That's all for today, readers. Thanks for staying on with our coverage of the day's action. Your enthusiasm encourages us to better our coverage every day. Do come back tomorrow for more news, views and insights.

20:18 ACC shelves merger with Ambuja Cements

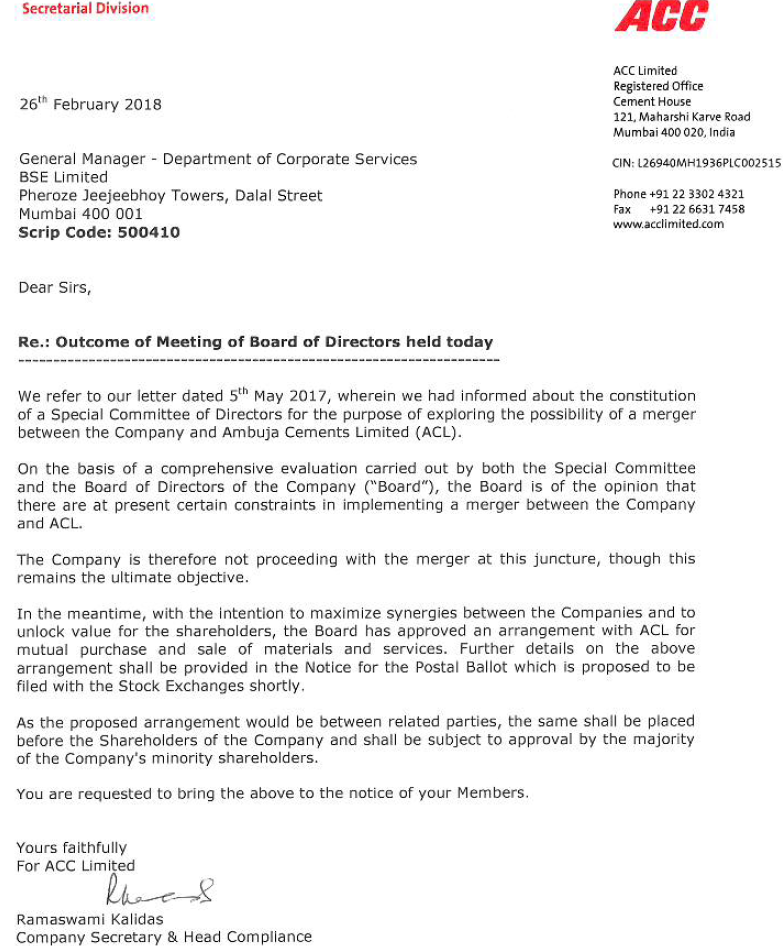

ACC has called off the merger with Ambuja Cements Limited (ACL). ACC has said in a BSE notification that currently there are 'constraints in implementing merger between the company and ACL." The notification continues to say that the merger with ACL remains to be 'the ultimate Objective' and will not be proceeding with the Merger at this juncture

19:40 PNB fraud: Former PNB MD, Executive Director under ED's scanner

After Central Bureau of Investigation (CBI) and Income Tax (IT), Enforcement Directorate (ED) is the third agency that has questioned Punjab National Bank’s (PNB) executive director KV Brahmaji Rao, over lapses in Rs 11,400 crore PNB fraud, reports Moneycontrol’s Tarun Sharma.

Meanwhile, PNB CEO Sunil Mehta could not attend to the summons issued to him due to business commitments.

Also, ED will soon issue summons to former PNB MD Usha Ananthasubramanian as it feels that Mehta’s tenure at the bank is lesser, sources said.

19:15 Aadhaar helped cancel 3 cr fake, duplicate ration cards: Minister

Nearly three crore fake and duplicate ration cards have been cancelled during the three years of the NDA government, CR Chaudhary, Minister of State for Consumer Affairs, Food and Public Distribution said today.

It had also saved the country Rs 17,000 crore every year during this time, he added.

Linking the ration card to the holder's Aadhaar number had allowed the government to clean up the system, the minister said.

19:01 There may be further delay in return of mortal remains of Sridevi

Further delay in return of mortal remains of Sridevi expected, say sources. Dubai police which earlier gave clearance now awaits clearance from Prosecution magistrate. Police reportedly informed Indian authorities the body can only be handed over after nod from prosecution magistrate, reports ANI.

18:38 Morgan Stanley pegs India's Q3 GDP growth at 7%

India's economic recovery is expected to have gathered momentum and GDP growth for the December quarter is likely to have accelerated to 7%, says a Morgan Stanley report. India's gross domestic product (GDP) grew by 6.3% in July-September quarter of the fiscal, up from 5.7% in the first quarter.

According to the global financial services major, growth in the industry and services sector is expected to have accelerated while growth in the agriculture sector decelerated. "We expect the economic recovery to have gathered further momentum with GDP growth accelerating to 7% YoY in the December-17 quarter from 6.3% in the September quarter," Morgan Stanley said in a research note. In GVA terms, growth picked up further to 6.7% YoY from 6.1% in the previous quarter, the brokerage said.

18:16 Farewell Sridevi

Sridevi's body has been released for embalming, reports Gulf News.

Many celebrities have visited Boney Kapoor's brother, Anil Kapoor's residence to offer their condolences.

17:47 Govt publishes names of 9,500 'high-risk' NBFCs

The government has categorised about 9,500 non-banking financial companies (NBFCs) in the country as "high risk" prone as they have not complied with a stipulated provision of the anti-money laundering law, reports PTI. A list of 9,491 "high risk financial institutions" has been published by the Financial Intelligence Unit (FIU) that works under the Finance Ministry to check crimes in the Indian economy and alert enforcement agencies against such instances. The list, containing the names of the firms, has been updated till January this year.

17:45 Sensex vaults 300 pts on global leads, macro optimism

Benchmark Sensex ratcheted up by more than 300 points for the second session in a row today on optimism over India's growth recovery amid positive global cues. The Sensex closed at a three-week high of 34,445.75, while the wider NSE Nifty went past the 10,550-mark.

Investor sentiment was bolstered after a Morgan Stanley report said India's economic recovery is expected to have gathered momentum and GDP growth for the December quarter is likely to have accelerated to 7%. The GDP numbers will be released on Wednesday.

The 30-share BSE Sensex opened on a strong footing at 34,225.72 and maintained its upward trend to hit the day's high of 34,483.39 before ending at 34,445.75, up 303.60 points, or 0.89%. This level was last seen on February 5, when the Sensex had closed at 34,757.16. The index had rallied 322.65 points in the previous session on Friday on value-buying by investors in recently-battered blue-chip stocks.

The Nifty finished the day at 10,582.60, showing a hefty gain of 91.55 points, or 0.87%, after shuttling between

10,592.95 and 10,520.20. Gains were led by realty, auto, capital goods, banking, infrastructure, metals, power, oil & gas, PSU and consumer durables sectors, which rose up to 3.3%.IT, teck and healthcare indices ended in the red.

Maruti Suzuki emerged as the leader of the Sensex pack today, with a 3.41% rise, followed by Tata Motors at 3.22%. Other gainers were IndusInd Bank, L&T, Axis Bank, M&M, Adani Ports, Kotak Mahindra Bank, ICICI Bank, HDFC Bank, Power Grid, Hero MotoCorp, Coal India, Dr Reddy's, HDFC Ltd, HUL, Bajaj Auto, Yes Bank, Asian Paints, RIL, ONGC, Tata Steel and NTPC, gaining up to 2.94%.

In contrast, Sun Pharma, TCS, Infosys, ITC, Bharti Airtel, Wipro and SBI succumbed to profit-booking and fell by up to 2.46%. In keeping with the overall trend, the small-cap and mid-cap indices rose 0.88% and 0.74%. Shares of scam-hit Punjab National Bank lost another 1.32%. Gitanjali Gems too slumped 4.84% to Rs 23.60.

Shares of Simbhaoli Sugars plunged 15.73% today after CBI registered a case against the company, its Chairman Gurmit Singh Mann, Deputy MD Gurpal Singh and others in connection with an alleged bank loan fraud of Rs 97.85 crore. The company's lender Oriental Bank of Commerce also fell by 10.02%.

17:41 CPI inflation to trend higher, chances of rate hike rising, says UBS

Inflation is expected to trend higher and though RBI may keep policy rates on hold in 2018-19, there are also increasing chances of a rate hike, says a UBS report. According to the global financial services major, minutes from the February 7 meet of Monetary Policy Committee (MPC) seem "hawkish", and highlight upside risks to inflation. UBS expects headline CPI inflation to remain in the range of 5.1-5.6% over the next few months and average 4.9% YoY in FY19. "In our base case, we expect the MPC to keep rates on hold in 2018-19," UBS said.

17:39 ONGC says KG-D5 output delay due to policy changes

Oil producer ONGC said it may miss the June 2019 target for starting production from its Krishna Godavari basin block due to new policies like GST and local purchase preference rules, including the one that mandates state-owned firms to source domestic iron and steel for infrastructure project, reports PTI. Clarifying on its last week's filing to stock exchanges, Oil and Natural Gas Corp (ONGC) said the new policies it had cited for a possible delay pertained to local purchase preference policy, steel policy and GST policy.

"The new policies concerning oil and mining sector, as referred in the reply of ONGC to NSE and BSE, though not amply clarified in the reply, were pertaining to policies like purchase preference policy, steel policy, GST policy etc. and not regulatory policy," ONGC said in a statement. While the ONGC Board had in March 2016 approved a $5.07 billion investment for bringing oil and gas discovered in the KG-DWN-98/2 or KG-D5 block in Bay of Bengal to production, new policies were formulated last year.

17:37 CBI case against Simbhaoli Sugars first registered in 2015, says OBC

State-owned Oriental Bank of Commerce said Simbhaoli Sugars is an old NPA account of the bank and the first case was registered with CBI in September 2015. "First complaint to CBI was filed on September 3, 2015 and amended complaint was filed on November 17, 2017. The case has now been registered as per procedures," the bank said in a regulatory filing.

The bank said Simbhaoli Sugars is an old NPA account which was reported to RBI and CBI as per extant procedures. The total exposure in this account has been adequately provided and there will be no impact on the profitability of the bank, it said.

17:34 Mercedes-Benz launches enhanced S Class in India

German luxury car maker Mercedes-Benz has launched the enhanced version of its flagship product Mercedes-Benz S-Class - S 350 d diesel, and also the S 450 petrol -- in India at a price starting from Rs 1.33 crore. While the Mercedes-Benz S 350 d is priced at Rs 1.33 crore, the petrol version S 450 is priced at Rs 1.37 crore, the company said in a statement. The new S Class 350 d is India’s first BS VI compliant ‘Made in India, for India’, vehicle with a state-of-the-art diesel engine that meets BS VI emission norms, two years ahead of the regulation, it added.

17:31 Future Generali Life expects Rs 950cr premium in FY18

Private insurer Future Generali Life Insurance is expecting to garner a total premium income of Rs 950 crore in the current financial year, a company official said. Since start of operations in 2007, assets under management (AUM) of Future Generali were to the tune of Rs 31,000 crore, of which unit linked insurance plans (ULIPs) share was 10% to 15%. "We are expecting to garner a total premium income of 950 crore in 2017-18. Out of that first individual is Rs 300 crore, first group Rs 250 crore and Rs 400 crore of renewal premium", CMO and EVP (strategy) Rakesh Wadhwa told PTI.

17:28 RInfra wins Rs 292cr arbitration award against Goa govt

Reliance Infrastructure (RInfra) has won an arbitration award of Rs 292 crore against the Goa government for non-payment of electricity dues. It said the need for arbitration arose due to prolonged non-payment of dues by the state government towards supply of electricity by RInfra from its 48 MW Goa Power Plant in Sancoale. The Tribunal has also ordered payment of interest at 15% per annum on the total award amount if the government fails to pay the entire award amount by the deadline, it said.

17:26 CIL board to consider payment of interim dividend for FY18

State-owned Coal India’s board will meet next week to consider payment of interim dividend for the ongoing fiscal. "A meeting of Board of Directors of the company will be held on Wednesday, the 7th March, 2018 inter-alia to consider payment of interim dividend, if any, for the year 2017-18," Coal India (CIL) said in a filing to BSE. The company said that it has fixed March 15 the purpose of payment of interim dividend on equity shares for 2017-18, if declared by the board.

17:25 Rahul questions PM over delay in setting up of Lokpal

Congress President Rahul Gandhi accused Prime Minister Narendra Modi of favouring the "super rich" and questioned why he had still not appointed a Lokpal to fight corruption, reports PTI. Gandhi, who has been targeting Modi in all public rallies in poll-bound Karnataka, also quizzed Modi over his "silence" on issues such as the Punjab National Bank fraud. "In Gujarat, Modi ji did not implement Lokayukta. It has been four years since he became prime minister... He did not implement Lokpal even in Delhi," he said.

The Congress president said Modi, who had described himself as the country's "chowkidar" (watchman), was silent on the fraud and the alleged increase in the turnover of a company owned by BJP president Amit Shah's son, Jay Shah. "The country's chowkidar comes to Karnataka and speaks about corruption with his chief minister (former chief minister Yeddyurappa) who had been to jail on one side and on the other side four ministers who also went to jail during the BJP rule," he said, addressing a rally here.

"Nudidante nade" (practise what you preach)," he urged Modi, quoting 12th century social reformer Basaveshwara from Karnataka. Gandhi, who is on the second leg of his three-day tour of the northern parts of Karnataka, said, "Modiji... nudidante nade. The country has not made you prime minister just to give speeches."

17:20 BSE waives transaction fees equity segment of Sensex 30 index

In order to facilitate and encourage participation by retail investors in financially sound companies, BSE has waived the transaction charges on Sensex 30 stocks from March 12. Currently, transaction charges range from Rs 0.50-1.5 per trade for securities under group A, B and other non-exclusive scrips.

In a statement, BSE said it has waived the transaction charges in equity segment on "S&P BSE Sensex 30 Stocks with effect from March 12, 2018. S&P BSE Sensex is the barometer of Indian economy". The move will help India in the growth story as BSE will now be the most preferred exchange for transacting in the Sensex 30 stocks, which are considered to be growth engine for India, it added.

Exclusive: Maruti Suzuki Swift's hybrid version could make its way to Indian roads

Maruti Suzuki, the country largest car maker, could explore the possibility of getting the hybrid version of Swift to India as a stop-gap arrangement before moving to fully electric mobility, reports Moneycontrol News’ Swaraj Baggonkar. The hybrid version of the Swift is presently available in Europe but with petrol engine option – 1.2 litre and 1.0 litre. A version of that model or in diesel could make it to Indian showrooms of the company.

Maruti Suzuki, the country largest car maker, could explore the possibility of getting the hybrid version of Swift to India as a stop-gap arrangement before moving to fully electric mobility, reports Moneycontrol News’ Swaraj Baggonkar. The hybrid version of the Swift is presently available in Europe but with petrol engine option – 1.2 litre and 1.0 litre. A version of that model or in diesel could make it to Indian showrooms of the company.

17:09 Bhushan Steel bid: Liberty House explains case in NCLT

Following the rejection of its bid for acquiring Bhushan Power and Steel, UK-based Liberty House made a case at the National Company Law Tribunal (NCLT), elaborating as to why it wants its bid to be opened, reports PTI. “The Court heard our petition. The judge heard our arguments. We explained our case stating why we want our bids to be opened in the first case," spokesperson with Liberty House told PTI.

Liberty House also explained to the NCLT that it wants to do business in India as there is no better time than this. There will be another hearing for the other party - Resolution Professional and Committee of Creditors (CoC)- in March, the spokesperson said. The matter, the spokesperson said, is sub-judice and "we have full faith in NCLT". The company had earlier said that it was planning to move NCLT this week to direct creditors and resolution professional to consider its offer.

16:59 Sridevi died due to accidental drowning, alcohol traces found in blood

The post-mortem report of actress Sridevi reveals that the cause of death is accidental drowning in her bathtub and forensic report has ruled out any criminal motive for the actor’s death. Forensic reports also shows that traces of alcohol were found in Sridevi's body, according to UAE's Gulf News.

16:07 Delhi HC attaches all assets of Singh bros

In a major blow to Singh brothers – the promoters of Fortis Healthcare and Religare Enterprises – the Delhi High Court in its interim order on Monday attached all assets of RHC Holdings and Oscar Investments. The latter are privately-held holding companies that own assets of Malvinder Singh and Shivinder Singh referred as Singh brothers.

The case is related to the enforcement of a foreign arbitration award of Rs 3,500 crore by Daiichi Sankyo in a case related to the sale of Ranbaxy Laboratories by Singh brothers. The court directed the Singh brothers to submit list of unencumbered personal assets that need to be valued and liquidated.

16:07 Did Sridevi die due to drowning?

As anxious crowds milled around her Mumbai home and stars visited the family to pay their condolences, a Dubai paper reported that Bollywood superstar Sridevi was getting ready for dinner with husband Boney Kapoor when she suffered a cardiac arrest, reports PTI. Uncertainty over when the body would arrive and the many questions surrounding her sudden death in Dubai late Saturday intensified as the day progressed.

Boney and Sridevi, 54, were in Dubai to attend nephew Mohit Marwah's wedding. While most of the extended family as well as Boney and younger daughter Khushi had returned, Sridevi decided to stay back. The elder daughter, Jhanvi, was in Mumbai to complete a shooting schedule. Some details of what may have happened were pieced together by the Khaleej Times newspaper, which quoted sources as saying that the matter was under police investigation.

According to the newspaper, an Indian Consulate official and a family member were called inside the morgue today afternoon. On Saturday, Boney, who produced "Mr India", which gave Sridevi one of her most remembered roles, flew back to Dubai to surprise his wife with a dinner, the paper reported. He reached the Jumeirah Emirates Towers Hotel around 5.30pm (Dubai time) and woke her up and they chatted for about 15 minutes, the report said.

Sridevi then went to the bathroom to get ready. When she didn't come out for 15 minutes, Boney knocked on the door. He did not get any response and forced open the door, to find her lying motionless in the bathtub that was full of water. "He tried to revive her and when he could not, he called a friend of his. After that, he informed the police at 9 pm," Khaleej Times quoted a source as saying. The police and paramedics rushed to the site, but she was pronounced dead. Her body was taken to the General Department of Forensic Medicine for an autopsy.

15:57 Nokia unveils curved glass flagship phone Sirocco, revamps classic 8110

Technology giant Nokia revealed its latest flagship smartphone — the Nokia 8 Sirocco — a day ahead of the 2018 Mobile World Congress in Barcelona. The company launched the new 8110 4G, an updated version of Nokia's classic 20-year-old phone, and also unveiled Nokia 7 plus, new Nokia 6 and Nokia 1. Sirocco will come with a 5.5-inch 2K display. The smartphone is 7.5 mm thick and is IP67 rated waterproof till 1 metre for up to 30 minutes.

14:43 Fitch says asset-backed securities not affected by PNB fraud

Fitch Ratings said Indian asset-backed securities (ABS) transactions are unlikely to be affected by the Rs 11,400 crore fraud at Punjab National Bank (PNB), reports PTI. PNB, it says, still remains eligible as an account bank for Indian ABS transactions rated at 'BBB-sf'. ABS are bonds or notes backed by financial assets. Typically, these assets consist of receivables other than mortgage loans, such as credit card receivables, auto loans, manufactured-housing contracts and home-equity loans.

14:20 No clarity on Sridevi's cause of death, body remains still in the morgue

According to various sources, more reports on Sridevi's death expected shortly. Also, Khaleej Times has ruled out second autopsy. More blood test will be conducted. And there is no confirmation on release of Sridevi's body yet.

13:41 Aster DM Healthcare makes weak debut, shares fall over 4%

Shares of Aster DM Healthcare made a weak debut at bourses today, falling over 4% from the issue price of Rs 190. The stock listed at Rs 182.10, a loss of 4.15% from the issue price, on BSE. On NSE, shares of the company debuted at Rs 183, a fall of 3.68%.

The company's market valuation stood at Rs 9,225.45 crore. The initial public offer of Aster DM Healthcare was subscribed 1.33 times during February 12-15. The price band for the offer was kept at Rs 180-190 per share.

The company operates in India, the Philippines, Jordan and all the Gulf Cooperation Council (GCC) states comprising the United Arab Emirates, Oman, Saudi Arabia, Qatar, Kuwait and Bahrain.

13:39 Manohar Parrikar is stable, says state minister

Goa Chief Minister Manohar Parrikar is "absolutely fine and stable", a state minister said today, a day after he was admitted to a Goa hospital following complaints of uneasiness, reports PTI. Parrikar, 62, was taken to the Goa Medical College and Hospital (GMCH) on Sunday evening on a wheelchair.

He was discharged from Mumbai's Lilavati Hospital on February 22, a week after he was admitted there and treated for a pancreatic ailment. "The chief minister remains admitted in hospital but he is absolutely fine and stable," state Health Minister Vishwajit Rane said. He was suffering from mild dehydration at the time he was taken to GMCH.

13:33 Meet Malegam, the man chosen by RBI to solve PNB fraud

On February 14, a Rs 11,400-crore scam breaks out at state-run Punjab National Bank following fraudulent deals involving diamantaire Nirav Modi and jeweler Mehul Choksi. A few days later, India’s banking regulator, the Reserve Bank of India (RBI), forms a committee under Yezdi Hirji Malegam – an 84-year-old chartered accountant and the longest-serving member on the RBI board till 2016, reports The Economic Times.

13:25 Bhaichung Bhutia quits Trinamool Congress

Former India football captain Bhaichung Bhutia announced his decision to quit the Trinamool Congress. The footballer, who contested elections twice as a Trinamool Congress candidate and lost both times, took to social media to announce his decision. "As of today I have officially resigned from the membership and all the official and political posts of All India Trinamool Congress party. I am no longer a member or associated with any political party in India," Bhutia said in a tweet.

Bhutia had unsuccessfully contested the 2014 Lok Sabha elections from Darjeeling and the 2016 West Bengal Assembly elections from Siliguri. The TMC declined to comment on Bhutia resigning from the party. However, sources told PTI that Bhutia had informed the TMC about his decision one month ago as he was no longer interested in being associated with any political party.

13:12 Strides Shasun to launch Ranitidine tablets in US

Drug firm Strides Shasun announced that it will launch Ranitidine Tablets USP, 150 mg, used to treat peptic ulcers of the stomach and intestines, in the US markets. Strides is already a key player in the US Ranitidine Rx market with 32% market share through its approval for Ranitidine Tablets USP, 150 mg and 300 mg. The new launch will further strengthen company’s Ranitidine franchise, the company said in a statement.

The company said, "the US OTC market for Ranitidine Tablets, which is the generic form of the popular brand Zantac, is approximately $200 million." This is the first product approval from company’s 50:50 JV with Vivimed Labs. The product will be backward integrated and will be manufactured at the JV’s oral dosage facility in Chennai, it said.

Strides will have exclusive marketing rights for the product in the US. The product will be launched immediately. The company has 82 cumulative ANDA filings with USFDA (including its JV with Vivimed), of which 50 ANDAs have been approved as of date and 32 are pending approval.

EXCLUSIVE: Govt readying a tough law for speedier recovery of dues from Nirav Modi-type fugitives

The government will shortly move a new law—the Fugitive Economic Offenders Bill—to impound and sell assets of Nirav Modi-type escapees, a move that will allow quicker recovery of dues through a special court from absconding corporate defaulters, reports Moneycontrol News’ Gaurav Choudhury. In September, the Law Ministry had approved the Finance Ministry’s draft of Fugitive Economic Offenders Bill, 2017, and its passage into law is now being expedited as part of the Modi government’s response to the PNB scam.

The Bill is likely to be introduced after Parliament reconvenes on March 6 for the second the part of the Budget session. It defines fugitive economic offender as a person who has an arrest warrant issued in respect of a scheduled offence and who leaves or has left India so as to avoid criminal prosecution, or refuses to return to India to face criminal prosecution.

The draft Bill covers a wide range of offences including wilful loan defaults, cheating and forgery, forged or fraudulent document of electronic records, duty evasion and non-repayment of deposits among others. Once voted into law the new legislation will empower investigating agencies to confiscate, and vest with themselves, any property of the absconding offenders without an encumbrances.

Also, at the discretion of any Court, such person or any company where the absconder is a promoter or key managerial personnel or majority shareholder, may be “disentitled” from bringing forward or defending any civil claim. This could effectively take away the fugitive offenders rights to reclaim the assets.

12:33 Sterlite Tech bags Rs 3,500cr project from Indian Navy

Sterlite Technologies has been awarded a Rs 3,500-crore advance purchase order to design, build and manage the Indian Navy’s communications network. "The Rs 3,500-crore system integration project will enable the Indian Navy with a digital communications network at par with the most advanced naval forces globally," the company said in a statement.

This will give the Navy digital defence supremacy at par with the best naval forces globally. This is the first time that an integrated naval communications network at such a scale is being built in India, the company added. The Navy’s communications network has been envisioned as a smarter network infrastructure with enhanced throughput, high-quality secure services and ease of network management. The scope requires Sterlite Tech to design, build and manage the communications network for over a decade through its system integration capabilities, it said.

11:58 Lenders back govt takeover of Nirav Modi & Gitanjali cos, says report

A set of lenders wants the government to take over the Nirav Modi and Gitanjali group of companies rather than have banks initiate bankruptcy proceedings, reports The Times of India. Banks said a precedent was set in the case of Satyam Computers, where the government appointed a board of directors to run the company and protect its assets.

However, sources in the Corporate Affairs Ministry said the government was not keen on taking over the companies as this would result in the Centre being responsible for all liabilities. Those opposed to insolvency proceedings are banks that have an indirect exposure to the Nirav Modi and Gitanjali fraud through their loans against unauthorised guarantees issued by Punjab National Bank (PNB).

If bankruptcy proceedings are initiated, it would mean that the resolution process has to be completed within 270 days from the date of admission. If there is no resolution plan, which is very likely given the fraud, the companies would have to be liquidated. Besides, insolvency would also adversely impact over 1,000 employees. Around 700 employees working in Hyderabad Gems SEZ — a 100% subsidiary of Gitanjali — have found themselves without a job after the SEZ was attached in the wake of the fraud. Over 250 of those employees in the SEZ were people with disabilities.

11:49 BSF foils infiltration bid along IB in J-K's Samba district

BSF troops foiled an infiltration bid along the International Border (IB) in Jammu and Kashmir's Samba district, police told PTI. BSF troops at a border out post observed some movement along IB in Ramgarh sector around 0500 hours today, a senior police officer told PTI. They fired several rounds and illumination flares, he said adding that the suspected militants were forced back and the infiltration bid was foiled. "Troops are on alert to foil any bid," a BSF officer said.

11:39 Sridevi's body to reach India by afternoon

Veteran actor Sridevi’s mortal remains will be flown back to India from Dubai today, her family said in a statement. Sridevi's body could not be repatriated on Sunday as the final investigation reports from Dubai Police were not ready till last evening.

Reliance Communications (RCom) chairman Anil Ambani has reportedly offered to fly her remains back home in his private jet. Sridevi, 54, wife of producer Boney Kapoor, died late Saturday night reportedly due to a cardiac arrest in Dubai's Jumeirah Emirates Towers. The body will be ready for repatriation by 1 to 2 pm, Dubai time, Khaleej Times reported.

Indian Consulate officials reveal that that after receiving the Police Clearance and forensic report, the other procedures including, immigration and embalming would be completed in the next 3 to 4 hours, a source told the publication. The actor and family were in town after attending the wedding of her nephew Mohit Marwah which took place in Ras Al Khaimah.

11:35 Porsche to launch electric vehicle in India in early 2020

Luxury car maker Porsche, part of the Volkswagen group, will launch an electric vehicle (EV) in India in the beginning of 2020, a company official told PTI. Porsche, which started operations on India in 2012, has so far been selling fully imported cars here as the company does have any manufacturing or assembly units outside its home country Germany. "We will launch a fully electric car in India in the beginning of 2020," Director of Porsche India Pavan Shetty said.

11:23 India Inc lines up Rs 25,000cr public offers

The IPO lane seems to getting busier as over two dozen companies have lined up initial share sale plans worth Rs 25,000 crore in the coming months, largely to fund their expansion projects and working capital requirements, reports PTI. Hindustan Aeronautics, ICICI Securities, Barbeque-Nation Hospitality and Flemingo Travel Retail are among the names that plan to launch share-sale offers in the coming months.

Most of these companies plan to utilise initial public offer (IPO) proceeds for business expansion as well as working capital requirements, as per the draft papers filed with capital markets regulator Sebi. Besides, some of the firms believe the listing of equity shares on bourses will enhance their brand name and provide liquidity to existing shareholders.

Barbeque-Nation Hospitality, ICICI Securities, Bharat Dynamics and Indian Renewable Energy Development Agency - have secured Sebi's go-ahead this year to float their public offers. In addition, 20 companies including RITES, Mishra Dhatu Nigam, Bandhan Bank, IndoStar Capital Finance, Nazara Technologies and Route Mobile are awaiting the regulator's approval to float IPOs. Together, these companies are expected to raise nearly Rs 25,000 crore, merchant banking sources said. Moreover, five companies, including Newgen Software Technologies and Amber Enterprises India, have already hit the capital markets.

11:13 OVL drops plan to build LNG export facility in Iran

ONGC Videsh has shelved plans to build a $5 billion LNG export facility in Iran and has instead opted to only invest in developing a giant gas field in the Persian Gulf, for which a revised cost is being worked out, reports PTI. OVL, the overseas arm of state-owned Oil and Natural Gas Corporation (ONGC), had last year made its 'best' offer to spend $11 billion in developing the Farzad-B field in the Persian Gulf as well as in building the infrastructure to export the gas but Iran deterred on awarding the rights of the field to the Indian firm owing to differences over investments and price of gas.

The company has now agreed to do just the upstream field development part, leaving the marketing of the fuel to Iran, the official said. As had been agreed during the visit of Iranian President Hassam Rouhani earlier this month, a team of OVL officials will be visiting Tehran this week to discuss modalities of the upstream development. "We had initially thought that the upstream field development would cost $6.2 billion. But, this is not the final cost. We will be able to arrive at a final cost only after we do at least well to appraise the discovery we had made about a decade back," he said.

10:52 Hindcon Chemicals IPO opens today, to raise Rs 7.73cr

Chemical products manufacturer Hindcon Chemicals said its initial public offer (IPO) will open today to raise up to Rs 7.73 crore. The company said it will use the proceeds to meet working capital requirements, general corporate purposes and expenses. The IPO will put to offer 27,60,000 equity shares of face value of Rs 10 each at a cash price of Rs 28 per piece. The issue closes on February 28.

In 2016-17, the company's net revenue of operations was Rs 33.94 crore, of which 32.14% came from exports to Nepal, Bhutan and Bangladesh. The key product portfolio of Hindcon includes protective waterproofing coatings, sodium silicates, concrete & mortar admixtures, epoxy grouts & mortars, waterproofing compounds, shotcrete aids, remover cleaning compounds, sealants, tile adhesives, among others.

10:45 PNB scam may cost banking sector about Rs 21,000cr

The final bill of the fraud at Punjab National Bank to the Indian banking system could well be in the vicinity of Rs 21,000 crore, if one were to account for the secured loans to the Nirav Modi group and the Gitanjali group of companies, reports Moneycontrol News’ Tarun Sharma and Beena Parmar. With investigative agencies cracking down on both groups and attaching their assets, many other banks, in addition to PNB, may struggle to recover the money loaned to these groups.

10:17 Morgan Stanley says RBI MPC's next move likely to be rate hike

The Monetary Policy Committee's next move will likely be a rate hike but this will not be taken up immediately as a recovery is still at nascent stage, says a Morgan Stanley report. According to the global financial services major, the inflation trajectory will hold the key towards determining when the central bank will likely hike interest rates.

"In this context and also from our read of the MPC statement and the minutes, while the next move is likely to be a rate hike, it is unlikely to be taken up immediately," Morgan Stanley said. Its base case assessment remains that "the RBI will hike in Q4 FY18. However, considering that we see upside risks to our inflation forecasts, the risks are also tilting towards an earlier-than-expected rate hike," it added.

10:10 Taxmen asked to step up collections to meet Rs 10.05 lakh cr target

Faced with a daunting target of Rs 10.05 lakh crore, the apex decision making body for direct taxes CBDT has asked its field officers to step up efforts and put more focus on better performing zones, reports PTI. In the 2018-19 Budget, the government has hiked the direct tax, which includes personal income tax and corporate tax, collection target to Rs 10.05 lakh crore, from Rs 9.80 lakh crore budgeted initially.

In a review meeting earlier this month, the Central Board of Direct Taxes (CBDT) has set higher target for zones which are performing well. "We are looking at better advance tax collection for January-March quarter. If the trend of October-December quarter continues, we will be able to achieve the landmark Rs 10 lakh crore target," an official said. The focus areas of the department for stepping up tax collection will be to follow up with entities which are currently giving taxes on the basis of self-assessment.

09:45 FPIs pull out Rs 9,899cr from equities during Feb 1-23

Foreign investors have pulled out nearly Rs 10,000 crore ($1.5 billion) from the Indian stock market so far this month primarily due to PNB fraud jitters coupled with global cues. This is against the total inflow of over Rs 13,780 crore by foreign portfolio investors (FPIs) in January, latest data with the depositories showed. According to depositories’ data, FPIs withdrew a net amount of Rs 9,899 crore from equities during February 1-23. However, they put in over Rs 1,500 crore in the debt markets during the period under review.

09:38 PNB fraud: Banks for raising cover against fraud by staff

Rattled by a spate of frauds in the banking sector, lenders are now planning to increase insurance cover against delinquencies by their employees to protect their bottomlines, reports PTI. "Frauds of such magnitude and scale - PNB fraud Rs 11,400 crore and OBC fraud Rs 390 crore - has forced us to consider substantially much higher risk cover than the basic banker's indemnity policy which various banks have right now," a top public sector bank official said.

Besides, tightening internal risk mechanism and vigilance, banks have to look for higher cover to guard against such fraud where employees are involved, the official said, adding, this will help insulate the balance sheet. For example, SBI alone in 2016-17 reported frauds of Rs 2,424.74 crore (837 cases). Out of this, an amount of Rs 2,360.37 crore (278 cases) represents advances declared as frauds.

09:20 Godrej Appliances eyes Rs 5,000 crore turnover in FY19

Godrej Appliances, the consumer durables division of Godrej Group, is targeting a 25% revenue growth to nearly Rs 5,000 crore in 2018-19, on higher demand expectation, reports PTI. "We should be close to Rs 4,000 crore this financial year. We will be targeting a 25% growth next year, at close to about Rs 5,000 crore," Godrej Appliances business head and executive vice president Kamal Nandi said.

08:58 JSW Steel set to acquire Italian Aferpi for Rs 600 cr: Source

Private steel maker JSW Steel is close to acquire Italy-based Aferpi steel firm for Rs 600 crore, a source told PTI. "The deal is almost finalised. Most probably by the end of March or beginning of April, it will be final," the source said, adding that the deal is worth about Rs 600 crore.

Aferpi makes specialty long products for railways, bars for auto industry parts, earthmoving vehicles, among others and is the second largest steel maker in Italy. The plan is to cater to the automobile customers of Europe. HR coils will be sent from India and further finished products will be sold to the customers there.

08:48 Liberty House appeal to NCLT to be heard today

The fate of Liberty House's bid for Bhushan Power and Steel may be decided on Monday morning, when its appeal to the National Company Law Tribunal will be heard, reports Moneycontrol News’ Prince Mathews Thomas. The UK-based company had moved the NCLT after its bid for Bhushan Power and Steel was rejected by Committee of Creditors last week.

The Committee, consisting of lenders, had refused to consider the bid as it was submitted after the deadline had passed on February 8. The appeal by Liberty House is an unprecedented one. In none of the auctions till now has a bid been accepted after the deadline. If the company's bid is accepted by the NCLT, it will open up a much contentious issue. Sources say that JSW Steel and Tata Steel may consider contesting it.

08:19 CBI files Rs 1bn fraud case against Simbhaoli Sugar executives

The Central Bureau of Investigation (CBI) said on Sunday it had filed a fraud case against executives of Simbhaoli Sugar for causing alleged losses of Rs 1.09 billion to state-run Oriental Bank of Commerce, reports Reuters. The bank alleged that the sugar refiner “dishonestly and fraudulently diverted” a Rs 1.48-billion-loan sanctioned in 2011 for financing cane farmers for private use, a statement issued by CBI said.

The case comes at a time when the Indian banking sector is getting to grips with its biggest banking fraud totalling $1.8 billion, in which the No 2 state-run lender PNB has alleged that two of its employees colluded with firms linked to well-known jewellers Nirav Modi and his uncle Mehul Choksi.

This is the second case in three days registered by the CBI upon complaints from the Oriental Bank of Commerce. The police has registered a case against several top officials of Simbhaoli Sugar, including its chairman and managing director, chief executive and chief financial officer, some unknown bank officials, and other private persons.

08:10 PNB fraud: ED to seek info from over dozen countries on Nirav Modi, Choksi's assets

Widening its probe into the PNB fraud case, the Enforcement Directorate will soon send judicial requests to over a dozen countries for obtaining information about the overseas businesses and assets of diamantaire Nirav Modi and owner of Gitanjali Gems Mehul Choksi, reports PTI.

Official sources said the agency will approach a competent court in Mumbai with a request to obtain Letters Rogatories (LRs) to be sent to about 15-17 countries where the central investigation agency has traced the footsteps of the diamond and gold jewellery businesses of the firms owned by Modi, his uncle Choksi and others associated with them.

The countries where the LRs would be sent include Belgium, Hong Kong, Switzerland, the United States, the United Kingdom, Dubai, Singapore and South Africa. Some official requests on the basis of agency-to-agency exchange will also be sent to few countries, the sources said.

07:51 Dr Reddy's Labs gets EIR from USFDA for Srikakulam plantPharma major Dr Reddy's Laboratories said it has received the establishment inspection report (EIR) from the US Food and Drug Administration for its formulations facility in Srikakulam, Andhra Pradesh. The company, without mentioning the contents of the EIR, said the USFDA has maintained OAI (Official Action Indicated) status at its API manufacturing plant in Srikakulam.

The US drug regulator has asked the company for more details, it said. "FDA has asked us for more details. We are providing those details and continuing to engage with FDA for resolution of pending issues," Dr Reddy's said in a regulatory filing. An OAI status is equivalent to finding of objectionable conditions at the audit site and also an indicative of regulatory and/or administrative sanctions by FDA.

The USFDA issues an EIR to an establishment that is the subject of an FDA or FDA-contracted inspection when the agency decides to close the inspection. In April 2017, the company had informed about completion of the audit at its API manufacturing plant in Andhra Pradesh and issuance of two observations by the US drug regulator. Dr Reddy's had said that it was addressing those issues.

07:46 Huawei unveils world's first 5G commercial modem

Chinese telecom gear firm Huawei on Sunday unveiled the world's first commercial 5G modem with a claim that it can deliver peak speed of over 2,000 megabit per second on next generation network, reports PTI. In India Reliance Jio has been delivering wireless broadband with peak average download speed of around 21 mbps and fixed broadband service provider Spectra claims to be delivering speed of up to 1GBPS (or 1024 mbps).

The company unveiled world's first 5G CPE (consumer premise equipment or router) with the promise of delivering broadband speed of up to 2 Gbps on 5G network. The CPE will also support 4G network. Besides the chipset, Huawei unveiled full touch-screen enabled notebook Huawei matebook X Pro with 13.9 inch display, pop-up camera on the keyboard with price range starting EUR1,399. The company unveiled three 4G tablet models in Mediapad M5 series with dual use as tablet and notebook at starting price of EUR349.

07:31 Samsung launches Galaxy S9 & S9+

South Korean tech major Samsung unveiled Galaxy S9 and S9+, its latest flagship model in the smartphone segment, a day before the Mobile World Congress 2018 in Barcelona, reports PTI. The phones have features like dual aperture and slow motion video options that compete with iPhone X and Google Pixel 2 series. It also have features like dual-stereo speakers and Dolby Atmos surround sound capabilities.

The S9 comes with 4 GB RAM and with internal memory options of 64 GB, 128 GB and 256 GB along with an external memory slot, which can support a capacity of up to 400 Gb. While the Galaxy S9+ comes with 6GB RAM and would also have memory options of 64 GB, 128 GB and 256 GB along with an external memory slot of 400 GB.

The company has incorporated several advanced features such as built in live automatic translator in its camera app, which could translate over 50 languages. Samsung has incorporated several Indian languages in the camera app which includes Hindi, Urdu, Bengali, Telugu, Tamil, Punjabi and Marathi.

Both the phones would be operated through Android 8 Orio and would give options to users to create their own emojis with their faces while chatting. The S9, which has put 3,000 mAh battery for its 5.8 inch screen and S9+ would have 3,500 mAh battery for 6.2 Inch screen. Both the phones would have a front camera which is 8 mega pixels and the rear would have a 12 mega pixels camera. The phones will also have features like rear figure scanning and wireless charging system.

7:15 Sridevi's autopsy complete, body to be flown back today

The autopsy of superstar Sridevi, who passed away in Dubai after a cardiac arrest, has been completed and her body would be flown back to India today, reports PTI. The actor, wife of producer Boney Kapoor, died late in the night reportedly due to cardiac arrest in Dubai, where she had gone along with her family to attend her nephew Mohit Marwah's wedding.

UAE officials have revealed that Sridevi's autopsy has been completed and the family is now awaiting laboratory reports conducted by the General Department of Forensic Evidence, Dubai, Khaleej Times reported. The body of legendary Indian actress Sridevi, who died in Dubai on Saturday night, is likely to be flown home on Monday, Gulf News reported.

Sridevi’s body could not be repatriated on Sunday as the final investigation reports from Dubai Police were not ready by late evening, officials dealing with the legal formalities were quoted by the report. Officials also said that as per usual protocols, these tests take up to 24 hours in the case a person has died outside a hospital in Dubai. The same safety and administrative protocols are being followed by the police in this case as well.

She reportedly had a fainting spell in her bathroom and was immediately rushed to Rashid Hospital in Dubai, the report said. The hotel, however, refused to comment on the matter and an employee stated that the matter is under police investigation.

That's all for today, readers. Thanks for staying on with our coverage of the day's action. Your enthusiasm encourages us to better our coverage every day. Do come back tomorrow for more news, views and insights.

As bezels on the latest smartphones are getting slimmer, the work of phone makers is getting trickier, as they're riddled with problems including where to place the fingerprint sensor or a selfie front camera, or even the earpiece. But it seems like Chinese smartphone maker Vivo has found a solution to the issue and launchedtheall new concept phone Vivo APEX at the ongoing Mobile World Congress (MWC) 2018.

Sridevi's body is not being embalmed today, it is likely to be done tomorrow, reports Khaleej Times.

Income Tax Department froze 66 more bank accounts of the Gitanjali Group which has a total credit balance of Rs 80.07 crores, sources told ANI. Search & Survey action was initiated at four locations in Mumbai on Thursday.

At one location, 173 paintings and artworks by eminent artists were found. The artwork and paintings have been placed under Prohibitory Orders as the process of valuation and are underway by the professionals of JJ School of Art, Mumbai, the sources added.

The H-1B visa programme has not undergone any fundamental change, a senior US diplomat said here today, seeking to allay the apprehension among Indians that amendments to it would harm their interest. There is no change in the processing of H-1B visas from the (US) Consulate (in Mumbai), USA’ Mumbai-based Consul General Edgard D Kagan told reporters.

“There is a sense in India that the changes in H-1B can have a big impact in India. We understand that andwe have heard that message from the Indian government and recognized that it is important here,” he said.

Mahindra & Mahindra says that LG Chem will develop unique cells exclusively for India application and will also supply Li-Ion cells based on Nickel Manganese Cobalt (NMC) chemistry with high energy density. These cells will be deployed in the Mahindra & SsangYong range of electric vehicles, CNBC-TV18 tweets.

ACC has called off the merger with Ambuja Cements Limited (ACL). ACC has said in a BSE notification that currently there are 'constraints in implementing merger between the company and ACL." The notification continues to say that the merger with ACL remains to be 'the ultimate objective' and will not be proceeding with the merger at this juncture.

Indonesia: Earthquake with a magnitude of 6.3 hit 194 kms northwest of Ambon, tweets All India Radio.

After Central Bureau of Investigation (CBI) and Income Tax (IT), Enforcement Directorate (ED) is the third agency that has questioned Punjab National Bank’s (PNB) executive director KV Brahmaji Rao, over lapses in Rs 11,400 crore PNB fraud, reports Moneycontrol’s Tarun Sharma.

Meanwhile, PNB CEO Sunil Mehta could not attend to the summons issued to him due to business commitments.

Also, ED will soon issue summons to former PNB MD UshaAnanthasubramanian as it feels that Mehta’s tenure at the bank is lesser, sources said.

A powerful explosion ripped through a three-storey building killed at least four people and injured four others in Leicester, police said today but ruled out a terror link to the “earthquake-like” blast in the English city, home to a large number of people of Indian-origin.

Police declared a “major incident” after the explosion occurred last evening on a stretch of road containing commercial and residential properties in Hinckley Road area of Leicester, some 140 km away from London. The city has a large Gujarati-origin population.

Four people were killed in the explosion and subsequent fire that destroyed the building which consisted of a Polish supermarket on the ground level and a two-storey flat above it, police said.