The bulls carried forward the momentum seen on Friday as Nifty managed to hit another ton on Monday and reclaimed crucial moving averages which is a positive sign for the bulls. The index made a strong bullish candle on the daily charts and now the next target of 10,900 looks possible.

The Nifty index opened positive and witnessed sustained buying interest for the second consecutive trading session. It rallied by more than 200 points from 10400 to 10600 zones in the last two sessions and finally managed to close above its 50EMA.

The Nifty broke above its crucial 50-days exponential moving average (DEMA) placed around 10,560 on closing basis which is a positive sign for the bulls. Traders can create long positions on the index now with a stop loss below 10,500 markets.

The Nifty which opened at 10,526 rose to an intraday high of 10,592. It slipped marginally to 10,520 before closing the day at 10,582, up 91 points.

“It was heartening to see the Nifty witnessing a follow-through buying with a strong gap up opening which sustained throughout the trading session before bulls signed off the day in style with a strong bullish candle near to intraday high,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

“Moreover with a close above 50-Days EMA, which offered resistance twice to the index, it appears that bulls are positioning themselves for a bigger upmove towards 10900 levels for which a confirmation will come once they conquer immediate hurdle of 10630 levels on closing basis,” he said.

Mohammad is of the view that on the downside it looks imminent for bulls to sustain above Monday’s gap zone of 10520 - 499 levels on a closing basis to retain bullish bias.

Hence, traders are advised to make use of dips, if any, to create fresh longs with a stop below 10500 and look for bigger targets as a close above 10630 will force the bears to run for cover, he said.

India VIX fell down by 3.57% at 13.69. Falling VIX is providing stability to bulls in the market. On the options front, maximum Put open interest is seen at 10000 followed by 10400 strikes while maximum Call open interest is at 10700 followed by 11000 which is shifting its support higher.

We have collated the top fifteen data points to help you spot profitable trade:

Key Support & Resistance Level for Nifty:

The Nifty closed at 10,582.6. According to Pivot charts, the key support level is placed at 10,537.53, followed by 10,492.47. If the index starts to move higher, key resistance levels to watch out are 10,610.33 and 10,638.07.

Nifty Bank:

The Nifty Bank closed at 25,687.9. Important Pivot level, which will act as crucial support for the index, is placed at 25,472.0, followed by 25,256.1. On the upside, key resistance levels are placed at 25,813.0, followed by 25,938.1.

Call Options Data:

Maximum call open interest (OI) of 30.46 lakh contracts stands at strike price 10,700, which will act as a crucial resistance level for the index in the March series, followed by 11,000, which now holds 30.25 lakh contracts in open interest, and 10,600, which has accumulated 24.84 lakh contracts in OI.

Call writing was seen at a strike price of 10,700, which saw the addition of 19.36 lakh contracts, followed by 10,900, which added 15.53 lakh contracts and 10,800, which added 14.73 lakh contracts.

There was hardly any Call unwinding seen.

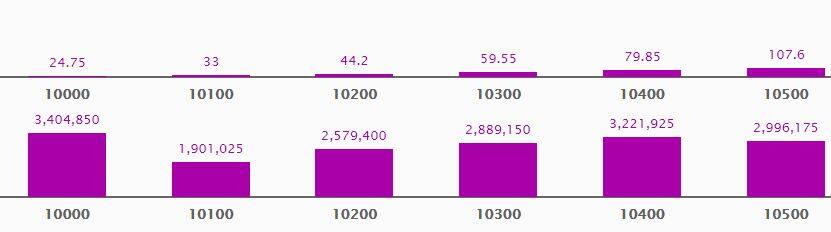

Put Options Data:

Maximum put OI of 34.04 lakh contracts was seen at strike price 10,000, which will act as a crucial base for the index in March series; followed by 10,400, which now holds 32.21 lakh contracts and 10,500 which has now accumulated 29.96 lakh contracts in open interest.

Put Writing was seen at the strike price of 10,400, which saw addition of 20.12 lakh contracts, along with 10,300, which added 18.20 lakh contracts and 10,200, which added 14.40 lakh contracts.

There was hardly any Put unwinding seen.

FII & DII Data:

Foreign institutional investors (FIIs) sold shares worth Rs 1,119.51 crore, while domestic institutional investors bought shares worth Rs 1,409.45 crore in the Indian equity market, as per provisional data available on the NSE.

Fund Flow Picture:

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting the delivery of the stock, which means that investors are bullish on the stock.

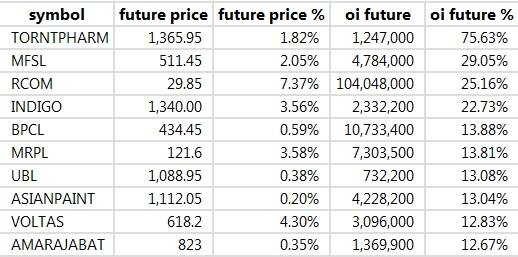

149 stocks saw long build-up:

14 stocks saw short covering:

A decrease in open interest along with an increase in price mostly indicates short covering.

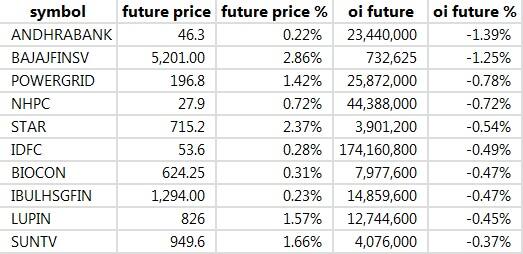

43 stocks saw short build-up:

An increase in open interest along with a decrease in price mostly indicates short positions being built up.

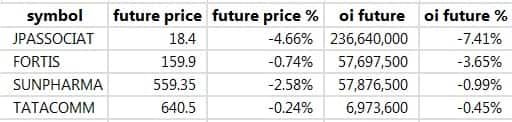

4 stocks saw long unwinding:

Long unwinding happens when there is a decrease in OI as well as in price.

Bulk Deals:

Coffee Day Enterprise Ltd: KKR Mauritius PE Investments II Ltd sold 90,00,000 shares at Rs 324.25 per share while Malavika Hegde bought 55,00,000 shares at Rs 324.00 per share.

Fortis Healthcare Limited: BNP Paribas Arbitrage bought 40,20,000 shares at Rs 157.59 per share and ECL Finance Ltd sold 41,95,754 shares at Rs 155.81 per share.

(For more bulk deals click here)

Analyst or Board Meet/Briefings:

Sadbhav Engineering is likely to meet investors at Kotak Securities Investors’ Conference on February 28.

Manpasand Beverages is likely to meet investors at Kotak Institutional Equities’ conference on February 28.

Greaves Cotton met representatives of HDFC Securities at February 26, 2018.

Stocks in news:

Indian Overseas Bank: The bank has approved the convening of EGM and to seek the approval of shareholders for issue of equity shares of face value of Rs 10 each to the government on preferential basis, aggregating upto the extent of Rs 4,694 crore plus Rs 173.06 crore.

Tata Power: Skill development institute given global HR skill development award 2018.

Torrent Pharma: The company plans to raise approx Rs 2,000 crore through a QIP.

Berger Paints: The company is planning setting up an integrated paint plant in Lucknow, Uttar Pradesh

Jain Irrigation subsidiary invests in Innova Food NV Belgium. CY17 turnover of the acquired co - Euro 23.6mn

Mahindra & Mahindra collaborates with LG Chem to for Lio-on battery technology to support EV revolution in India

ACC says there are constraints in implementing merger between the Company and Ambuja Cements

IOB approves preferential issue of shares to GoI upto Rs 4694cr

Music Broadcast - Radio city and Apple music launch Bollywood countdown show

LT Foods - CRISIL upgrades long term and short term ratings of the Co

Sagar Cements board approves acquisition of hydel power plants (capacity of 4.3 MW and 4 MW) for a sum of 26.9cr

USL - ICRA upgrades ratings of various debt instruments

HDFC Bank says will work closely with SEBI in relation to whatsapp data leak

Simbhaoli Sugar says that in relation to the fraud case registered by OBC- co is in process of submitting the information and clarifications to the investigating

agencies

PNB says quantum of unauthorized transactions can increase by USD 204.25 mn Clarifies that govt hasnt asked PNB to pay the fraud liabilities

Indiabulls Real Estate’s EGM on March 23 to seek shareholder approval for divestment of stake in Indiabulls Properties

3 stocks under ban period on NSE

Security in ban period for the next trade date under the F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

Securities which are banned for trading include names such as Fortis, JP Associates and Oriental Bank of Commerce.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!