The Indian auto industry has entered the second half of FY26 on a strong footing, buoyed by festive demand, stable macroeconomic indicators, and the recent Goods and Services Tax (GST) 2.0 reforms that have improved vehicle affordability and consumer sentiment, according to industry body Society of Indian Automobile Manufacturers (SIAM).

In its official industry performance communication, SIAM said the sector is witnessing renewed cheer across all major vehicle categories -- passenger vehicles (PVs), two-wheelers, three-wheelers and commercial vehicles (CVs) -- as the festive and wedding season coincides with a more favourable policy and economic environment.

According to SIAM, the festive season began earlier this year, starting September 22 with Navaratri, which helped stimulate retail activity during the latter part of the second quarter itself. The extended festive and wedding season is expected to sustain the momentum through the third quarter, reinforcing positive consumer sentiment across both urban and rural markets.

A broadly healthy Kharif harvest, aided by an above-normal monsoon, is also expected to support rural demand, though flooding in parts of North, West and East India temporarily impacted certain crops and logistics. Despite these regional disruptions, SIAM noted that overall agricultural output and rural sentiment remain stable, which is likely to support rural consumption and mobility demand in H2.

The rollout of GST 2.0 reforms, along with earlier Reserve Bank of India repo rate rationalisation and recent income tax reliefs for individual taxpayers, are seen as key tailwinds for sustaining buying interest through the festive and post-festive months. "While the industry remains watchful of geopolitical developments, the overall outlook for the rest of the current financial year remains encouraging, with the sector expected to close FY26 on a positive growth trajectory," SIAM said.

SIAM President Shailesh Chandra described the new tax structure as a transformative move for the economy. "The GST 2.0 reform is a landmark decision of the Government of India, which apart from catapulting the Indian auto industry to the next level, would bring in vibrancy in the entire economy, as this industry is closely intertwined with strong forward and backward linkages," he said.

He added that even with the new GST rates coming into effect from September 22, covering only nine days of the month, PVs, two-wheelers and three-wheelers have already posted their highest ever sales of September.

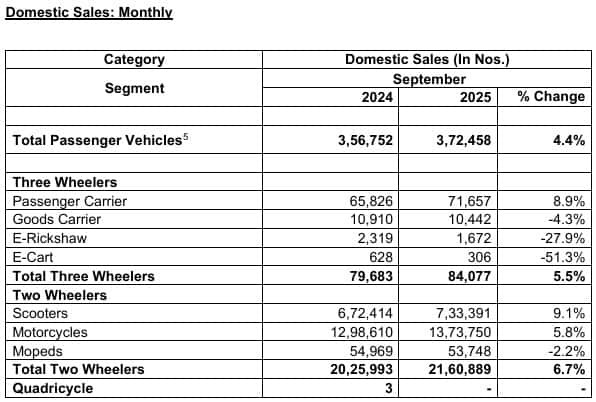

Industry-wide domestic sales in September 2025 reflected the early signs of this recovery. PVs posted sales of 3,72,458 units, up 4.4% year-on-year (y-o-y). Two-wheelers recorded sales of 21,60,889 units, a growth of 6.7% y-o-y. Three-wheelers saw sales rise 5.5% y-o-y to 84,077 units.

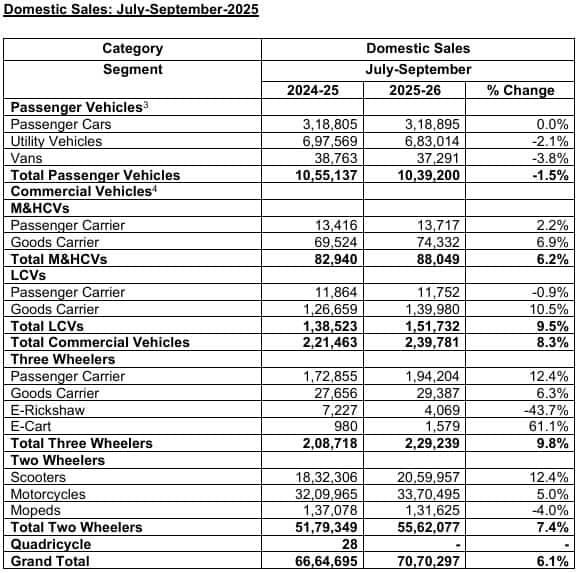

During the second quarter of FY26, the auto industry's domestic sales stood at 70,70,297 units, a 6.1% y-o-y increase. PV sales for the quarter were 10,39,200 units, declining 1.5% y-o-y.

Two-wheelers posted sales of 55,62,077 units, up 7.4% y-o-y, supported by higher economic activity, improved affordability, and resilient rural demand.

Three-wheelers achieved their highest-ever second-quarter sales at 2,29,239 units, registering 9.8% y-o-y growth. CVs also saw broad-based growth of 8.3% y-o-y, with total sales at 2,39,781 units, aided by strong freight movement across sectors such as steel, cement, mining, and construction.

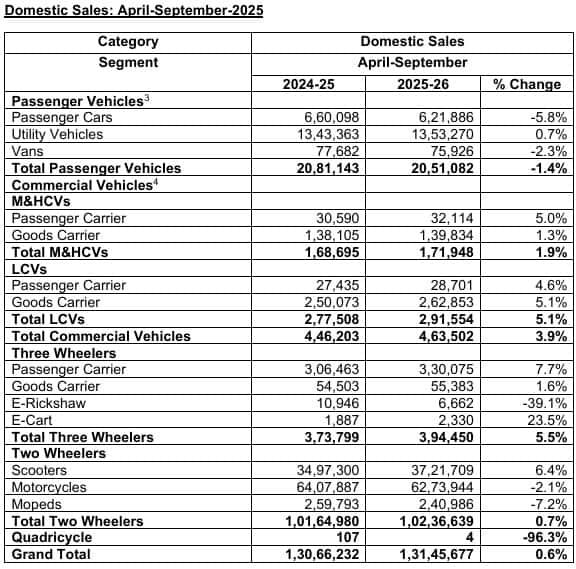

During the first half of FY26, the total vehicle sales in the domestic market stood at 1,31,45,677 units, witnessing a marginal growth of 0.6% y-o-y.

PV sales in the six-month period stood at 20,51,082 units, down 1.4% y-o-y. Two-wheelers recorded 1,02,36,639 units, a 0.7% y-o-y increase, while three-wheelers rose 5.5% y-o-y to 3,94,450 units. CV sales reached 4,63,502 units, up 3.9% y-o-y.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.