The global market for Additional Tier 1 bonds is back in business with a big offering by a Japanese bank just weeks after Credit Suisse Group AG’s collapse hammered the notes.

Sumitomo Mitsui Financial Group Inc. sold 140 billion yen ($1 billion) of AT1 debt, becoming the first major global bank to issue such notes since the finance-sector crisis erupted last month. It’s another sign that the turmoil first triggered by the failure of Silicon Valley Bank is easing.

The sale is one of the largest deals in the yen corporate-bond market this year, indicating that at least in Japan there’s firm demand for riskier debt sold by local lenders. Another of the country’s megabanks, Mitsubishi UFJ Financial Group Inc., is planning a two-part AT1 bond sale as soon as mid-May.

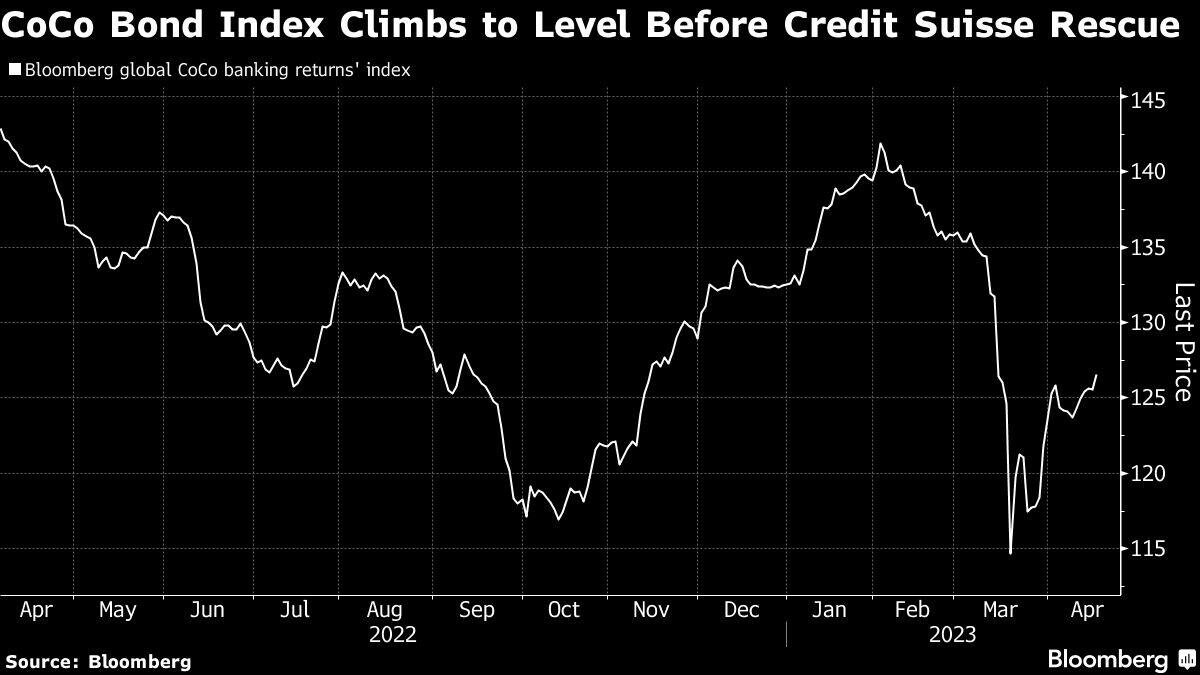

Globally, the securities have rebounded in recent weeks while cross-asset volatility has dropped to around 14-month low, reflecting easing concern about banking systems. SMFG’s offering came after Swiss regulators imposed more than $17 billion of losses on holders of Credit Suisse AT1 debt, securities created after the global financial crisis to bolster banks’ capital in efforts to prevent future taxpayer bailouts.

“This deal indicated that the Japanese AT1 market is very much open and the megabanks are still able to issue junior capital securities at relative low spreads,” said Pri de Silva, senior analyst for Bloomberg Intelligence. “The global AT1s market is somewhat siloed along geographic lines. Yet, this is a step in the right direction for sector.”

AT1 notes, also known as contingent convertible or CoCo bonds, are considered the riskiest debt sold by banks. That’s because they are designed to impose losses on bondholders or be converted into equity if a lender’s capital ratios fall below a predetermined level. Regulators can write them down as well if a bank starts to fail.

Swiss authorities have defended their decision to make the notes at Credit Suisse worthless in a state-brokered takeover by UBS Group AG, telling bondholders that they had been warned of the risk in the paperwork. The wipeout was unmatched in Europe’s $275 billion CoCo bond market.

SMFG priced both 89 billion yen of perpetual notes that can’t be called for five years and two months and 51 billion yen of similar non-call 10-year, two-month debt at spreads of 171 basis points, according to sole underwriter SMBC Nikko Securities Inc. SMFG’s prior such deal was in December, selling 107 billion yen in two parts with spreads of no larger than 148.3 basis points, according to data compiled by Bloomberg.

The firm selling more AT1s with an earlier call date is an indication that even in Japan, investors prefer safer debt after the recent market turbulence, said Kazuma Ogino, a senior credit analyst at Nomura Securities Co.

Financial authorities regard SMFG as one of around 30 global systemically important banks, and no lender of that rank had sold an AT1 bond since Credit Suisse’s collapse, Bloomberg-compiled data show.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.