So, banks have recovered almost the entire principal loan amount given to the grounded Kingfisher Airlines by selling promoter Vijay Mallya's shares in various group companies.

What's next?

Although banks have recovered a total of Rs 7,182 crore from Mallya by selling his shares in group companies, there is still around Rs 5,000 crore due to banks by Kingfisher if one factors in the interest amount accrued over years, top bankers said.

Personal guarantees valid till full recovery

Till the time the entire amount is recovered, the personal guarantee given by Mallya against the loan amount stands valid. This means banks will continue to fight for recovery through legal channels, bankers said. A personal guarantee is an assurance by the promoter to the banks that if the loan is not paid back, banks can recover the money from the guarantor.

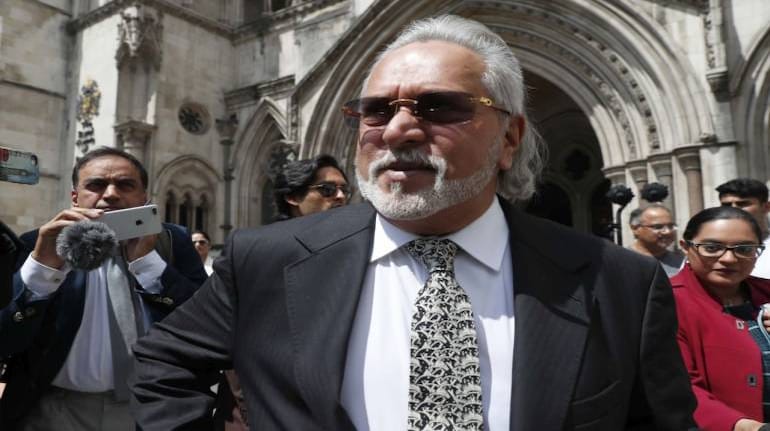

Mallya originally owed around Rs 9,000 crore to a bank consortium led by the country's largest lender by assets State Bank of India (SBI). There were 17 banks in the consortium. Kingfisher became an NPA (non-performing asset) for banks in later 2012 while the airline was grounded on October 20, 2012. Mallya had drawn the loans from the bank consortium against his personal guarantees. This proved to be the banks' biggest weapon against him during legal proceedings.

"Till the time banks get 100 percent money back from Kingfisher account, banks will chase him using the personal guarantees," said a senior banker based in Mumbai who used to be part of the lender group that gave the loan to Mallya. "Even after the recovery, the cases with respect to financial irregularities and frauds will continue," said the banker.

Probes to continue

Various investigative agencies, including the Enforcement Directorate (ED) and the Central Bureau of Investigation (CBI) are probing the loan deals between Mallya and banks. Even though banks have managed to sell Mallya's shares and recover a substantial chunk, Mallya's extradition is still key as the baron is being investigated for allegedly defrauding banks using the loan amount. The CBI has alleged that Mallya has diverted funds for other activities.

The CBI probe revealed that after availing loans from IDBI Bank, State Bank of India and another consortium of banks, the accused (Mallya) diverted the sanctioned amounts for purposes other than those avowed to the banks. Giving a specific example, the CBI said an aggregate amount of Rs 263.08 crore, out of loans availed from IDBI Bank in 2009, was diverted for purposes like payment of TDS overdues, lease rentals of corporate jet used by Mallya privately, payment of salaries and others.

Citing another instance, the probe agency said a diversion of Rs 15.90 crore to Royal Challengers Sports Private Limited, a Bengaluru-based based IPL Team, from proceeds of SBI loan in May 2009 has also surfaced. Similarly, there are significant diversions to related parties, associates and entities like Force India Formula One team, it said.

Hence, getting Mallya back to India is not only in connection with banks' loan recovery but also for investigations into the alleged fraud.

Besides SBI, lenders to Kingfisher Airlines include Punjab National Bank, IDBI Bank, Bank of Baroda, Allahabad Bank, Federal Bank, and Axis Bank, among others. These lenders gave loans to Mallya over a period of few years against intangibles like company brand and goodwill and Mallya’s personal guarantee.

How did banks recover the money?

On June 23, as first reported by Moneycontrol, banks recovered Rs 5,800 crore by selling Vijay Mallya's shares in United Breweries to Heineken international. Banks sold 15 percent stake in the company to Heineken. Earlier, banks had sold Rs 1,357 crore worth of shares and are planning to sell Rs 800 crore worth of shares by June 25, according to reports. So far, banks have recovered Rs 7,1 82 crore from Vijay Mallya through the share sales, which is a little over 70 percent of the amount that the liquor king owes to the lenders.

Since the shares were attached by the ED, banks were not free to sell earlier. However, after a special court designated under the Prevention of Money Laundering Act (PMLA) granted the bank consortium the rights of United Breweries Holdings Ltd (UBHL), which were earlier attached by the ED, banks moved to sell UBHL shares. Also, on June 8, with the Competition Commission of India clearing the proposal of additional stake buy by Heineken in United Breweries, the path became clear.

Mallya left for the UK in March 2016. Since then banks are locked in a long legal battle in multiple courts to get their money back. Most bankers who signed the cheque to Kingfisher have retired from service. Others had lost hope of any meaningful recovery. For them, there is a sense of victory now in the case. With the government cancelling Mallya's passport in April 2016 and India pushing for the extradition of the businessman, the case had grown beyond a banker-corporate defaulter case. The intense media scrutiny and political comments made the Vijay Mallya case a battle of egos and a political issue.

But Mallya is a small fish in the pond...

Yet, if one looks at the large corporate default cases involving Indian banks, Vijay Mallya is a small fish among the sharks.

"Media and politicians are overly obsessed with Vijay Mallya and Kingfisher but he is relatively a small fish in the big pond," said the banker quoted above. "Mallya case came to the limelight because of his lifestyle. Even when there was no money to pay to his staff, Mallya was partying which obviously the government and the media didn't like," said the banker.

In fact, the recovery in the Kingfisher-Vijay Mallya case may be the best deal Indian banks may have got in a long time, with lenders recovering almost the entire principal amount by selling the shares, said another senior banker who used to work for a state-run bank which is part of Kingfisher consortium. But, in most other large corporate cases, banks are staring at huge losses. In cases where they have made recovery, the amount is only a miniscule of what borrowers actually owed them.

Banks have pushed most large corporate default cases to National Company Law Tribunal (NCLT) under the Insolvency law. In most cases, lenders have taken haircuts in the range of 80 percent-95 percent.

Banks have taken major haircuts in cases either in IBC courts or during one-time settlements. Some of these cases include IDBI Bank-Sivasankaran deal (Rs 500 crore likely recovery against a loan of Rs 5,000 crore through OTS), Videocon group loan settlement in NCLT (about 5 percent recovery on a Rs 65,000 crore loan) and Jet Airways in NCLT (where banks set to take 95 percent haircut). Similarly, in cases like Deccan Chronicle, Alok Industries, Amtek Auto too banks took 80-95 percent haircut. Reliance Infratel, which was resolved in the October-December quarter of FY21, yielded just 10.32 percent for financial creditors.

Banks are sitting ducks in the cases of major bank frauds too. For instance, in the case of Rs 14,000 crore Punjab National Bank fraud perpetrated by Nirav Modi and Mehul Choksi, where the duo fooled the bank with fake documents, the recovery has been almost nil.

What is the biggest learning from the Kingfisher episode for bankers? "Don't throw good money after bad money. Also, always insist on personal guarantee of the promoter," said the second banker quoted above.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.