The Nifty rallied over 18 per cent from 7,738 recorded on 31 March 2016 to 9,173 on 30 March 2017, but the rally may not be over. Most analysts see Nifty hitting mount 10K in the next 12 months or so but there will lot of specific action.

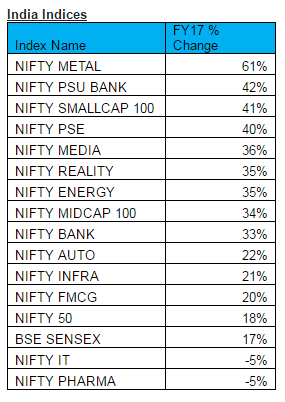

In FY17 metals, PSU banks, smallcap, media, realty, energy midcap, banking, auto infra and FMCG sector made money for investors while pharma and IT gave negative returns largely weighed down by a strong dollar and regulatory hurdles.

Most analysts see improvement in earnings to double digits in the new financial year along with expansion in the economy.

“There is ample liquidity with local and foreign institutional investors. We expect 20 per cent earnings CAGR expected in next 3 years compared to sluggish earnings growth seen in the last 4 years,” V K Sharma, Head (Private Client Group), HDFC Securities told Moneycontrol.com.

“Assuming markets have already started pricing FY19 earnings, we adjust Nifty levels for 15 per cent growth, to get a Nifty target of 10,030 for FY18 (target 1 year forward PE at 17.5X),” he said.

The equity market is likely to remain buoyant in FY18 even though valuations are trading higher than long-term averages. Let’s not forget that FY18 will see the fruits of important reforms undertaken by the government such as demonetization and GST.

Both these reforms together would result in a gradual shift from informal economy to formal leading to the enhanced tax base, transparent system, and efficient utilization of resources, suggest experts.

“Markets are vehicles that discount the future cash flows of a business to the present. Valuations are thus a function of a) the business outlook and b) discount rate that is applied,” Prateek Agrawal, Business Head & CIO, ASK Investment Managers told Moneycontrol.com.

“Demonetisation and GST (which would soon be implemented) has actually improved the outlook for businesses in the organised sector over businesses in the unorganised sector.

He further added that in the medium to long term we have the benefit of both an improvement in business outlook and a reduction in the discount rate. This we believe would sustain valuations at a higher level.

Going by the buzz on D-Street, we have collated a list of top ten sectors from various experts which are likely to remain in the spotlight in FY2018.

Analyst: Arun Thukral, MD & CEO, Axis Securities

Infrastructure & Railways:

FY18 is likely to be driven by the government spending especially in the infrastructure sector. The promise of infrastructure sector would not be limited to FY18 but the investments are expected over a couple of years.

The government is investing in building roads, bridges, highways, airports, waterways etc. offering ample of opportunities for the private players.

In the current budget, the government has allocated Rs 1.3 lakh crore for spends in Railways in 2017-18. The government has also lined up investment worth Rs 8.5 lakh crore in Railways over five years starting FY17 where Rs 1.21 lakh crore were already spent.

Road Construction:

The road construction business has enormous potential in India. The government has allocated Rs 64,000 crore to build highways in FY18 budget. For transportation sector as a whole, including rail, roads, and shipping budget has allocated Rs 2.4 lakh crore in 2017-18.

This magnitude of investment will spur a huge amount of economic activity across the country and create more job opportunities. “We prefer the EPC companies which carry out the construction activities after winning the tenders,” said Thukral.

Auto Ancillary:

Auto ancillary sector holds a lot of promise given the fact that the penetration of automobiles in India is just 18 cars per 1000 person as against 80 plus for China and nearly 800 for the US.

Moreover, India is also been looked upon as manufacturing hub for low end or small cars by the OEMs. These cars would be manufactured in India and exported around in SE Asia, Middle East, Africa and Latin American nations.

Auto ancillaries who are supplying to domestic and foreign OEMS are good investment opportunities. Indian auto ancillary enjoys substantial competitive advantage due to the availability of qualified professionals at reasonable cost and quality conscious supply chain.

Textile:

Indian textile industry is expected to benefit from global exports opportunity in face of loss in competitiveness for Chinese textiles due to rise in employee cost. Indian textiles which are integrated players from yarn to the fabric are expected to benefit largely as compared to the standalone players.

Moreover, the purchasing power of an Indian consumer is also rising. The brand conscious Indian consumer’s spending would also benefit the domestic branded apparel producers.

GST Related Sectors:

Ushering in of GST will bring about the shift from unorganized to the organized sector as the former lose their price competitiveness. The sectors which have a high share of the unorganized segment at current juncture viz., plywood, leather goods, FMCG, textiles etc. would see a shift towards the organized players.

The logistics sector is also expected to benefit from the implementation of GST as the transit time reduces facilitating the seamless interstate flow of goods and improved utilization of trucks.

Analyst: Hitesh Agrawal, EVP & Head – Retail Research, Religare Securities Ltd.

FMCG/Consumer Durables:

FMCG/Consumer Durables are likely to be in focus in FY18. Their performance has been muted over the last couple of years, impacted by the slowdown in consumer spending.

However, the Government’s plan to double the farmers’ income in five years along with increasing emphasis to boost rural infrastructure, normal monsoon, the decline in inflation and low-interest rates should boost consumer spending and drive the demand for FMCG products/Consumer Durables. A revival in FMCG sector would also result in improved demand for packaging products, especially flexible packaging industry.

Private Banks

The outperformance of private banks will continue in FY18 as well, as a favorable demand environment supported by lower interest rates would aid in garnering higher market share vis-à-vis their PSU counterparts, especially in the retail banking space.

It looks like corporate credit growth is expected to pick up only with a lag. Asset quality of private banks is also largely expected to remain stable, resulting in lower stress on their balance sheets, leading to better-operating metrics and higher profitability.

Housing Finance Companies (HFCs)

Mid-to-small ticket home lending received a fillip in FY17 with the government’s thrust on affordable housing, including a 39 per cent higher budgetary allocation, an extension of the credit linked subsidy scheme to loans of up to Rs. 12 lakh, infrastructure status and talks of stamp duty exemption (already exempt from service tax).

The housing shortage in India is close to 1.9 crore units, with economically weaker sections/low-income groups accounting for 96 per cent of the urban shortage.

The demand for low-cost homes should continue, with sustained government initiatives in the run-up to 2019 elections, and would be the key growth driver in the mortgage financing space.

Building Products Industry (Paints, Ceramics/Tiles, and Plywood):

The building products industry is currently at an inflection point and improvement in macro-economic conditions and strong demand drivers such as growing urbanization, shortening replacement cycle, changing consumer preferences with increasing aspiration to shift to premium products and higher per capita income should drive healthy industry growth.

Also, the Government’s thrust on affordable housing and implementation of GST will be another growth lever, as demand will shift from non-branded products to branded products. Thus, sectors like Paints, Ceramics/Tiles and Plywood stand to benefit.

Analyst: V K Sharma, Head (Private Client Group), HDFC Securities

Media & Entertainment

The increase in disposable income is going to boost fortunes of media and entertainment industry. “We are expecting double-digit growth in advertising revenues for media industry Increase in literacy and penetration of smartphones is providing tailwinds to regional languages print media Digital and FM radio segments are looking lucrative for non-linear growth,” said Sharma.

Fertilizer & Chemical sector:

The demand for fertilisers is likely to increase by about 5 percent year-on-year in FY18, on account of an increase in purchasing power of farmers due to a rise in farm income and a rise in minimum support price of key rabi crops

Lower dependence on government subsidies following lower international. Low prices of raw materials will aid to profits for the companies. Implementation of the direct benefit transfer (DBT) system for payment of fertilizer subsidy to farmers.

Steps being taken to curb import of Chinese chemical & reduction in chemical production in china because of population control.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.