The market extended gains for the third consecutive week, ending November 28, at a new closing high with more than half a percent rally. During the week, the index made a new high of 26,310 before witnessing some profit booking. Positive global cues with increasing hope for a Fed funds rate cut in December, and subdued oil prices that helped temper inflation concerns, supported market sentiment, along with strong DII inflow.

The week, starting December 1, is expected to remain positive for the market, thanks to stronger-than-expected Q2FY26 GDP numbers and hope for healthy credit growth in the second half of FY26.

Benchmark indices are likely to touch new highs, with focus on RBI monetary policy, Fed Chair Powell's speech, monthly auto sales, manufacturing & services PMI numbers, and US economic releases, experts said.

The Nifty 50 soared 135 points (0.52 percent) to 26,203, and the BSE Sensex climbed 475 points (0.56 percent) to 85,707, while the Nifty Midcap 100 index outperformed the benchmark indices, up 1.27 percent. Still, the Nifty Smallcap 100 index underperformed, falling 0.1 percent.

Going forward, after making a new high last week, markets are expected to maintain a gradual up-move, with investors focusing on the RBI policy meeting this week, Siddhartha Khemka, Head of Research, Wealth Management at Motilal Oswal Financial Services, said.

According to Vinod Nair, Head of Research at Geojit Investments, the stronger-than-expected Q2 GDP print, driven by resilient manufacturing, solid construction activity, and healthy private consumption, is set to support sentiment in the near term.

Investors will now focus on a critical lineup of macro data, including India and US PMI releases, US core PCE inflation, initial jobless claims, and, crucially, the RBI’s policy decision, he said.

Here are 10 key factors to watch for this week:

RBI Policy

Market participants will keep a close watch on the RBI monetary policy decision and its commentary scheduled on December 5. Experts are divided in opinion as some still expect a 25 bps cut in repo rate to 5.25 percent, but others give importance to liquidity and see status quo on rates given strong economic growth numbers.

"Last month’s tightening, driven by tax outflows and foreign exchange intervention to stabilize the rupee, raised expectations of RBI action. As a result, monitoring RBI’s liquidity stance is critical, as it will influence short-end rates and funding conditions more immediately than a rate cut," Nimesh Chandan of Bajaj Finserv Asset Management.

Domestic Economic Data

Further, the industrial production data for October, along with the manufacturing PMI for November, will be released on December 1. Preliminary estimates suggested that the manufacturing PMI dropped to 57.4 in November against 59.2 in October.

Services PMI numbers for November will also be announced this week on December 3. According to preliminary estimates, service PMI increased to 59.5 in November, against 58.9 in October. Foreign exchange reserves for the week ended November 28 will be released on December 5.

Fed Chair Powell Speech

Globally, the focus will be on speech by the US Federal Reserve Jerome Powell on December 2, especially ahead of the FOMC's meeting scheduled on December 10. His commentary on labour data, economic progress and further rate cut trajectory will be watched. Most economists see a 25 bps cut in the benchmark interest rate by the central bank.

Apart from that, the economic releases like manufacturing & services PMI, PCE price index, and weekly jobs data will also be watched.

Global Economic Data

Besides manufacturing and services PMI numbers in Europe, and other key nations like China, Japan, the market participants will also focus on Europe's retail sales, and July-September quarter economic growth estimates scheduled this week.

Auto Sales

Back home, auto stocks including Tata Motors, Hero MotoCorp, Ashok Leyland, Bajaj Auto, TVS Motor, Ashok Leyand, Royal Enfield, Mahindra and Mahindra, Maruti Suzuki, and Hyundai Motor India - will be in focus this week as companies will start releasing their November sales numbers effective December 1. According to experts, overall numbers are expected to be positive with a possible surprise in commercial vehicle sales.

Market participants will also keep an eye on the mood of the FIIs (Foreign Institutional Investors) who have intermittently been buying in equities, but they remained net sellers for the fifth consecutive month in November to the tune of Rs 17,500 crore. For the last week, they have net sold Rs 3,659 crore worth shares, but that was completely offset by the inflow of DIIs both on a weekly and a monthly.

Domestic Institutional Investors have net bought Rs 22,763 crore worth of shares last week, taking the total monthly buying to Rs 77,084 crore, the highest since August.

Meanwhile, the Indian rupee strengthened by 0.28 percent during the week to 89.33 against the US dollar after sharp weakness in the previous week, while the US dollar index could not sustain above the 100 mark, falling for the second consecutive week, down 0.04 percent to 99.44 as the US Fed is expected to lower rates given the softer US economic data.

The primary market will be super busy this week as 15 IPOs (Initial Public Offerings) are scheduled for launch with a total fund raise of over Rs 7,000 crore, including Meesho (Rs 5,421 crore), Aequs (Rs 922 crore), and Vidya Wires (Rs 300 crore) - from the mainboard segment, which are all opening on December 3.

The SME segment will have 12 public issues worth more than Rs 400 crore this week. Of which, Astron Multigrain, Clear Secured Services, Speb Adhesives, Invicta Diagnostic, and Ravelcare are opening for subscription on December 1, followed by Helloji Holidays and Neochem Bio Solutions on December 2.

Further, Shri Kanha Stainless' IPO will be launched on December 3, followed by Western Overseas Study Abroad, and Luxury Time offers on December 4, while Methodhub Software and Encompass Design India will open their initial share sale on December 5.

Apart from new openings, Purple Wave Infocom, Exato Technologies, and Logiciel Solutions will close their IPOs on December 2 and make their market debut on December 5, while the trading in SSMD Agrotech India will commence on the BSE SME effective December 2, followed by Mother Nutri Foods and K K Silk Mills on December 3.

Technical View

Technically, the continuation of the higher high-higher low formation on larger timeframes, along with healthy momentum indicators and the Nifty 50 holding well above all key moving averages, signals confidence for the index to move toward 26,500–26,600 this week, with support at 26,000–26,100, followed by 25,850 as crucial support.

F&O Cues

The weekly options data also suggested the 26,500 as a target for the week, with 26,100-26,000 being immediate crucial support.

The 26,500 strike holds the maximum Call open interest, followed by the 26,300 and 26,400 strikes, with the maximum Call writing at the 26,400, 26,500, and 26,300 strikes, while the maximum Put open interest was seen at the 26,000 strike, followed by the 26,100 and 26,200 strikes, with the maximum Put writing at the 26,200, 26,100, and 26,000 strikes.

Meanwhile, the significant fall in India VIX, the fear index, provided comfort for the bulls and signaled less uncertainty. It dropped 14.77 percent during the last week (the biggest fall since May this year) to the 11.62 level, the lowest closing level in five consecutive weeks.

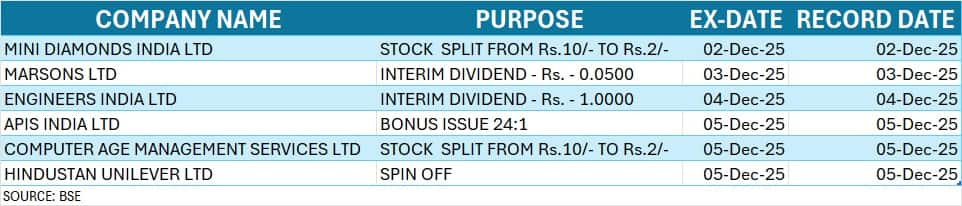

Corporate Action

Here are key corporate actions taking place this week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.