With the Union Budget 2025 less than a month away, individual taxpayers – middle-class families to young professionals and senior citizens, everyone has a Budget wishlist.

“The government should provide certain benefits to the middle class like capping the maximum tax rate (effective rate including surcharge and cess) at 30 percent under the new tax regime and including certain specific benefits like higher deduction for housing loan in the new regime,” says SR Patnaik, Partner (Head - Taxation), Cyril Amarchand Mangaldas.

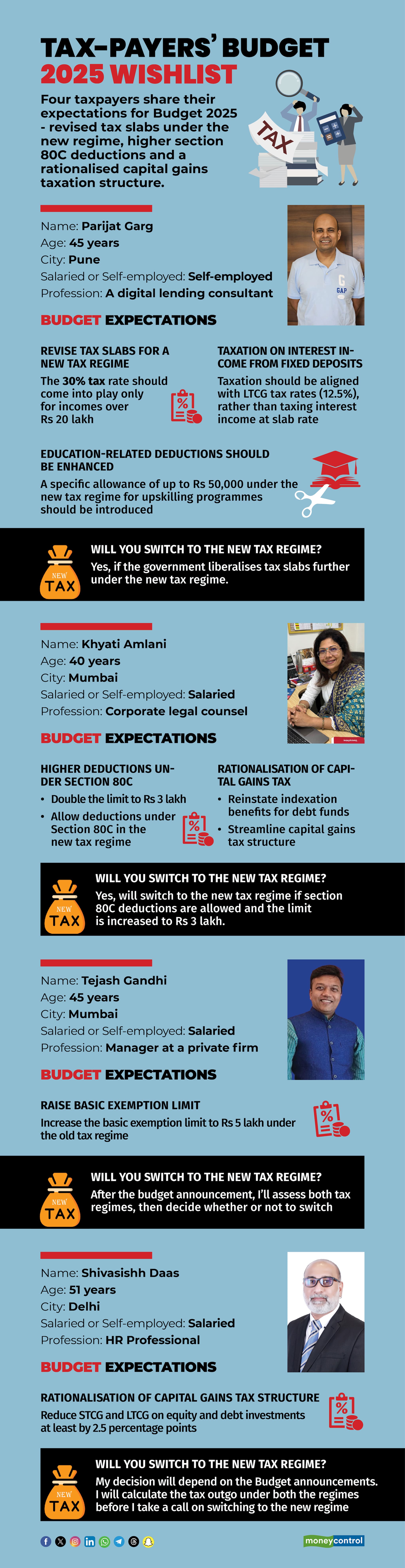

Moneycontrol spoke to four taxpayers to find out what’s on their wishlists for Budget 2025, which will be presented on February 1.

Relax income tax slabs further under new regime

Parijat Garg, a 45-year-old digital lending consultant from Pune, is hoping for some tax relaxation under the new tax regime. He feels that the government should consider imposing the highest 30 percent tax rate only for those with incomes of over Rs 20 lakh (currently, those earning over Rs 15 lakh fall in the 30 percent tax bracket).

Garg is optimistic that these changes in the tax slabs if they were to fructify, will make the new tax regime more appealing. “If the Union Budget 2025 announces these changes in tax slabs, I plan to switch to the new tax regime,” he says.

Higher deductions under section 80C

While the government has been clearly incentivising taxpayers to switch from the old, with exemptions regime to the new, minimal exemptions structure, many continue to hope that Finance Minister Nirmala Sitharaman will introduce some benefits under the latter as well.

Khyati Amlani, 40, a Mumbai-based corporate legal counsel, believes the current Rs 1.5 lakh deduction limit under section 80C is inadequate for taxpayers' financial needs. The limit of Rs 1.5 lakh under section 80C of the Income Tax Act was last increased in the financial year 2014-15. This section covers various investments, including Public Provident Fund (PPF), National Savings Certificate (NSC), Equity Linked Savings Scheme (ELSS), and tuition fees.

“Union Budget 2025 should incorporate section 80C deductions into the new regime and double the limit to Rs 3 lakh to encourage disciplined savings,” feels Amlani.

If these deductions cannot be included in the new regime, then the old regime limits should be increased, say some tax experts. “There is a need to increase the 80C limit to Rs 2 lakh, which would better reflect current expenses in education, housing, and savings,” says Sameena Jahangir, Partner, Kochhar & Co. Alternatively, introducing separate sub-limits for specific expenses, such as Rs 50,000 for tuition fees and Rs 50,000 for housing loan principal repayments, would provide relief, she adds.

Ankit Namdeo, Managing Partner, ANK Advisors, says, “The government may consider increasing the basic exemption limit under the old regime to Rs 3.5 lakh.”

Reduce tax burden on FD interest income

Garg stresses that taxation on interest income from fixed deposits (FDs) should be aligned with the long-term capital gains (LTCG) tax rate of 12.5 percent for other asset classes. He proposes a differentiated tax approach, where interest income from FDs with a tenure of over 36 months is taxed at 12.5 percent, while shorter-term FDs are taxed according to income tax slab rates. “This would encourage a lot of people like me to park a higher proportion of my savings into FD as an avenue for portfolio diversification,” says Garg.

Also read | Budget 2025 wishlist: Four housing loan reforms that home buyers want on February 1

Increase in the old regime’s basic exemption limit

Tejash Gandhi, 45, a manager at a private firm in Mumbai, wants a hike in the basic exemption limit under the old tax regime, which currently stands at Rs 2.5 lakh. This limit has remained unchanged since the financial year 2014-15, despite inflationary pressures.

“Raising the limit to Rs 5 lakh would provide substantial relief to small taxpayers by increasing disposable income,” says Jahangir.

Also read | Tax rebate denied in July 2024? Revise your return by Jan 15 to claim the same

Rationalisation of capital gains tax

“Finance Act 2024 had rationalised capital gains tax rates across asset classes and holding periods and withdrawn the benefits of indexation, thereby resulting in higher tax outgo for a number of taxpayers,” says Patnaik. In 2023, the Finance Act had withdrawn LTCG benefits for debt fund units purchased after April 1, 2023. Prior to this, LTCG from debt funds were taxed at 20 percent with indexation benefits.

As a result, debt mutual funds bought after April 1, 2023, are no longer eligible for indexation benefits. All debt mutual fund capital gains are treated as short-term capital gains and taxed as per the investor’s slab rate.

Amlani’s demands include the reinstatement of indexation benefits for debt funds and a more streamlined capital gains tax structure. This move would incentivise long-term savings by making debt funds more attractive to investors like her.

“Overall, I think the rate of tax on STCG and LTCG on equity as well as debt investments should be reduced,” says Shivasishh Daas, 51, a Delhi-based HR professional.

Also read | Budget 2025: Why tax relief for debt funds tops wish list of mutual fund industry

Enhance education related deductions

Garg is seeking the introduction of a specific allowance of up to Rs 50,000 in the new regime for upskill programmes. The idea is to encourage middle-aged individual taxpayers to invest in skill upgradation, thereby opening new employment opportunities and career growth prospects.

Increase housing benefits

Urban home ownership can be a costly affair, with substantial home loans straining finances and limiting savings and spending power. However, homeowners can claim tax deductions under sections 80C (principal repaid) and 24B (interest on housing loan) of the old tax regime.

Experts are calling for enhanced housing benefits in the upcoming Budget. “The interest deduction cap on housing loans should be increased from Rs 2 lakh to Rs 3 lakh. This move would benefit individuals, particularly first-time homebuyers who might have liquidated their savings and investments to purchase a house,” says Ritika Nayyar, Partner, Singhania & Co.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.