When Punjab National Bank (PNB) floated a public tender in August 2024 seeking partners to help deploy BFSI-specific Large Language Models (LLMs), it was more than just another IT procurement exercise. It was a signal that India's state-owned banking sector is now deep-diving into the world of GenAI, LLMs, and agentic AI with newfound urgency.

They’re not alone.

In February 2025, Union Bank of India issued a request for proposal (RFP) for GenAI-based automation across core workflows. In July 2024, Bank of Baroda floated a tender to empanel AI and GenAI partners. State Bank of India (SBI) has also issued tenders involving API-based integration infrastructure designed to support LLM prompt engineering.

Multiple industry sources confirmed that more than half a dozen banks and NBFCs have either floated tenders or are in advanced discussions with tech vendors to customize LLMs for use cases like fraud detection, credit underwriting, grievance redressal, and compliance automation.

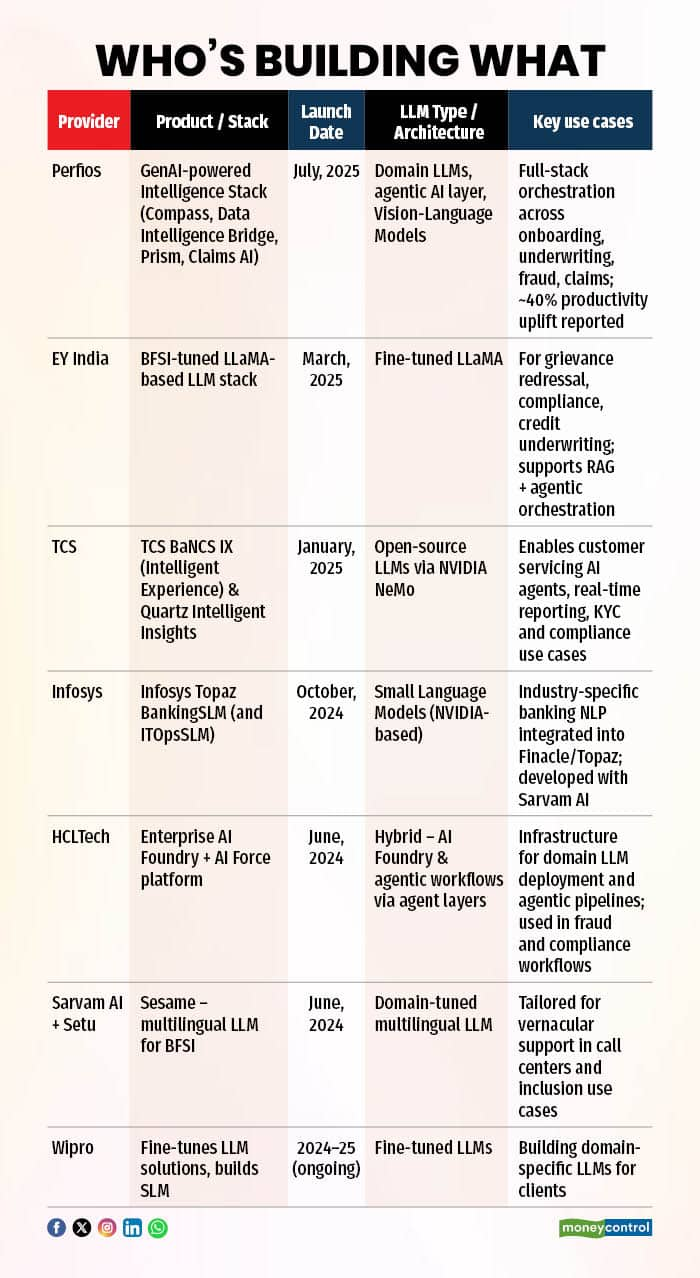

Tech majors such as TCS and HCLTech, consulting firms such as EY, and startups including Perfios and Sarvam are among those responding to the demand for secure, BFSI-tuned Gen AI tools and intelligent copilots.

So what changed? Why now?

Banks reject generic AI

“Banks may no longer rely only on generic LLMs. You need models that understand grievance language in Hindi, detect anomalies in a bank statement, and parse lending fraud—not just parrot out Wikipedia pages,” said Rohit Pandharkar, Partner, Technology Consulting, EY India, which launched a fine-tuned BFSI LLM stack in March 2025.

This sentiment echoes a growing recognition across the industry that pre-trained general-purpose models often fall short when applied to the heavily regulated, context-rich domain of Indian banking. Banks are now demanding AI tools that offer domain accuracy, vernacular fluency, data privacy, auditability, and smooth integration with existing internal IT systems.

LLMs are AI systems trained on vast datasets to understand and generate human-like text, while Agentic AI refers to AI systems that can autonomously take actions or make decisions based on goals, context, and feedback.

A silent race

The demand has sparked what some insiders describe as a silent contest among AI solution providers or vendors to become the go-to LLM partner for India’s BFSI sector. Pandharkar noted that nearly every major tech consulting and AI firm is either already bidding or preparing proposals as banks rush to formalize their GenAI strategy.

“We’re seeing a wave of interest—not just from public sector banks but private ones too,” said Pandharkar. “There’s real competitive energy among tech providers to demonstrate BFSI-specific GenAI maturity. The firms that have domain grounding, data readiness, and governance capabilities will win.”

This surge in demand, he added, is unlikely to taper soon. “I expect 10–12 BFSI sector Gen AI projects to go live, which may need such sector-specific LLMs within the next 12–18 months.”

India’s IT majors bet on startups to stay ahead in the Gen AI era

The RFP trail: Custom models, vernacular support & Agentic AI

The PNB RFP, seen by Moneycontrol, specifically seeks “a GenAI platform with domain-tuned LLMs for the BFSI sector,” that can address underwriting, fraud ops, risk compliance, and even agentic AI orchestration—systems that can independently reason, take actions across IT systems, and improve over time. The scope includes model training, hallucination guardrails, and even co-pilots for branch staff.

Union Bank, meanwhile, emphasizes a “multi-agent architecture”, combining retrieval-augmented generation (RAG), orchestration layers, and multiple task-specific agents. It envisions use cases such as loan document summarization, agent-assisted underwriting, audit trail generation, and more—all with explainability, security, and data compliance built in.

Bank of Baroda’s July 2024 RFP calls for partner empanelment across a range of GenAI use cases, indicating interest in both front-end and back-end automation pilots. Meanwhile, SBI’s October 2024 RFP for an API integration layer highlights prompt engineering capabilities compatible with GPT-like tools—suggesting the bank is preparing the infrastructure needed for LLM deployments.

The emergence of these detailed RFPs also underscores a key shift: banks are no longer looking at GenAI for chatbots alone. Instead, they’re examining how AI copilots can operate behind the scenes, reading through regulatory filings, making sense of transaction flows, or pulling relevant case laws for non-performing asset (NPA) management.

Over 50% Indian consumers trust banks to use Gen AI on personal, financial data

Who’s building what: The new LLM builders club

EY India, which released its BFSI-tuned LLaMA-based stack earlier this year, is already engaged with multiple banks. The firm trained its stack on public filings, regulatory documents, grievance tickets, financial SOPs, and internal BFSI knowledge.

“For instance, a generic model may say Amazon is a rainforest. But our tuned model knows AMZN is a Nasdaq-listed company, quotes its CEO and PE ratio,” Pandharkar said. “The point is: context matters. And BFSI needs contextual intelligence.”

EY’s model supports both agentic orchestration and RAG-based search--adaptable depending on the bank’s needs. “If someone says ‘mera Mudra loan kab aayega,’ we need a model that knows Mudra isn’t just a classical dance term—it’s a government loan scheme,” he added.

Perfios, meanwhile, has gone deeper into orchestration. Chief Technology Officer Sumit Nigam revealed that Perfios is offering a full-stack, agentic AI-powered intelligence system and not just model wrappers. They recently launched an end-to-end agentic AI system that spans onboarding, underwriting, collections and fraud, leveraging BFSI-specific data, including bank statements, ITRs, GSTR filings and compliance data.

“It is not enough to have multiple agents. You need a central orchestration layer so agents don’t conflict. That’s what we’ve solved,” Nigam said. “You can’t have ten agents with their own thinking brains and no coordination. That’s chaos.”

The system is already being tested with multiple leading banks and NBFCs, and is designed to plug into core banking infra without disruption.

TCS, according to its latest release, has partnered with NVIDIA’s NeMo framework to offer BFSI-tuned LLM orchestration to banks. The stack emphasises governance, scalability, and vertical-specific fine-tuning, and works across domains like KYC, fraud monitoring, and compliance automation.

Sarvam AI and Setu, too, had launched Sesame, a BFSI-focused multilingual LLM with Indic language support, back in 2024. While it’s broader in scope, sources say banks are exploring Sesame’s vernacular capabilities, especially in call centers and financial inclusion tools where English-only chatbots falter.

HCLTech, via its Financial Services AI unit, has been working on a mix of narrow domain-specific language models (SLMs) and fine-tuned LLMs tailored for BFSI. “Our engagements include customer FAQ generation, Smart Service Desks integrated with CRM, fraud detection through anomaly analysis, and compliance-focused text analytics," said Srinivasan Seshadri, Chief Growth Officer and Global Head, Financial Services, HCLTech.

“The trend is hybrid. Some banks want fully private LLMs for data sovereignty. Others are happy fine-tuning open-source models. But everyone wants ongoing managed services, not one-off deployments,” he added.

Additionally, Infosys has already built four Small Language Models, one of them for the BFSI industry. Cross-town rival Wipro also builds SLMs and fine-tunes models for its BFSI clients.

From hype to hard problems

The latest RFPs make one thing clear: Indian banks are no longer testing GenAI for chatbots alone. They are now building internal copilots for branch staff and back-office, grievance redressal systems trained on past customer tickets, fraud and risk analysis engines using multi-modal and multi-source data, trade finance assistants that interpret contract clauses, and loan decisioning copilots that crunch thousands of data points.

But with ambition comes caution. Experts say hallucination, explainability, and data security remain top concerns. “LLMs are stochastic parrots. They regurgitate what they’ve seen. But a hallucinated explanation in underwriting can cost millions,” said a data scientist working with a large BFSI client.

Ravindra Patil, VP, Data Science at Tredence, echoed the sentiment.

“Most banks are customising foundation models rather than building from scratch. Risk and compliance are the top use cases. The biggest traction is around anti-money laundering, risk scoring, and audit readiness, not customer marketing,” he said.

He added that post-deployment, these are treated as managed AI products. “It’s not fire-and-forget. We’re doing prompt audits, performance benchmarks, retraining cycles—it’s a full service now.”

What’s driving the rush

There are three key forces driving this sudden flurry of RFPs in the Indian banking sector.

First, the maturity of open-source models like LLaMA-3, Falcon, and Mistral has made it technically feasible to fine-tune LLMs for BFSI-specific tasks—without always relying on proprietary APIs like GPT-4.

Second, regulators such as the RBI and MeitY have begun outlining frameworks around AI auditability and data governance, prompting banks to move forward with confidence. The

In December last year, the regulator had constituted a committee to develop a Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI) in the Financial Sector.

Third, competitive pressure is mounting. With digital-first fintech lenders, embedded finance players, and agile NBFCs rapidly adopting GenAI, traditional banks are under pressure to modernize or risk falling behind.

As the space matures, some banks will buy plug-and-play copilots. Others will build internal LLM stacks—their own domain-specific ‘brain.’

“Imagine an underwriter who can query a 30-page memo in Marathi or English and get actionable, compliant answers instantly,” said Nigam. “That’s no longer science fiction.”

Still, experts urge realism.“Most banks are still early,” Pandharkar said. “The real challenge is integration, hallucination control, and aligning these tools with legacy infrastructure.” The LLM race is underway—not just to build better chatbots, but to develop the smartest, most secure minds in Indian banking.

Strategic shifts and IT opportunity

Pareekh Jain, Founder and CEO of consulting firm EIIRTrends, explains that RFPs by large banks, specifically public sector banks, are primarily fixed-price contracts for services over three years, followed by an Annual Maintenance Contract (AMC) in the fourth or fifth year.

The contracts require the transfer of all licenses and training fees to the government banks, with a focus on fixed pricing for hardware, tools, and implementation costs.

The Indian IT service sector is less active in domestic markets, often dominated by multinational corporations. However, there is a shift in the last year as emerging market demand grows for Indian IT players and the traditional markets of North America and Europe face pressure.

While Indian service providers are cautious about pricing, the evolving market presents opportunities for product development and implementation, which can serve as reference points for future contracts.

“I think it is important because Indian IT players already have a product. All these are the use cases which will help them further penetrate in at least the emerging markets because their cost structure will be similar to any other emerging market,” added Jain.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.