Singapore’s central bank kept its monetary policy settings unchanged after five straight tightening moves since October 2021, pointing to rising global growth risks and ebbing inflation.

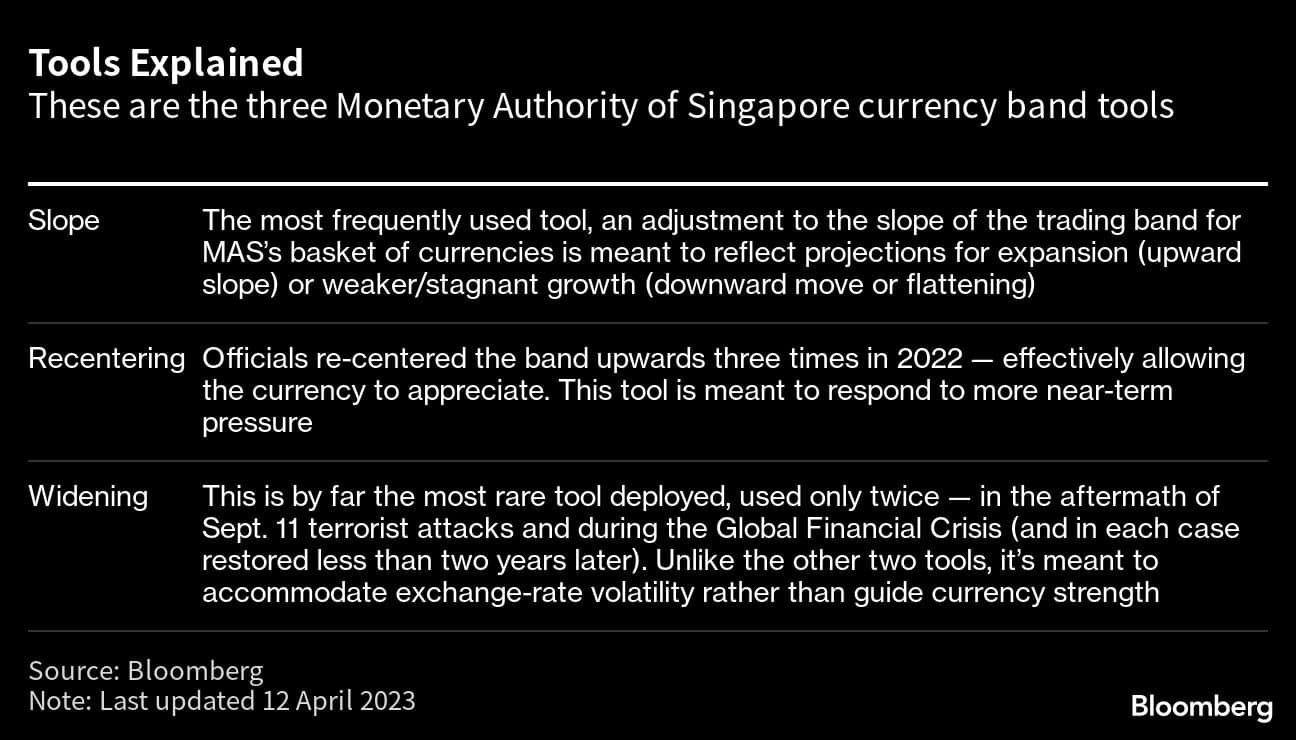

The Monetary Authority of Singapore, which uses the exchange rate as its main policy tool, maintained the slope, center and width of the currency band, according to a statement Friday. The decision came at the same time as gross domestic product data that showed the economy contracted more than expected in the first quarter.

Twelve of 22 respondents in a Bloomberg survey had predicted the MAS would tighten, signaling it was seeking a stronger local dollar to curb imported inflation pressures. The remaining 10 expected the authority to pause.

“With intensifying risks to global growth, the domestic economic slowdown could be deeper than anticipated,” the central bank said. “While inflation is still elevated, MAS’s five successive monetary policy tightening moves since October 2021 have tempered the momentum of price increases. The effects of MAS’s monetary policy tightening are still working through the economy and should dampen inflation further.”

The city-state’s officials have continued to cite the risks of still-elevated inflation, with MAS Chairman Tharman Shanmugaratnam noting earlier this week that the central bank would focus on ensuring medium-term price stability as the basis for sustained economic growth.

Even as price gains linger at a 14-year high, policymakers also are watching for more signs that economic growth is cooling more than anticipated and bring inflation down as a result. The monetary authority’s decision follows a weaker-than-expected first-quarter economic performance, with separate figures also out Friday showing the economy decelerated led by a decline in manufacturing activity.

The Singapore dollar weakened 0.35% following the decision indicating that some investors were hoping for further tightening by the MAS.

Singapore’s GDP growth is projected to moderate significantly this year, in line with the global goods and investment cycle downturn, the monetary authority said in the statement. MAS core inflation will remain elevated in the next few months but should progressively ease in the second half of 2023 and end the year significantly lower, it said.

The “MAS statement is somewhat dovish,” Selena Ling, head of treasury research & strategy at Oversea-Chinese Banking Corp., said, adding that core CPI is expected to ease materially by end-2023 and “growth projected to be below trend this year.”

“Overall, growth in Singapore’s major trading partners will be slower in 2023, below the pace recorded in the previous two years,” according to the MAS.

Officials convening in Washington this week for meetings organized by the International Monetary Fund and the World Bank have pointed to still-bubbling risks of banking turmoil that could restrict credit conditions and accelerate downturns in many economies.

That puts the focus more on global growth risks ahead, even as inflation remains a headache for most economies worldwide, according to the IMF’s latest outlook.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.