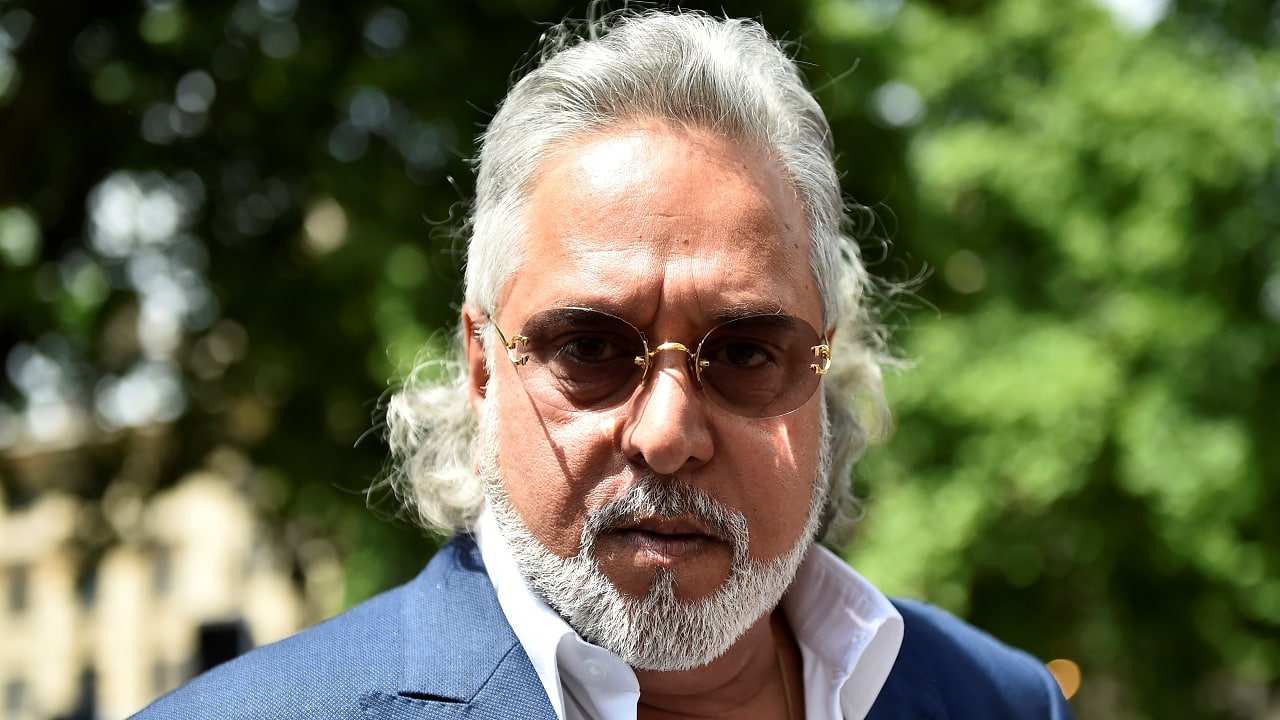

Vijay Mallya

- Who's the GOAT? Virat Kohli, Rohit Sharma, MS Dhoni fans weigh in on Twitter

While Twitter users battled it out, the goat hashtag appeared with other celebrity names too such as actors Salman Khan, Prabhas, Vijay, NTR and even tennis player Rafael Nadal.

- What happens in the Bahamas... Vijay Mallya saves his signature London home - again

A favourable ruling by the Supreme Court of Bahamas on February 11, 2022, unlocks trust funds, means that UBS can redeem the mortgage on the house and any associated interest.

- Supreme Court gives Vijay Mallya last chance to present arguments in contempt case

Mallya is convicted of contempt of court and the issue before the Supreme Court now remains to be the quantum of punishment to be awarded to him.

- Vijay Mallya desperately fights eviction from his signature London house

Swiss bank UBS has managed to get a possession order from a London court; Vijay Mallya is on the verge of losing the house with a gold toilet.

- Vijay Mallya faces prospect of bailiffs knocking on doors of his luxury London home any time now

The 65-year-old former Kingfisher Airlines boss intends to appeal against the ruling on Tuesday, when a High Court procedural judge concluded that Mallya's position in the matter was completely hopeless at the end of an extended stay from eviction due to the pandemic.

- Unpaid loans may drive Vijay Mallya out of his London residence, orders UK court

The judge also declined permission to appeal against his order or to grant a temporary stay of enforcement, which means UBS can proceed with the possession process to realise its unpaid dues.

- When the UK Home Office revokes visas to curb corruption

Mounting criticism that London is used for money laundering led to Pakistani billionaire losing 10-year multi-entry visit visa, but questions remain on investor visa that provided refuge to Nirav Modi.

- “Waited long enough”, Supreme Court to hear Vijay Mallya’s contempt case in January for final disposal

Vijay Mallya’s personal presence is not possible due to the legal proceedings going on in the UK where the fugitive is residing currently.

- SC proposes to go ahead with hearing on sentence in contempt proceeding against Vijay Mallya

On January 18 this year, the Centre told the top court that the government is making all efforts to extradite Vijay Mallya from the United Kingdom but the process is being delayed due to some legal issues involved in the matter.

- Why rich people in need of financial wizardry often flock to the UK and its outposts including British Virgin Islands

Vijay Mallya, Nirav Modi, Pramod Mittal, Lalit Modi have added a strong Indian flavour to London as a destination for dubious, failed, problematic business enterprises.

- Review | 'If I’m Honest' talks about Vijay Mallya, but that's not why you should read it

This book is for readers who've been told that their mental health issues are a figment of their imagination.

- Vijay Mallya’s Kingfisher House sold for Rs 52 crore

Vijay Mallya has been declared a wilful defaulter and is wanted by Indian authorities for default in payment of loans related to Kingfisher Airlines that was grounded in 2012.

- Can a bankrupt Vijay Mallya still live as a baron?

Legal experts have mixed opinions over what the tag of bankruptcy granted by a UK court means for Vijay Mallya.

- Vijay Mallya bankrupt, declares London High Court

The ruling will help the consortium of Indian banks led by the State Bank of India to recover debt from loans given to Vijay Mallya’s now-defunct Kingfisher Airlines by seizing his India assets.

- Banks recover another Rs 792 crore from Kingfisher Airlines share sale

The ED said that Rs 1,060 crore has been granted to banks by a Fugitive Economic Offense Court in the Nirav Modi case.

- Actor Vijay fined Rs 1 lakh by Madras High Court for evading taxe on a luxury car purchase

The funds from this will be put towards the Tamil Nadu Chief Minister's Public Relief Fund to fight COVID-19.

- What next for banks post the Kingfisher loan recovery?

In fact, the recovery in the Kingfisher-Vijay Mallya case may be the best deal Indian banks may have got in a long time, with lenders recovering almost the entire principal amount by selling Mallya's shares.

- SBI-led consortium gets over Rs 5,800-cr in Mallya loan default case: ED

The ED had issued a statement on Wednesday stating that about 40 per cent of the money lost by banks in alleged frauds perpetrated by fugitive businessmen Nirav Modi, Mehul Choksi and Mallya has been recovered so far due to its "swift" action in attaching and freezing their assets.

- SBI, others have the last laugh in Kingfisher-Vijay Mallya saga

Why didn't banks go ahead and sell the shares before? That's because there was a court stay that prohibited banks from selling the securities in Mallya's name. Also, there was ED attachment on these assets.

- ED transfers portion of assets seized in Vijay Mallya, Nirav Modi cases to Centre and PSBs

The Enforcement Directorate (ED) said on June 23 that it had transferred a part of the attached or seized assets in cases related to fugitive billionaires Vijay Mallya, Nirav Modi and Mehul Choksi, to state-run banks and the Centre.