BUSINESS

How will the withdrawal of long-term tax benefit on debt schemes impact bank & AMC stocks?

The amendment to Finance Bill 2023 will not only alter the course of financial savings but will also impact the fortunes of stocks in the finance space

BUSINESS

Why ICICI Securities is worth a look despite off-colour markets

Diversified revenue profile, strong financials, and attractive valuations make this company’s stock a worthy long-term bet

BUSINESS

Aditya Birla Capital: Business growth in fast lane, profitability takes on shine

A well-diversified financial services player with strong parentage

BUSINESS

Why do AMC stocks lack shine despite strong equity inflows in mutual funds?

The profit of AMCs may not grow in tandem with AUM growth as passive assets keep rising.

BUSINESS

Will the US banking crisis cast a shadow on Indian banks?

Contagion risk from SVB collapse seems less likely, but if Indian banking stocks correct, investors should accumulate the same

BUSINESS

Should you consider BSE despite off-colour equity markets?

BSE’s efforts to recoup market share in the equities segment have experienced little success

BUSINESS

How durable is the retail lending boom?

Economic slowdown triggered by a possible weak monsoon can hamper retail lending growth and adversely impact the financials and stock prices of leading retail lenders

BUSINESS

Why are paper stocks lying low despite strong earnings?

The paper industry is cyclical on account of input price volatility and capital expenditure plans

BUSINESS

IDBI Bank divestment: Why has it sparked so much interest?

While the bank has improved profitability and strengthened balance sheet, the prospective buyer will be lured by its banking licence, large deposit franchise, and a wide branch network

BUSINESS

City Union Bank: Should investors bet on this stock?

Investors need to be watchful as the bank’s valuation has moderated to 1.2 times the book value estimated for FY24, way lower than its three-year historical average of 2.6 times.

BUSINESS

PB Fintech – Strong business growth, profitability in sight

The stock may see some meaningful upside in the near to medium term

BUSINESS

Should investors bet on the LIC stock?

The life insurer’s stock is trading closer to its lowest level despite healthy operating performance

BUSINESS

Will the Paytm stock recover lost ground as loss narrows?

Paytm’s stock price may not move significantly higher even with improving operating metrics as the goal posts have shifted

BUSINESS

SBI poses a dilemma despite blockbuster earnings, what should investors do?

The Street was getting confident about the SBI’s turnaround story, but the Adani group saga has jolted sentiments again

BUSINESS

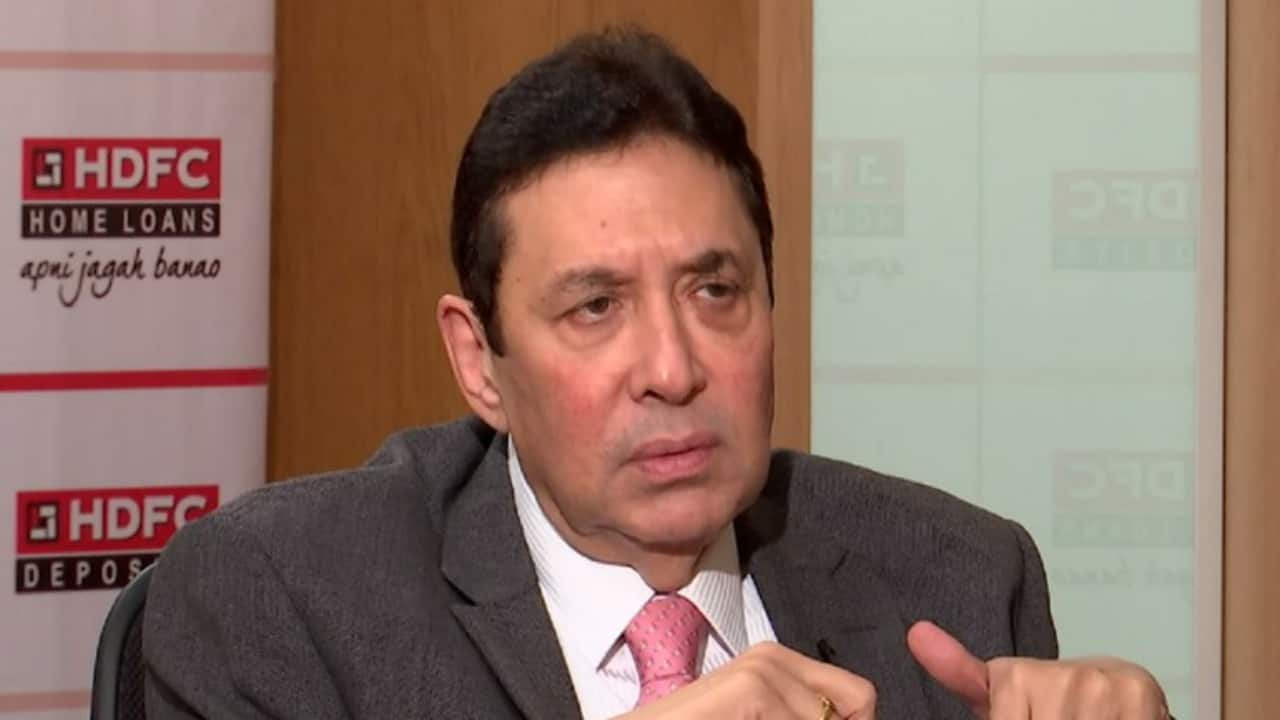

HDFC: Q3 FY23 on an even keel, merger matrix to steer stock

The housing mortgage lender’s plus point is its ability to deliver a consistent performance across credit cycles and in the face of intense competition

BUSINESS

Budget 2023: Which life insurance stocks should one consider?

The budget seeks to address the disproportionate tax incentive structure prevailing in the life insurance sector

BUSINESS

Can Budget 2023 deliver the Deng moment for India’s financial market?

Since all PSBs have been nursed back to health, there will be enough suitors interested in the solid deposit franchise and the unmatched distribution strength of PSBs

BUSINESS

Bajaj Finance Q3 strong, expansion strategy to support growth

If the finance company can replicate its offline dominance in the online space, it will be a radical transformation

BUSINESS

What does Adani saga mean for banking stocks?

Indian banks have little to worry as their debt exposure to Adani entities is limited

BUSINESS

Why is this mutual fund distributor buzzing on bourses since its listing in May last year?

Prudent Corporate Advisory is the second largest MF distributor after NJ India among the non-banks in terms of commission earned in FY22

BUSINESS

Tamilnad Mercantile Bank’s Q3FY23 profit rises but business growth sluggish

Lower provisions led to Q3 earnings growth but loan book growth muted and deposit trend weak

BUSINESS

IIFL Wealth Q3 show steady, valuation attractive

Earnings likely to remain strong in the near to medium term, which along with valuation re-rating, will drive the stock upside

BUSINESS

Is the worst over for Bandhan Bank?

Though Q3 earnings were muted, the same is set to improve in FY24; however, the stock may not see a big rally

BUSINESS

ICICI Bank’s Q3 FY23 signals a wide scope for valuation re-rating

There are multiple factors why ICICI Bank should trade at a premium to HDFC Bank