Note to readers: Healing Space is a weekly series that helps you dive into your mental health and take charge of your wellbeing through practical DIY self-care methods.

Elon Musk recently predicted America is sliding into a recession, the markets have been volatile, margins are reducing, and life savings have received a setback. Crypto, that was supposed to be a safe harbour, has fallen through the floor, and nothing seems a sure bet anymore. If you have been taking a financial hit recently, it is likely the hit to your confidence and mental health has been far more detrimental.

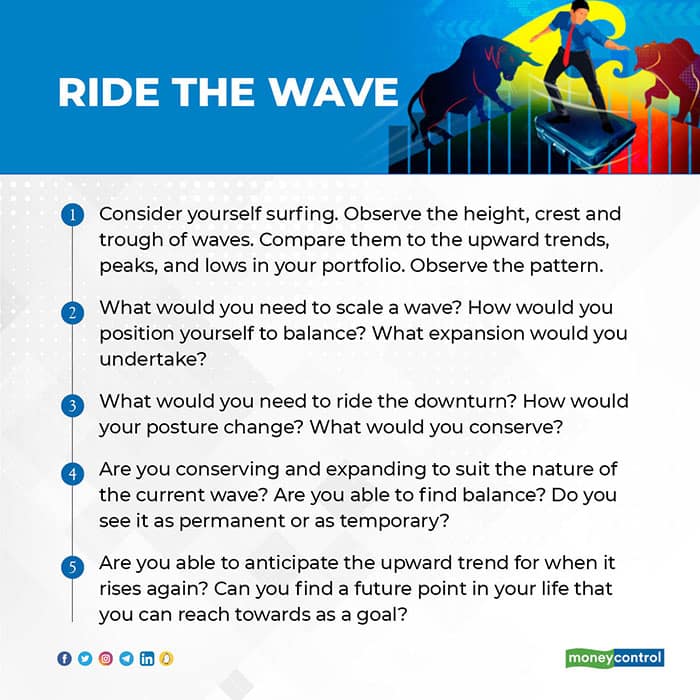

The collapse of structures we take for granted leave us shaken. While we expect some slides and swings, we expect them within a framework in  which we are comfortable. We set a bottom line and a top line. Within their ambit we find resilience easier. When reality exceeds our expectations, on either side, we are taken out of our comfort zones and need a strategy to find our emotional way back.

which we are comfortable. We set a bottom line and a top line. Within their ambit we find resilience easier. When reality exceeds our expectations, on either side, we are taken out of our comfort zones and need a strategy to find our emotional way back.

Bouncebackability is the capacity of the markets to rebound after a crash. In terms of your mental health, it is your resilience, your ability to recover after a fall. Bouncebackability is a collective resilience, the perspective to put our faith in a future when the market correction will swing it back the other way, on an upward trend.

Why do markets affect us personally, deeply? It’s not just money, it’s trust. We understand volatility as essentially a wave, an inevitable up and down movement. Those who watch the markets know, it is not random, it comes with some logic, sentiment, and passion. These are what make the markets sentient, exciting, and relatable. Like any relationship, we are attached to our portfolio not only for what it gives us, but because the markets have an innate collective identity that we relate to and by which we relate to each other through trades.

If anything, it shows us that we are not alone. We are in fact interdependent. We are a collective. Neither in our loss nor gain do we suffer alone. This sense of belonging, participating in a market sentiment, is something that we can lose sight of when we step outside the framework. When we get a windfall, we see ourselves as ‘chosen’, when we lose hard, we can see ourselves as ‘punished’. When in reality the market does neither. It simply responds to sentiment that is co-created by investors and industry. It’s not personal. It is a swing that reflects the global atmosphere, war in some part, shortage in another, glut in another, fear and adversity in one, and faith and triumph in another. When we step back from the immediateness of our own gain and loss, we recognize that we are part of a whole and our fates and fortunes are linked.

‘But how does that lessen the pain of my own sting?’ you may think. ‘My loss is my loss and my gain is my gain. What runs my house, pays my bills, goes into my savings and my portfolio is deeply personal, and when it is diminished, pinched, the hurt is also deeply personal.’ It feels personal, but the truth of the markets emerges when we step back, we see that only when the larger wheels turn does it turn for us individually. Seeing the larger picture is what creates impetus. Individually, we accomplish nothing. Our loss also is not ours alone. Our mutual spending, investment, our faith in the future is our credit and debt. What we believe of ourselves creates the momentum. When we live divisively, without optimism and hope, the markets crash. It’s telling us that every individual voice matters. Who you are and how you live, your disposable income, what you are able to save and invest, the quality of your individual life matters immensely because it holds this larger picture up.

Your bouncebackability, and that of the market rests in individual perspective, each of us believing in a future worth investing in and that immediate downslide does not take away from the windfalls that are to come. One downturn is a valley in a landscape of many peaks, and it is seeing ourselves on a journey that allows us to put our losses and gains in perspective. Hope, the resilience of your mind, is the median by which the market will rise again.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.