Madhuchanda DeyMoneycontrol Research

In the past fortnight while markets were trying to reconcile the macro reality with the euphoria of the indices, some of the eye-catching numbers from smaller companies may have been overlooked. While earnings are not the only lead indicator of a stock's outperformance, but it is an essential ingredient that goes into turning undiscovered undervalued companies into multi-baggers.

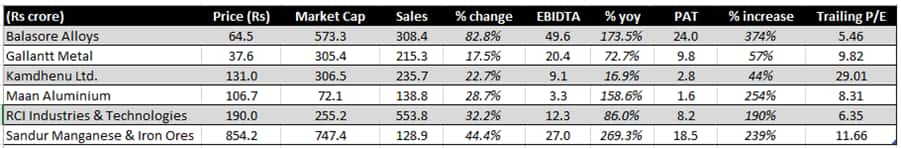

The red hot metals space

The metals sector has come of age in the past one year and the gains are not restricted to large names alone. Smaller companies have also seen revival as evident from their earnings.

Some of these companies offer comfort on the valuation front like Balasore Alloys that produces different types of Ferro Alloys. The producer of stainless steel & tool steel is the largest consumer of ferrochrome and charge chrome.

Another small company that reported healthy earnings was Gallantt Metal (GML) that producers all kinds of iron and steel products such as sponge iron, pig iron, cast iron, bars, rods, billets, Captive power plant, etc.

A diversified company that made it to the list was Kamdhenu. It manufactures thermo-mechanically treated (TMT) steel. The Company's segments include steel, paints and power (wind mills).

While being a leveraged entity, Maan Aluminium also posted impressive numbers. The company is engaged in the business of Aluminium Extrusion. It supplies its products in both heat treatable and non-heat treatable alloys and include over 10,000 shapes and tools among others.

Another company that drew our attention was RCI Industries, one of the leading manufacturers and exporters of brass and copper foils/coils/strips & copper wires.

The last stock from the metals space is Sandur Manganese & Iron Ores, which is engaged in the mining of manganese ore and iron ore and manufacturing of ferro-alloys.

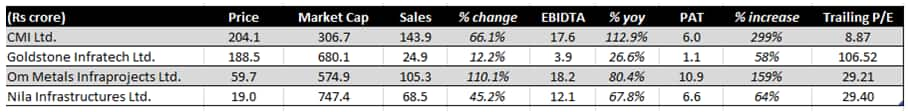

Few winners from infra & allied sectors

From the infrastructure and allied activities, few of the niche entities stood put.

CMI is into development of various types of cables in the field of telecommunication, railways and other specialty cables in the country to meet requirement of core sectors in infrastructure.

Goldstone Infratech is engaged in manufacturing polymer insulators. The Company's products include power utilities and 25 kilovolts (KV) railway traction. The company has also developed and tested approximately 1,200 KV insulators for Power Grid Corporation of India. However, the valuation tempers our excitement.

An interesting but untested name that we came across was High Ground Enterprises (HGEL). The growth trajectory has been interesting. The company is primarily diversified and operates under two niche verticals, EPCM (Engineering Procurement and Construction Management) that caters to oil & gas sector, water sources/hydro projects, waste management and infra & support services/consulting. The other vertical of the company caters to allied media services (M&A).

The other company from the infrastructure space is Om Metals Infraprojects. It is a conglomerate having diverse business activities and interests related to hydro mechanical equipment, turnkey solutions for steel fabrication. However, near-term upside remains capped by valuation.

Nila Infrastructures is another idea that prima facie looks promising. It actively participates in urban development in the form of EPC/turnkey projects of affordable housing schemes floated by government authorities. It is involved in public infrastructure development projects and has put its extensive land bank to use by coming up with residential real estate schemes that range from affordable flats to premium apartments. Nila Infrastructures holds prime commercial property in Ahmedabad, which is leased to reputed corporates. While the valuation factors in the superior delivery, an accumulation would be worth considering.

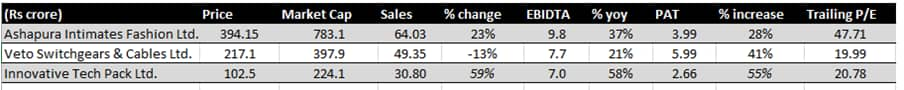

Consumer-facing businesses that stole the show

Consumer-facing businesses have been holding up better that the rest of the market. The name that impressed with the number despite heady valuation is Ashapura Intimates Fashion. It is a fashion house engaged in designing, branding, marketing and retailing of intimate garments for men, women and children.

The other company that churned out decent number and looks reasonably valued is Veto Switch Gears and Cables. The company is engaged in manufacturing of wires & cables, Electrical Accessories & all type of range of led lighting, CFL & fans.

The little known packaging company that caught our attention was Innovative Tech Pack. This company serves reputed clients from FMCG and pharma with products like jars, bottles, caps, closures and dispensers in PET, PP, HDPE and PCTA.

The small cement, pharma & textile companies that stole the show

The two small cement companies that threw positive surprise were Gujarat Sidhee and Keerthi Industries. The former is a part of Mehta group. The Gujarat-based company reported profit for during the quarter after reporting losses for several quarters in the past.

Keerthi Industries is another promising name in the cement space. The company is in Nalgonda district which is near Amravati city. The company, therefore, enjoys a location advantage. In addition to cement, Keerthi Industries has Wind Mill and Electronics Division.

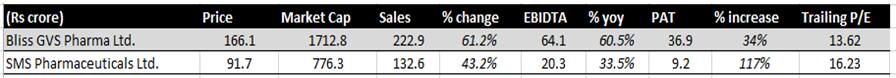

The couple of companies that grabbed attention from the pharmaceutical space are Bliss GVS and SMS Pharmaceuticals. The former is a fast-growing pharmaceutical company that is among the world leaders in Suppositories and Pessaries dosage forms with one of the largest portfolios in this segment.

The other name is SMS Pharmaceuticals, a global player in API (active pharmaceutical ingredients) manufacturing and has four multi-product facilities in operation and two research centres.

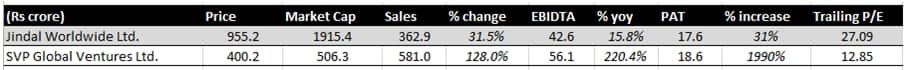

From the textile space, the companies that deserve mention are Jindal Worldwide, which is into weaving, manufacturing and finishing of textile. Lower down the value chain, but nevertheless impressive numbers were reported by SVP Global Ventures (SVP). It is a diversified yarn manufacturing company having a wide product portfolio ranging from cotton, blended yarn, open-end yarn to superior yarns such as compact yarns.

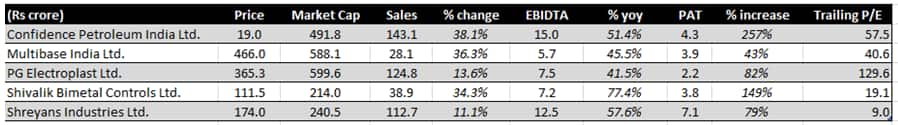

The five other names that find a place in the list of top 24 impressive performers also include Confidence Petroleum - India’s leading LPG Bottler & largest LPG cylinder manufacturing company - and Multibase India – a company engaged in the business of manufacturing of high-technology thermoplastic elastomeric compounds.

The other interesting ideas are PG Electroplast - a diversified electronic manufacturing services and plastic injection moulding company catering to leading OEMs in consumer electronics and automotive Industry.

Shivalik Bimetal Controls is a company specialised in the joining of material through various methods such as diffusion bonding /cladding, electron beam welding, solder reflow and resistance welding, etc. The very last name for the day is Shreyans Industries that has two paper manufacturing units manufacturing writing & printing paper, from agro-based raw materials.

While Shreyans still offers value, most of the others don’t lend valuation comfort and should be ideal candidate for accumulation by long-term investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!