As automation and Generative AI (Gen AI) transform the technology across industries, India’s top information technology (IT) services firms are increasingly betting on startups, investing in them, partnering with them, and co-creating solutions to stay relevant.

Gen AI is disrupting traditional application development, software engineering, and testing, leading to anaemic growth for the IT industry over the past few quarters. In February, the CEOs of HCLTech and Infosys declared that the clock has already run out on the traditional IT services model.

From Infosys to Wipro, TCS, HCLTech, and Tech Mahindra, annual reports show a decisive pivot: a push to move away from purely linear, headcount-led services revenue toward intellectual property and high-margin platforms.

For instance, India’s largest IT services company, TCS, relies on its Co-Innovation Network (COIN), which has become one of the largest global startup ecosystems in IT services.

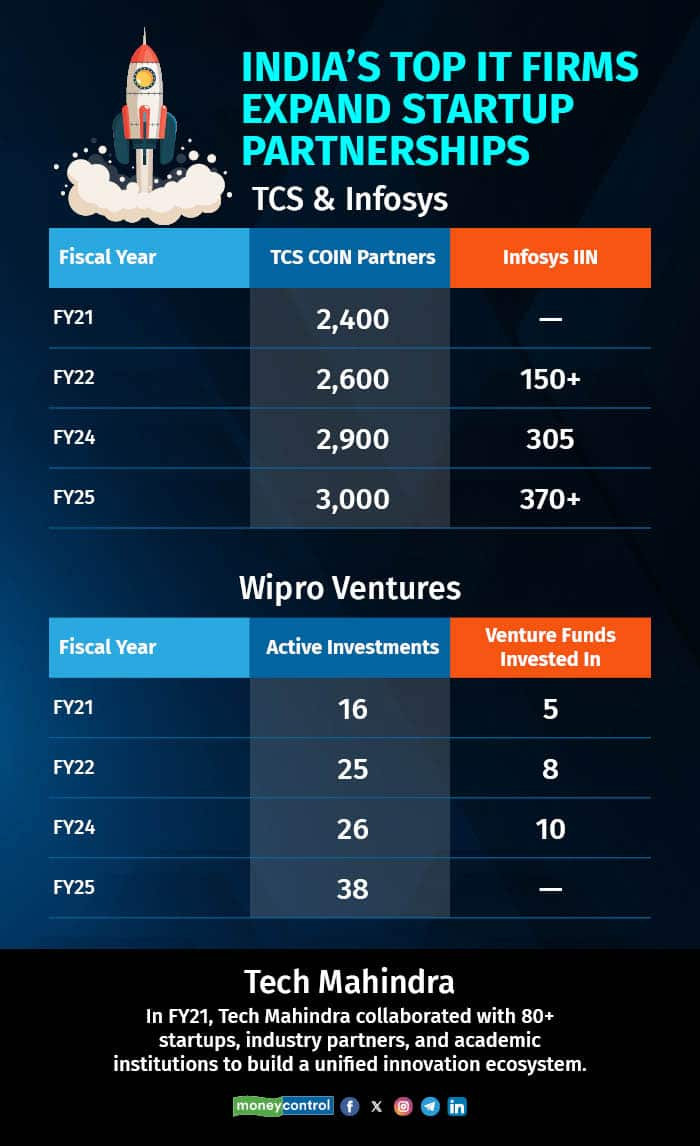

In FY21, COIN had about 2,400 startups. This grew to 2,600 in FY22, 2,900 in FY24, and reached 3,000 startup partners in FY25, alongside 55 active academic partnerships. Rather than direct equity investments, TCS uses COIN to co-create and prototype rapidly in AI, blockchain, cybersecurity, and IoT.

TCS’ nearest rival, Infosys, expanded its Infosys Innovation Network (IIN) over the past few years. In FY22, IIN included over 150 startups. By FY24, this number had grown to 305 startups, and further to more than 370 startups in FY25, as the company expanded its focus on co-creation and next-generation delivery models.

“IT companies were investing and collaborating in some form or the other for the last 10 years but it has gone up exponentially in the two-three years due to Gen AI, tech disruption,” Pareekh Jain, Founder and CEO, EIIRTrend, told Moneycontrol.

While Infosys has maintained its $500 million Innovation Fund launched in 2015, the focus has shifted from pure investing to deeper co-creation. Rather than owning equity stakes in most cases, Infosys increasingly sees value in embedding these startup capabilities directly into client solutions.

Also, read: India’s top IT firms lean towards IP-led growth as Gen AI shrinks the pyramid

Wipro has taken a more direct investment approach through Wipro Ventures, launched in 2015. The venture arm started with 16 active investments and 5 enterprise-focused venture fund investments in FY21.

By FY22, Wipro Ventures managed 25 investments (with 6 successful M&A exits) and 8 venture funds. In FY24, the firm reported 26 active investments and 10 venture fund partnerships, and by FY25, Wipro Ventures expanded to 38 total investments, with 13 exits.

The fund, now sized at $500 million, targets early- and mid-stage enterprise software startups, many focused on AI and automation. According to the FY24 report, these bets have generated over $200 million in influenced revenue, a modest but important reflection that startup-led innovation is paying off commercially.

HCLTech has followed a more targeted, integration-first strategy.

Without a formal venture fund, HCLTech uses its Innovation Labs and co-creation programs to bring startup technologies directly into its automation and software platforms, such as DRYiCE and IoTWorks.

These collaborations help accelerate HCLTech’s product development without taking equity exposure, described internally as a "build and integrate" approach to scaling IP and platform revenue.

Tech Mahindra has also been an early mover in forging startup collaborations. In FY21, it partnered with over 80 startups, industry players, and academic institutions, building a network in 5G, automotive software, and immersive technologies.

“These investments are more like strategic partnerships, enabling IT firms to take differentiated capabilities to their enterprise clients. Large IT firms often struggle to build such innovation internally due to rigid structures and RoI-driven mandates. Startups on their part benefit from access to enterprise clients of the IT companies, computing infrastructure, and other resources,” says Gaurav Parab, principal research analyst at NelsonHall.

While the company hasn’t updated cumulative startup numbers in recent years, its Makers Lab initiatives continue to focus on emerging tech areas to shift beyond traditional IT services and toward high-value, IP-led solutions.

Nonetheless, these firms do not disclose specific year-on-year revenue contributions solely from startup partnerships.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.