FirstCry filed its draft red herring prospectus (DRHP) with markets regulator Securities Exchange Board of India (SEBI) on December 28. The Pune-based company will be the first new-age e-commerce firm that will go public after Nykaa, an online beauty retailer, listed in 2021.

While the share price and total IPO size will be revealed only later, Moneycontrol had reported that FirstCry will likely raise $500 million at a valuation of $3.5-3.75 billion in its IPO. We parsed through the DRHP for key takeaways.

Offer size and who is selling shares?

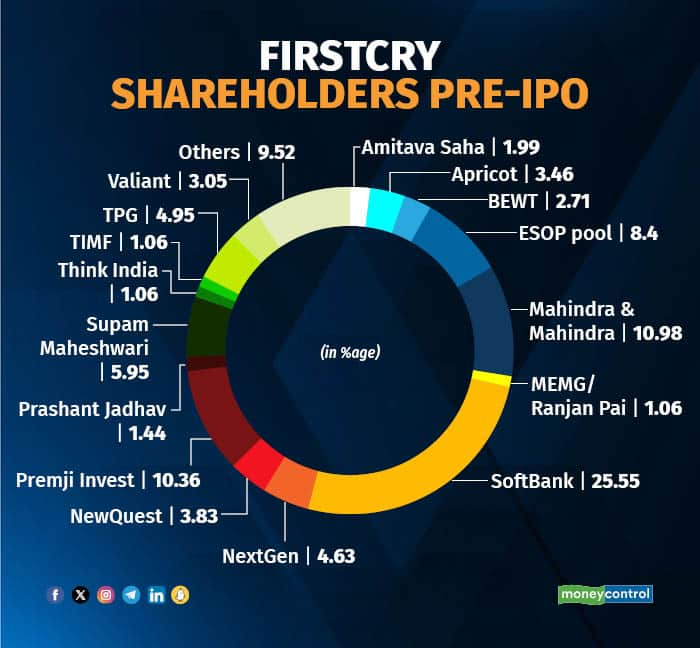

FirstCry aims to raise Rs 1,816 crore through a primary issue of equity shares. Existing investors like automotive company Mahindra and Mahindra (M&M), SoftBank, Premji Invest, TPG, NewQuest and others will sell a total of 5.4 crore shares in the offer for sale (OFS).

Apricot Investments, Valiant Mauritius, TIMF, Think India Opportunities Fund, Schroders and will also sell a part of their stake in FirstCry.

Further, Supam Maheshwari, founder and CEO of FirstCry, will sell some of his shares in the company, along with other top executives, as part of the OFS. Tata Sons’ Ratan Tata, who had received 77,900 preference shares, will sell all his shares in the company for around Rs 66 lakh.

FirstCry shareholding pattern on the day of filing the DRHP

FirstCry shareholding pattern on the day of filing the DRHP

What will the money be used for?

FirstCry said it will use the money to open new stores and warehouses. It will also expand to international markets like Saudi Arabia (Kingdom of Saudi Arabia (KSA)).

In India, FirstCry will open a total of 483 retail stores between FY25 and FY27. FirstCry has a total of 936 stores in India, per its DRHP. Franchise-owned and franchise-operated (615 stores) while company-owned and company-operated (321).

FirstCry will use the fresh proceeds to open new stores, warehouses and expand internationally

FirstCry will use the fresh proceeds to open new stores, warehouses and expand internationally

Financial report card:

In the DRHP, there is no clear mention of FirstCry's path to profitability

In the DRHP, there is no clear mention of FirstCry's path to profitability

In the DRHP, FirstCry also said: “We may have to incur sustained advertising and promotional expenditures or offer more incentives than we anticipate in order to attract customers. If we are unable to adapt our marketing strategies in line with evolving trends, or if one or more of our marketing efforts fails to deliver the expected outcome, our business, results of operations and financial condition may be adversely affected.”

In FY21, FirstCry spent Rs 164 crore in advertising and sales promotion expenses which accounted for 10.23 percent of its revenue from operations. In FY22, the expenses increased to Rs 269 crore or 11.19 percent of its revenue from operations. While the total ad expenses jumped to Rs 416 crore in FY23, its share as a percentage or revenue fell to 7.39 percent. As of June 30, 2023, FirstCry had already spent Rs 110 crore in ads, or 7.82 percent of its operating revenue.

“Going forward, we expect our expenses towards marketing, expansion, retail distribution, and stock options could adversely impact our financial condition.”

Risk factors:

FirstCry, which saw its loss widening from Rs 79 crore in FY22 to Rs 486 crore in FY23, said: “Negative cash flows over extended periods or significant negative cash flows in the short term, could materially impact our ability to operate our business and implement our growth plans. We cannot assure you that our net cash flows will be positive in the future.”

"We have had negative net cash flows in the past and may continue to have negative cash flows in the future," FirstCry said in its DRHP.

It also flagged risks around customer acquisition. "We cannot assure you that we will continue to grow our customer base at this rate or at all in the future. Further, if we fail to acquire new customers, or fail to do so in a cost-effective manner, we may not be able to maintain or increase our revenues or grow our operations."

Another risk for the Pune-based company was the money it owes to creditors. FirstCry owes a total of Rs 797 crore to 6,925 creditors, per its DRHP. Of that one creditor is material and FirstCry owes the creditor Rs 49 crore as of June 30, 2023.

Key Managerial Personnel (KMP):

FirstCry's top deck

FirstCry's top deck

FirstCry board of directors

FirstCry board of directors

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.