BUSINESS

UPI logs 3.55 billion transactions in August worth Rs 6.39 lakh crore

NPCI's Bharat BillPay, too, saw transactions grow from 51.13 million in July to 58.88 million in August. Their value crossed the Rs 10,000-crore-mark in August, coming in at Rs 10,307.40 crore

BUSINESS

Explained | PayU-BillDesk deal worth $4.7 billion: Who gains and how

With PayU and BillDesk operating complementing businesses in India, the acquisition will help PayU address the gaps in its portfolio. For BillDesk founders, a seemingly expensive valuation is a great outcome given the stock markets would have valued them even higher.

BUSINESS

Aim to create a digital 'Pigmy' to encourage daily savings, says Setu CEO Sahil Kini

Setu provided the Application Programming Interface to provide Equitas Small Finance Bank FDs on Google Pay. Kini said that hundreds of FDs have been booked already within a few days since the interface went live.

BUSINESS

PayU to acquire BillDesk for $4.7 billion: Prosus

The acquisition brings Prosus' cumulative investment in Indian tech to over $10 billion.

BUSINESS

PhonePe receives insurance broking licence, can now offer products from all insurance companies

The licence will allow PhonePe to distribute products from all insurance companies and offer personalised product recommendations to users.

BUSINESS

PayU, Alpha Wave Incubation lead $12 million investment round in Indiagold

With this round, Indiagold has raised a total of $14 million. Other investors include Leo Capital, Better Tomorrow Ventures, 3one4 Capital and Zerodha-backed Rainmatter Capital.

BUSINESS

Four years ago, everything changed in India; We call it the Jio effect: PhonePe CEO Sameer Nigam

80 per cent of PhonePe’s users come from non-metros. The fintech is thus focused on ensuring products remain simple to use and access for Tier-II & III customers.

BUSINESS

PhonePe receives in-principle approval from RBI to operate as account aggregator

The licence will enable the free and instant exchange of financial data between the Financial Information Users (FIUs) and Financial Information Providers (FIPs) with due consent from customers.

BUSINESS

Millennials open a NiyoX savings account every 30 seconds, product crosses 5 lakh customers

The fintech’s NiyoX account, which is offered in partnership with Equitas Small Finance Bank and Visa, has 82 per cent of customers below the age of 35.

BUSINESS

Google to 'significantly expand' Play support team, says committed to resolving issues

Google is committed to listening to the ecosystem and acting swiftly to help resolve issues that can tarnish the experience of a user or a developer, David Kleidermacher, VP Engineering, Android Security and Privacy, has said

BUSINESS

Prime Venture Partners announces fourth fund of $100 mn, to invest in Crypto, Electric Vehicle & Gaming platforms

Prime Venture Partners will look to make 15 to 20 investments through this fund and will expand its investments into decentralized finance/cryptocurrency, electric vehicle and gaming infrastructure.

BUSINESS

BharatPe forays into consumer fintech space with P2P product 12% Club

BharatPe aims to achieve an investment AUM of $100 million and a lending AUM of $50 million from 12% Club by the end of FY22. The upper limit for investments by an individual has been set at Rs 10 lakh, which will be increased to Rs 50 lakh over the next few months.

BUSINESS

Credit Saison India raises $47 million from Japanese parent company

Credit Saison India aims to become a neo lending conglomerate and is targetting to achieve Assets Under Management (AUM) worth $1 billion in the next few years.

BUSINESS

Why companies are lining up for RBI’s PA license & what the card data hiccup is, explained

The RBI has received around 30 applications for the PA license, a source said, adding that most companies will choose to apply because without the license their costs will go up. They added that the number will of applications is likely to increase closer to the September 30 deadline

BUSINESS

NPCI International to offer UPI in UAE, ties up with Mashreq Bank

The UAE will be the third country to accept UPI payments outside of India after Singapore and Bhutan.

BUSINESS

Flipkart Wholesale aims to triple footprint, expand to 2,700 cities by December

The platform expects the number of registered suppliers to increase by 58 percent by the end of 2021. It witnessed a 17 percent growth in the kirana customer base between January and June 2021.

BUSINESS

Smallcase raises $40 million from Amazon, Premji Invest and Faering Capital

The startup will use this funding to add more asset classes and grow its use cases. It is currently in the process of adding mutual funds, bonds, and global equities to the platform.

BUSINESS

INDmoney wants to become super money app: Ashish Kashyap

With an aim to provide end-to-end financial solutions, the company will soon be selling insurance through its platform. It will also look at offering on-tap loans through its platform.

BUSINESS

Exclusive: ZestMoney to foray into insurance, gets IRDAI’s corporate agent licence

ZestMoney will offer sachet-sized insurance plans which will be co-created with the insurance players, especially for its customers in Tier-II and III cities

BUSINESS

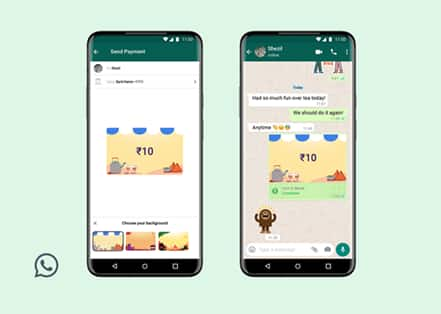

Whatsapp adds payments background feature for UPI transactions

This is similar to the feature available in Google Pay where users can choose from a range of backgrounds while transferring money.

INDIA

Moneycontrol Masterclass | Nuanced approach to reopening schools needed, there is severe learning loss: Experts

Since the onset of the pandemic, schools have remained shut and have shifted to a virtual at-home learning environment. The threat of a third wave may mean a second year of online learning for kids. As the debate around reopening schools grows louder, we assess the impact of long hours of online learning and if India is ready to send its kids to school.

BUSINESS

KreditBee offers RuPay credit card, aims to become a neo bank in two years

The company’s Co-founder and CEO Madhusudan Ekambaram said that in the next three to five years the company hopes to grow its customer base to 10 percent of India’s population. KreditBee will soon foray into the Buy Now Pay Later (BNPL) segment, he added.

BUSINESS

Super apps: WhatsApp best placed, Tata yet to have a core use case: Report

A super app comes with multiple apps and brands under a company, offered within one umbrella app which has at least two strong use-cases.

BUSINESS

NPCI appoints former PayU top executive Noopur Chaturvedi as Bharat BillPay CEO

NPCI says Noopur Chaturvedi's mandate is to work on the RBI's vision to scale up the Bharat Bill Pay System platform. In June, the RBI permitted mobile prepaid recharges as a biller category in BBPS to be implemented on or before August 31.