Paytm will continue to add more machine capabilities to its platform, which may reduce its demand for workforce, CEO Vijay Shekhar Sharma has said.

Sharma was answering a query on the payments company’s artificial intelligence (AI) strategy to improve efficiency, as a consequence of which over 1,000 employees from operations, sales, and engineering team were recently laid off.

“Instead of expanding more business functions, we are trying to add capabilities of machines and systems on our platform. These capabilities will continue to grow. That means there will not be so much demand, in a linear way, of the number of people that we need,” Sharma said during the earnings call on January 19 to discuss the firm’s Q3 results.

The fintech major, which has been using AI tools to streamline its operations, reduce staffing needs, and improve efficiency, will not be adding more salesforce on ground.

“We added a lot of people in Q2 due to festive season. We have seen a moderate expansion in the salesforce and now have a decent penetration. We will not see more expansion now compared to previous quarters,” president and group CFO Madhur Deora said.

He, too, reiterated leveraging AI to achieve operational efficiency and consequent drop in people costs.

“Don’t want to comment on what press is writing (on the layoffs). We will remain much focused and tighter on people costs, especially on ground, which is a very large part of our overall cost," he added.

Demand for business loans, Insurance focus

Paytm reported a 38 percent jump in consolidated revenue at Rs 2850, with losses narrowing to Rs 222 crore in the third quarter.

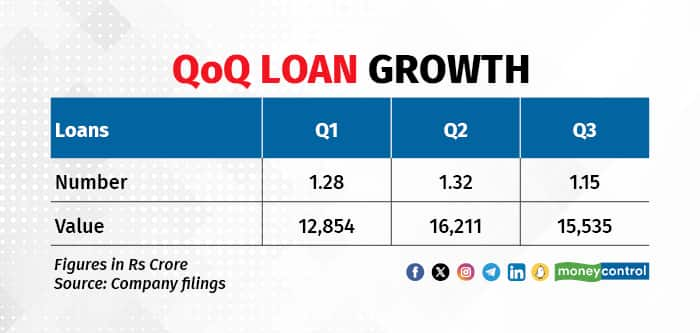

Its decision to curtail postpaid loans was partially reflected in the third quarter earnings, as the total value of loans distributed was down to Rs 15,535 crore from Rs 16,211 crore in Q2. The value of postpaid loans dropped by 17 percent at Rs 7,469 crore (QoQ).

However, the overall revenue from financial services grew 6 percent, as other credit categories like personal and merchant loans performed well.

Paytm results Q3FY24

Paytm results Q3FY24

The fintech will continue to take a conservative approach toward postpaid loans while doubling down on high-ticket lending.

“Post-paid is a good product but its contribution to P/L is very marginal. The GMV loss is easily getting compensated by high-ticket loans,” Deora said.

The company is expecting a further decline in the postpaid gross margin contribution (GMC) in Q4. “The numbers will stabilise by end of Q4 or early Q1FY25,” he added.

Paytm claims to have added 20 million users to its waitlist for the relaunched high-ticket personal loans product. It is working with two lenders as of now and plans to add more.

“We have been able to source and build high quality loans, including home loans. We also have demand for business loans,” Sharma said.

Paytm is seeing encouraging trends on Credit on UPI and will double down on its wealth management and insurance verticals. “The insurance business results are better than what we expected. It will become one of our key KPIs. The equity trading segment also presents lots of cross-sell opportunity," the CEO added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!