A week that promises to feature a lot of drama in markets began with a twist in equity options.

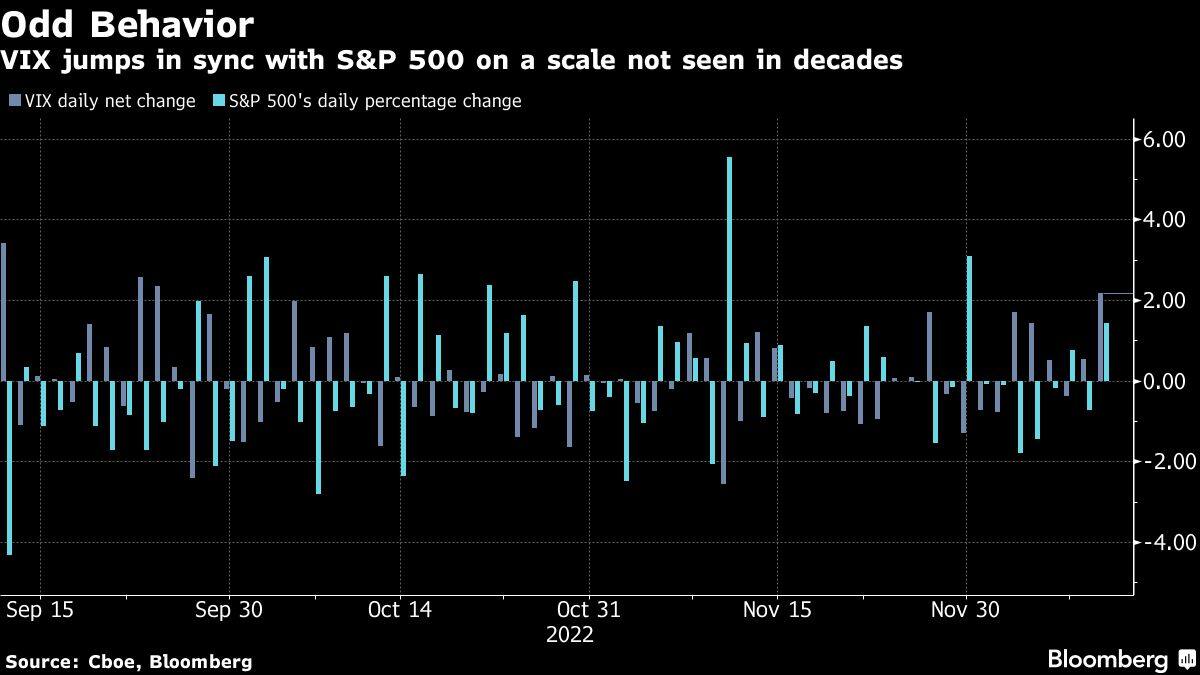

While the S&P 500 was en route to a 1.4% gain Monday, the Cboe Volatility index — a gauge of cost on options tied to the stock benchmark also known as VIX — jumped more than 2 points to surpass 25. Not only do same-direction moves buck the historical pattern where the two normally move in opposite directions, their outsize jumps today mark the first time since 1997 when both climbed in sync as much as they did.

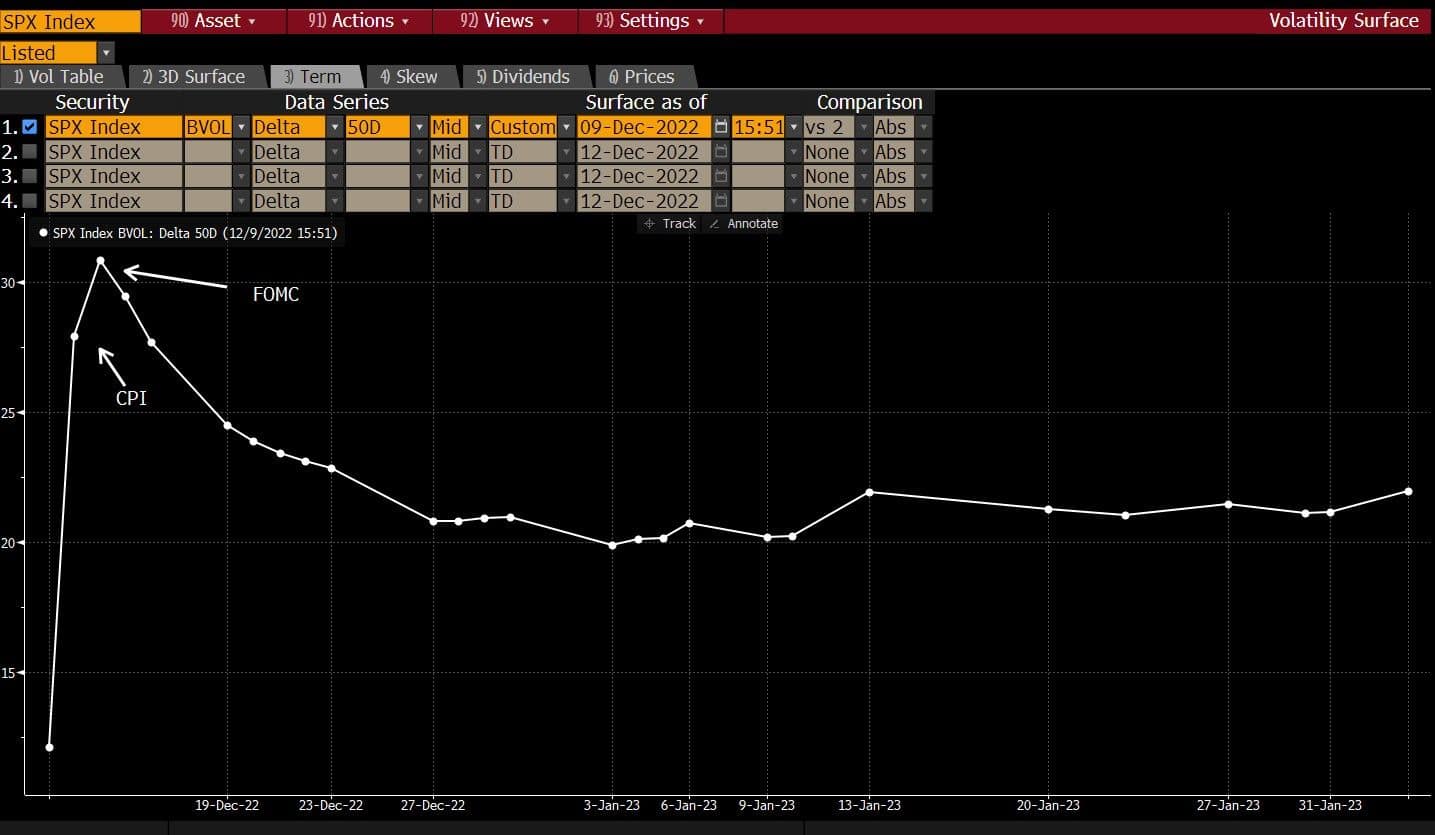

S&P 500s implied volatility curve. Source: Bloomberg

S&P 500s implied volatility curve. Source: Bloomberg

While one market watcher attributed the wrinkle to vagaries of how the VIX trades on Mondays, others said it’s a sign of concern among investors — bulls and bears alike — that the market is poised to escape a tight trading range in a week full of catalysts. Those include data on the consumer price index and the last policy meetings of the year for both the Federal Open Market Committee and the European Central Bank.

After failing to hold above its average price over the past 200 days, the S&P 500 has managed to stay higher than its 100-day average. With the index stuck between key trendlines, a break in either direction is likely to create trouble for some players. The expiration of $3 trillion of options on Friday also has the potential to spur turmoil.

“There are plenty of events that could induce volatility over the coming days — CPI, FOMC, ECB,” said Steve Sosnick, chief strategist at Interactive Brokers. “So it’s not out of the question that some would utilize VIX as a hedge.”

For the majority of traders, the bigger stock-market risk is to the upside. Those who have slashed equity holdings to mutliyear lows during the 2022 bear market are now fretting over being left behind should equities stage a year-end rally.

“This week will be nuts,” said RBC Capital Markets’ strategist Amy Wu Silverman. “I have spoken with a number of clients who are more worried about the upside grab and continue to demand call options.”

But to Chris Murphy, co-head of derivatives strategy at Susquehanna International Group, focusing on the VIX’s spot level is misleading in that the index’s futures curve tends to slope upward to reflect future risk and when the weekend passes, even if the curve doesn’t move VIX has to go higher because it’s moving along the upward sloping curve. In fact, he notes, VIX futures across the curve fell Monday.

“The outsize VIX move is a bit deceiving,” Murphy said. “It’s mostly due to the upward sloping curve and the focus on the CPI and FOMC events this week. VIX is up because time is passing but the options aren’t decaying like they normally do because CPI/FOMC is all that matters.”

Yet the VIX’s elation underlines the heightened caution among options traders of late. In every session last week, implied volatility spiked higher for S&P 500 options expiring on Tuesday when the CPI lands and Wednesday when the Fed decides, according to strategists at Deutsche Bank AG.

The buildup in the volatility premium has set the stage for a market rally once the events pass without big shocks, Deutsche Bank strategists including Parag Thatte wrote in a note Friday. A similar setup, they suggested, is why a cooler CPI reading from the prior month triggered a 5.5% daily surge in the S&P 500.

“A continued rise in the vol premium would make a post-event equity rally more likely regardless of the fundamental outcome,” they wrote. “If the event vol premium stays at current levels, a post-event rally is still more likely in our view while a selloff would need inflation to surprise strongly to the upside as it did in September.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!