI has climbed back to ninth place with a loan book of Rs 2.11 lakh crore.

Yes Bank’s story, by contrast, has been one of volatility. Once a fast-rising challenger, Yes Bank stood fifth in 2015 with advances of Rs 75,550 crore, looking well-positioned to break into the upper ranks. But a series of governance lapses, mounting bad loans, and regulatory interventions derailed its growth trajectory. By 2020, it had slipped to eighth place, and by 2026, it had fallen further to seventh, with advances of Rs 2.41 lakh crore. Yes Bank’s fall illustrates how quickly momentum can evaporate in India’s competitive banking environment when internal controls and trust are compromised.

Federal Bank offers a different narrative. Ranked eighth in 2015 with Rs 51,285 crore in advances, it rose to sixth place by 2020 with advances of Rs 1.71 lakh crore and maintained that position through 2026, with a loan book of Rs 2.41 lakh crore. Importantly, Federal remains the only “old private bank” to have found a place in the mid-sized league, distinguishing itself from other legacy peers.

For the other old private banks such as South Indian Bank, Karnataka Bank, Karur Vysya Bank (KVB) and City Union Bank, the story has been one of stability without breakout relevance. Exception to the list are Dhanlaxmi Bank and Lakshmi Vilas Bank. While the latter is not in existence any more, thanks to its merger with DBS Bank India during the pandemic, Dhanlaxmi Bank after years of struggle to raise capital managed to secure its name in the list, though not too material in the overall scheme of things.

South Indian Bank and Karnataka Bank, for instance, have remained outside the top 10, with steady balance sheet growth but insufficient scale to challenge the mid-tier. City Union Bank, which held ninth place in 2015 with Rs 17,695 crore in advances, exited the top 10 by 2020 as newer players climbed ahead. Though these lenders have managed stable growth, their scale has not allowed them to break into the fiercely contested mid-tier, keeping them anchored at the periphery of the rankings.

The mid-segment has also seen the rise of newer banks that entered the fray after the Reserve Bank of India’s 2014 licensing round. Bandhan Bank, which began operations in 2015, quickly built scale to break into the rankings, reaching ninth place in 2020 with advances of Rs 66,629 crore and rising further to tenth in 2026 with a loan book of Rs 1.33 lakh crore.

IDFC First Bank, on the other hand, has been slower to carve out a strong identity. However, post its merger with Capital First, the rechristened IDFC First Bank has grown larger than Bandhan Bank, securing the sixth position in 2026 with Rs 2.43 lakh crore in advances. RBL Bank, once seen as an aggressive challenger, has struggled in recent years to maintain momentum, weighed down by asset quality concerns, and has now slipped out of the top 10 after peaking mid-decade.

Meanwhile, AU Small Finance Bank, which has surpassed old-timers such as RBL Bank in terms of loan book size and is due to transition into a universal bank, represents the next wave of challengers that could reshape the mid-tier rankings over the coming years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.