India may have over 100 operational airports currently, but only a handful operate international flights. International flights have always been a bone of contention for airports, with very few cities beyond the metros getting permission for international flights as late as the 2000s. International operations in India are complex. There are airports which are classified as international but divided into those which are operated as public-private partnerships, those which are joint ventures, those which are owned by state governments and those which have customs handling permission but are government airports.

International airports are more than a status symbol these days. Airports have been lobbying to get access to international flights and in some cases trying hard to include themselves as a point of call for foreign carriers. The government has often argued that the current bilateral rights are lopsided and that no additional points will be allotted to foreign carriers while Indian carriers are free to mount as many flights from airports within India.

International passengers also get additional revenues in more ways than one for the airport. There is a higher UDF (User Development Fee), the ability to lease out more space for retail and duty-free, and the potential for more sale of food and beverages as passengers tend to come in early for their flights, as compared to domestic routes.

For the first nine months of FY23, Delhi airport saw non-aero revenue at Rs 1,800 crore. The largest share of this was from retail which included duty-free, followed by space rentals and cargo. The beauty of international traffic is that it opens potential revenue streams at both departures and arrivals, unlike domestic passengers which tend to spend next to nil at arrivals. The business is so lucrative that as part of vertical and horizontal integration, GMR Airports has started a subsidiary to operate duty-free concessions at airports.

The closure of international operations and subsequent limited opening during the pandemic meant that airports were lacking international passengers, which had an impact on revenues. The government allowed scheduled international services to resume in March 2022, at the beginning of the summer schedule of 2022. As the financial year closed, it roughly marked one year of international operations – covering one summer and one winter season.

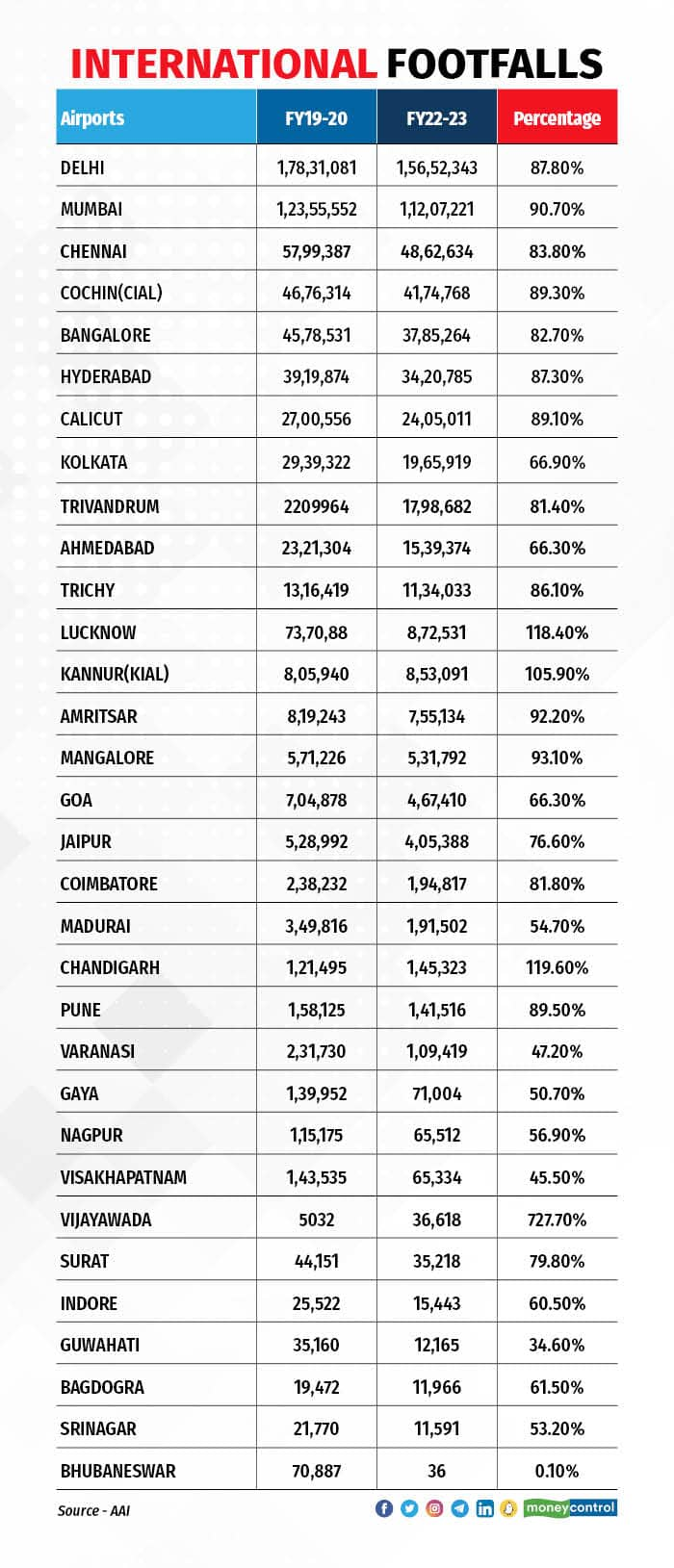

Of the 40 airports which are classified as international, eight did not record even a single international passenger. These airports are Imphal, Port Blair, Aurangabad, Kushinagar, Shirdi, Goa (Mopa), Tirupati and Patna. Another one, Bhubaneshwar, saw only 36 international passengers.

How have the airports performed?

Secondary airports performed better than the metro ones, largely due to a small base. Only four airports saw higher international traffic than pre-Covid times. These include Vijayawada, Chandigarh, Kannur and Lucknow. While the first two are operated by the state-run Airports Authority of India (AAI), Kannur is a private airport while Lucknow is part of a public-private partnership operated by the Adani group. Mangalore and Amritsar came in next with 7 percent and 8 percent short of pre-Covid traffic respectively.

Eleven airports have seen recovery which is between 80 percent and 90 percent of the pre-Covid traffic. Two airports have seen a recovery between 70 percent and 80 percent while five airports saw a recovery between 60 percent and 70 percent. Four airports have seen their traffic drop to less than half of what they catered to pre-Covid.

How did the six metros perform?

International air traffic in India has been largely driven by six large metros, thanks to age-old bilateral agreements allowing these as points of call and the large volume which they cater to due to businesses and sheer population.

Delhi, the largest airport in the country, fell 13 percent short of FY20 numbers while Mumbai was short by 10 percent. Chennai - the third-busiest airport in the country by international passenger traffic saw a 17 percent drop. Kochi continued to have strong international traffic and maintained its lead over Bengaluru, Hyderabad and Kolkata. Overall, it remained 11 percent lower than the pre-Covid numbers. Kolkata slipped to eighth place, having seen Calicut overtake it. Kolkata’s international footfalls were 33 percent lower than pre-Covid times, a significant dip. This was largely driven by China being closed for business and Kolkata having significant connectivity to China.

International footfalls

International footfalls

Will there be recovery for non-metros?

A lot of airports see less than daily flights on the international segments, a few others have been caught up in geopolitics like the case of Srinagar where the flight to Sharjah was not allowed to overfly Pakistan. With a low base in passenger numbers, even a small increase in services has a positive impact.

The numbers are significant for those run by the AAI. A lot of airports will be up for privatisation soon. International passenger numbers are an additional attraction for increasing valuation and helping AAI earn a revenue share.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.