It took a minute for Kunal Shah to commit $20,000 to a new startup he had never heard of. At 3:20 pm, an investor sent Shah a short message on WhatsApp, detailing the financing company’s pitch. At 3:21 pm, Shah replied, agreeing to invest the money as part of a half-a-million-dollar funding round, according to the exchange of messages Moneycontrol reviewed.

The episode offers a peek into the investment habits of Shah, founder and CEO of fintech firm CRED. Shah, 42, is India’s most active, prolific and arguably powerful angel investor.

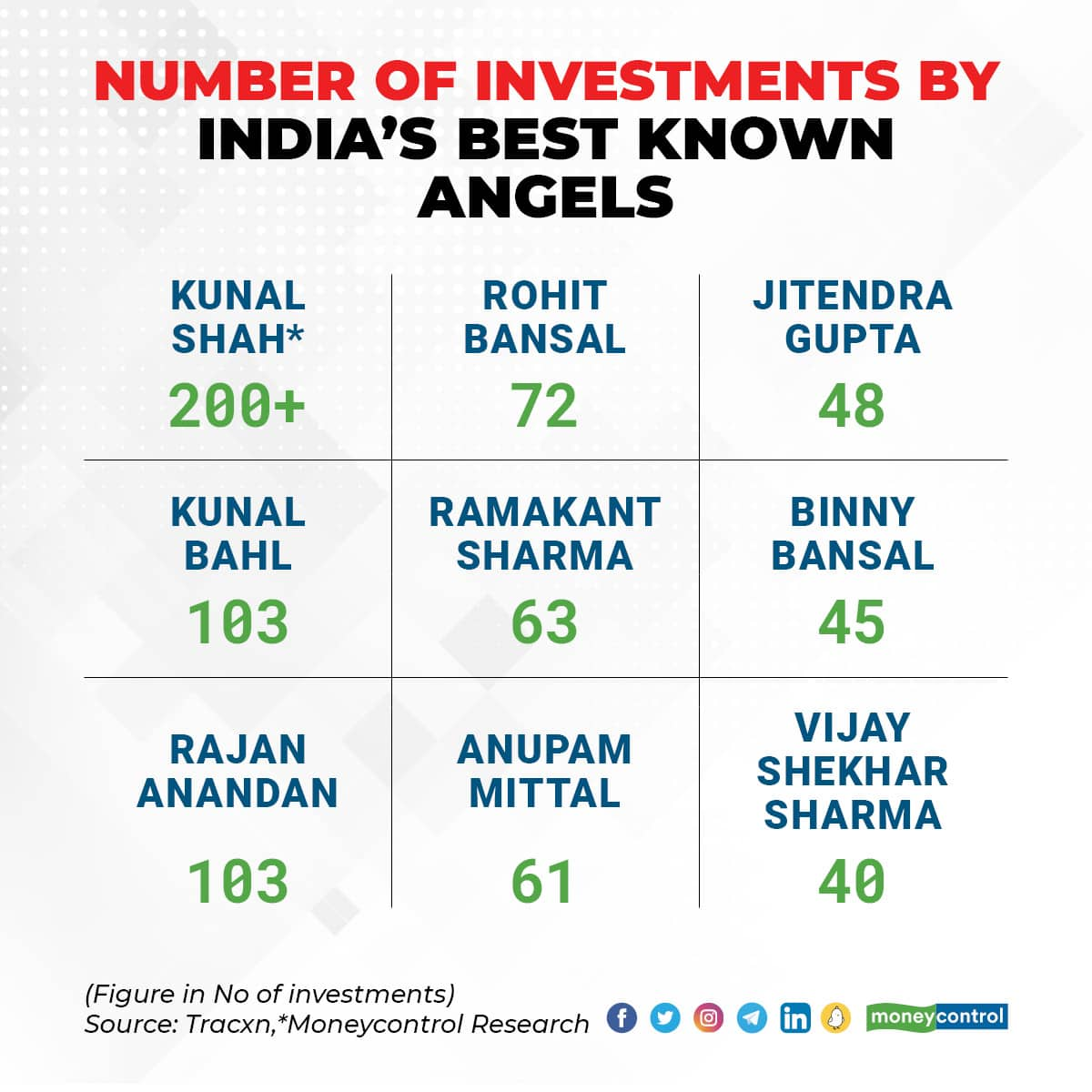

Shah has more than 200 investments under his belt. He has made double the angel investments than the closest contenders on the list —Snapdeal’s Kunal Bahl and former Google India head Rajan Anandan who have each put money in 103 companies, according to data tracker Tracxn. Other well-known angels such as Livspace’s Ramakant Sharma, Flipkart’s Binny Bansal and Jupiter’s Jitendra Gupta all have between 40 and 70 angel investments.

As he aims to disrupt how people pay their credit card bills and manage their money, Shah is also disrupting how entrepreneurs make angel investments.

Despite the rush of money, it usually isn’t easy for fledgling startups to raise money. Such exercises are often driven by relationships. A startup founder often has to wait months to even land a meeting with a venture capitalist. What follows is a whole song and dance that has the founders trying to convince investors and investors asking questions about the business.

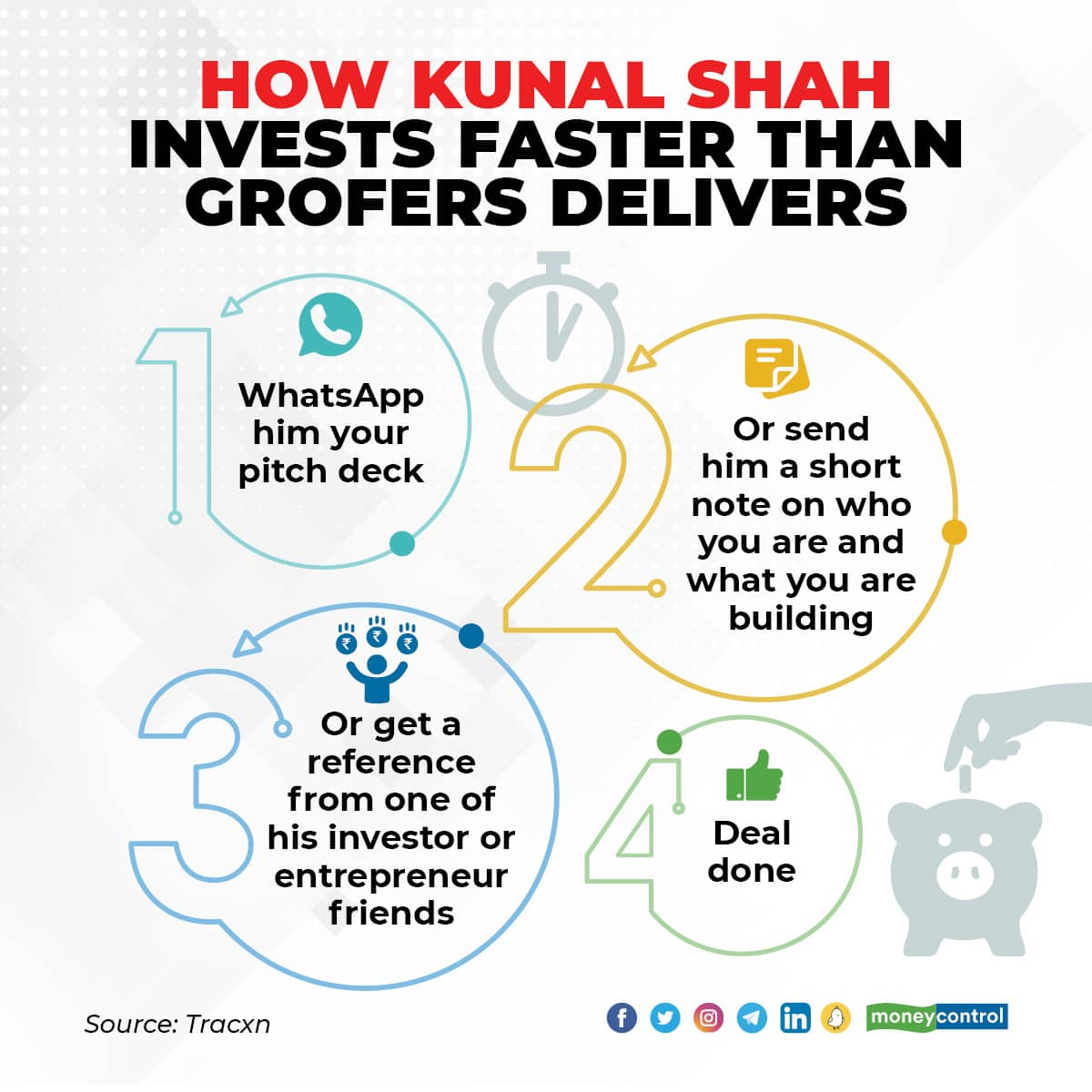

Not so with Shah. Founders who raised money from Shah, and investors who pitch to Shah on founders’ behalf, say almost all of Shah’s angel investing decisions are done on … wait for it, WhatsApp!

In one instance, an entrepreneur sent his pitch deck to Shah on WhatsApp, and said he’s raising a million dollars. Shah, who had never spoken to the founder before, committed $50,000 in a few minutes, said a person involved in the transaction.

As Shah wants to change people’s relationship with money, his own relationship with money may be changing too.

Moneycontrol spoke to over a dozen of Shah’s portfolio companies, his own investors in CRED and before, and his friends in the startup community to understand his angel investing strategy. They spoke on the condition of anonymity, so they could speak candidly.

Shah, who previously founded and later sold a payment-wallet company named Freecharge to e-commerce firm Snapdeal, declined to be interviewed for this article. “He does angel investments in a personal capacity to give back to the ecosystem and to support founders. It’s not something he’d talk about,” a spokesperson said.

Super AngelEstimates vary on how many investments Shah has made. He told Moneycontrol last month that he does not track his angel investments, but estimated his portfolio at 150-170 companies. Two people close to Shah say it crossed the 200 mark recently.

Raviteja Dodda is bemused by one-minute and two-day deals these days. The founder and CEO of MoEngage, a software and analytics firm, says he was lucky to close his seed funding quickly. In 2015, quickly meant two months, even when the company knew its investor Helion Venture Partners for a few years.

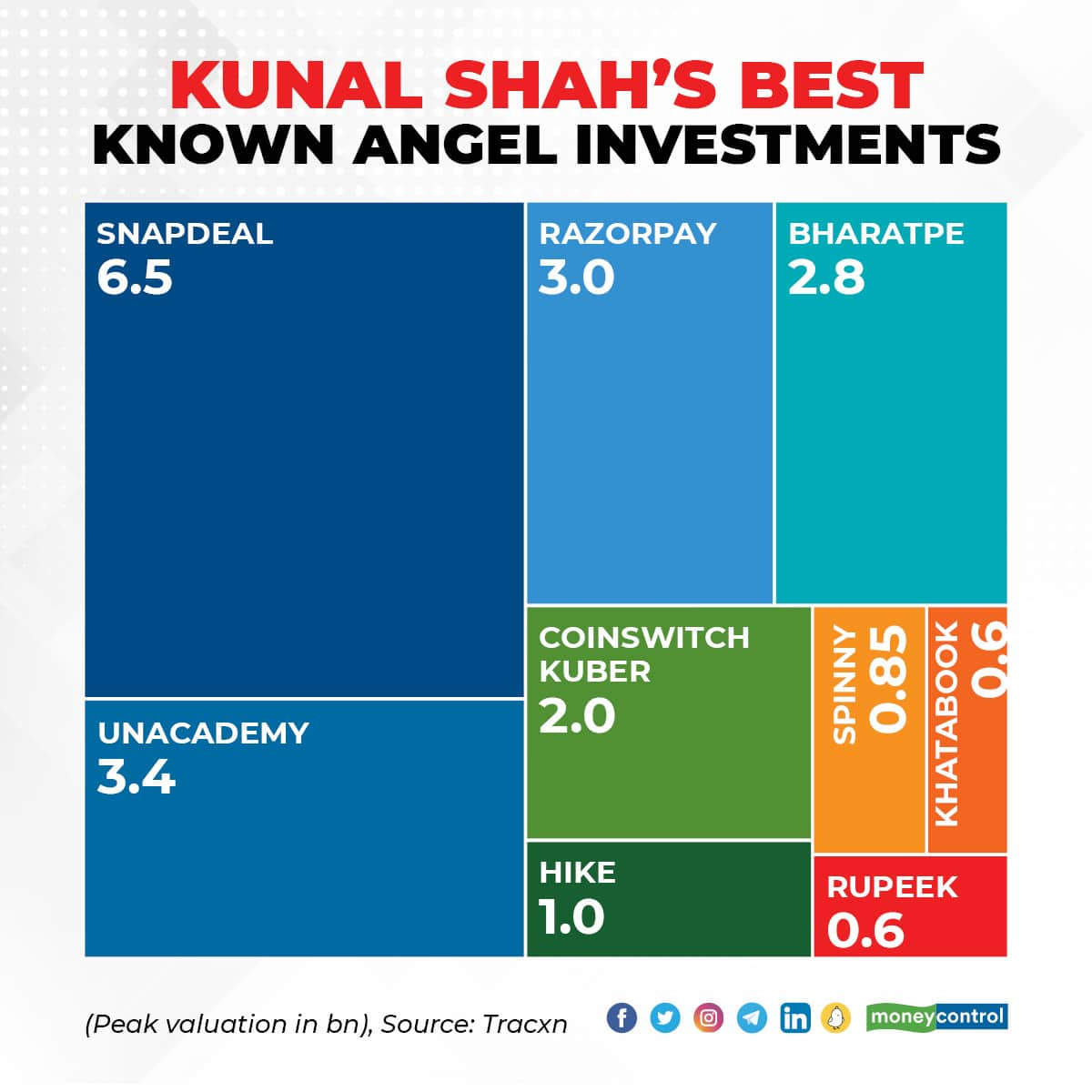

Angels usually start investing in the sector they know best—fintech in Shah’s case—but his portfolio today encompasses companies from almost every sector- health and fitness, ecommerce, logistics, B2B marketplaces, and mobility, among others. He does however hold stakes in a number of top fintechs such as Razorpay, Rupeek, BharatPe, CoinSwitch Kuber, and Khatabook, among others.

Angels usually back a company in its earliest financing rounds, but here too Shah has gone against the grain. He recently invested in Zetwerk, a custom manufacturing platform, in its $150 million Series E round.

Shah invests between $10,000 and 50,000. He usually lets the founder decide how much. By now, founders pitch to Shah knowing how much he typically invests.

It is not unusual for entrepreneurs to frequently dabble in angel investments. But the sheer volume of Shah’s dealmaking has raised eyebrows among his peers, friends and investors.

He has made at least 50 investments this year alone, and 16 in the last two months, according to Tracxn. Some of the investments have not been announced yet.

“Kunal does one deal a day. He gets the quality of deal flow that would make the best VCs jealous,” one founder in Shah’s portfolio says, only half in jest.

Shah gets his deal flow from fellow repeat entrepreneurs, senior employees at startups, his own investors such as Sequoia Capital and Ribbit Capital, and many VCs who haven’t invested in CRED or his previous firm Freecharge, but are friendly with Shah nevertheless. His investments have become a flywheel, where older portfolio founders refer newer founders to Shah, and each deal Shah does helps him get even more deal flow.

But the act of raising money from Kunal Shah, and what it means, has changed over the years, particularly as with over 200 portfolio companies, Shah simply cannot promise what other angel investors promise- spending time with entrepreneurs, mentoring them and serving as a sounding board in a startup’s tumultuous journey.

Angel investing isn’t a new fad for Shah though. In early 2015, Shah reached out to Harshil Mathur and Shashank Kumar via Facebook Messenger (the choice of messaging app also tells you how long back it was), wanting to invest in their new payments firm. He got the reference from Snapdeal’s Kunal Bahl, also an angel investor in Razorpay.

“He is the most helpful angel investor we have ever come across,” Razorpay co-founder and CEO Mathur told Moneycontrol.

Mathur said before each funding round that Razorpay raises (it has raised over $350 million so far), he consults Shah to decide who will invest in the round and what stake they should get, which helps Razorpay negotiate with investors for the right structure. Shah also introduced Razorpay to Sequoia Capital, one of Razorpay’s biggest investors today.

Entrepreneurs from 2015-18 have similar tales to tell about Shah, whose connections and network in the startup and investing world are one of the biggest reasons new entrepreneurs want him on their capitalisation table (a company’s list of investors).

While most experienced entrepreneurs boast similar connections, two people said that Shah helps more founders with connections than nearly anyone else they know. One even joked that Shah’s networks stretch so wide, if you need to speak to the Chinese Premier, Kunal Shah will put you in touch.

“If he knows you well, Kunal is happy to share his network. He will put you in touch with the person and get out of the way, rather than some founders, who will put you in touch, but want to be involved in the process and may micromanage. When it comes to his network, Kunal is pretty secure,” the person added.

But as Shah becomes a more active investor, his relationship with his portfolio founders has changed.

One founder of a consumer startup, who raised money from Shah last year, wanted to talk to him recently and get advice. He reached out to one of Shah’s friends, a well-known Bengaluru-based senior founder, to make an introduction.

This founder was mystified. “He’s on your cap table. Why are you asking me for an introduction?”

Founders generally rely on such introductions to speak to people they don’t know, or an investor they want to pitch to, not an investor they have raised money from.

Newer entrepreneurs and venture capitalists are slowly realising that raising money from Kunal Shah may not be as big a deal as they think it to be, or want it to be, because in their eyes today, Kunal Shah seems to be investing in every other company.

A partner at a venture fund secured an investment for his portfolio company from Shah earlier this year. He was happy, because early stage startups work largely on signaling and promise- and an investment from Shah certainly meant you were promising and signaled you were special in some way. Having reputed angels and investors helps hire talent, quash competition and play a perception game that you are the next big thing.

Six months on, the partner has seen Shah invest in over 50 startups this year alone. “I’m not sure whether it is that big a deal anymore. It looks like he’ll fund anyone who reaches out to him. And that makes you wonder, should you raise from him at all?,” the partner said.

Like any angel, money from Shah is no guarantee that your business will succeed. His portfolio has a posse of companies that flattered to deceive such as Bharat Bazaar, Cookify, Pianta, and Voonik, among others. With his current style of WhatsApp dealmaking, Shah also does little to no due diligence, counting on whoever has referred the founder to him—generally a venture capitalist leading the round—to perform diligence.

Entrepreneurs say raising money from Shah is optimised for speed. He is quick to respond on WhatsApp, even if he is busy. For documentation and other procedural back-and-forth, founders are more in touch with a man named Vasant Shah, who works with Kunal on his angel investments and manages them.

Why does Kunal invest?Shah told Moneycontrol last month that he invests to pay it forward. “I don’t track my investments. You can do philanthropy or fund job creators. India needs job creators.”

By all accounts, making money from these investments is not his primary purpose. He will certainly though.

He is an early investor in at least four unicorns—Unacademy, Razorpay, CoinSwitch Kuber and BigBasket. Many more such as Spinny, Rupeek, and Shiprocket, among others, are poised to get there.

Angel investing helps Shah give back to the startup ecosystem which gave him a career, pay it forward, and firmly places him in the upper echelon of Indian technology entrepreneurs. Along with his two startups, his social media following, filled with esoteric yet massy tweets at the same time have garnered him a following and cult-like status that not even the Flipkart’s Bansals, Paytm’s Vijay Shekhar Sharma or Ola’s Bhavish Aggarwal have, despite all of them building larger companies, generating more revenue and employing more people than Shah.

“Kunal really wants to do what he can for the ecosystem. If that one random founder can sell his company’s story to investors because Kunal Shah’s name is on his pitch deck, he does not mind that. This is his version of philanthropy,” another person close to Shah says.

“Investing in so many founders, giving them money early on builds him tremendous goodwill. That is what he wants. Imagine the goodwill of 200-300 people compounding for you,” this person added.

Not always. Shah’s social media following also leads to a lot of trolling. Skeptics make memes about CRED’s lack of a business model and ballooning valuation (some of this was before CRED started lending, its first attempt to make money).

He spends more time on Twitter and Instagram than building his company, they allege. While general mocking from unknown people hardly bothers Shah, other entrepreneurs mocking CRED or Shah affects him. His affinity and respect for fellow entrepreneurs, big and small is a big reason for being an active angel investor, so active that even he can’t keep track of his investments anymore.

Early this year, an entrepreneur tweeted a spiritual guru’s picture, with the caption that this guru is one of two people who understands CRED’s business model. The founder thought this was a harmless joke.

Later that day, the founder was surprised to get a call from Shah, who was disappointed with the tweet, explained to him that lending is CRED’s business model, and told him that “entrepreneurs need to support each other” rather than making fun of each other. The founder then deleted the tweet.

Kunal Shah: Angel Investor 2.0Entrepreneurs today realise that an investment from Kunal Shah by no means guarantees any help or support from him. Two founders, who raised from him recently, know this because it still felt beneficial to them.

“Today, all these well-known angels are of no use operationally or for mentorship etc. But having them signals that you’re going somewhere, doing something meaningful. People take you seriously when these well known angels are on your cap table. Their personal brand is reflected in my young company,” one of them said.

Other angel investors, less wealthier and influential than Kunal Shah, but as invested in India’s startup scene, still want to mentor founders, and want angels who will work closely with them. But today Shah can invest how he wants, where he wants, when he wants and how much he wants simply because of the pomp and glamour that comes with being Kunal Shah, or being even remotely associated with him.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.