Paytm will slow down its small ticket Postpaid loans even as it is looking to expand its high ticket personal loans and merchant loans, the company said in an analyst meet on December 6.

The company said its Postpaid loans could be down by 50 percent but will not have any impact on margins or revenue. Postpaid had the lowest take rate and hence revenue impact will be minimal, the company added.

"On the back of recent macro development and regulatory guidance, in consultation with lending partners, in line with its continued focus on driving a healthy portfolio, the company has recalibrated the portfolio origination of less than ₹50,000, which is prominently the postpaid loan product and will now be a smaller part of its loan distribution business going forward," the company said in a media statement.

The company said that none of its lending partners have stopped lending to its customers.

Paytm has slowed down its postpaid loan products on the platform from December 1, with several users complaining on social media platform X (formerly Twitter). The accounts have been blocked for multiple users despite paying the loans on time, the users complained.

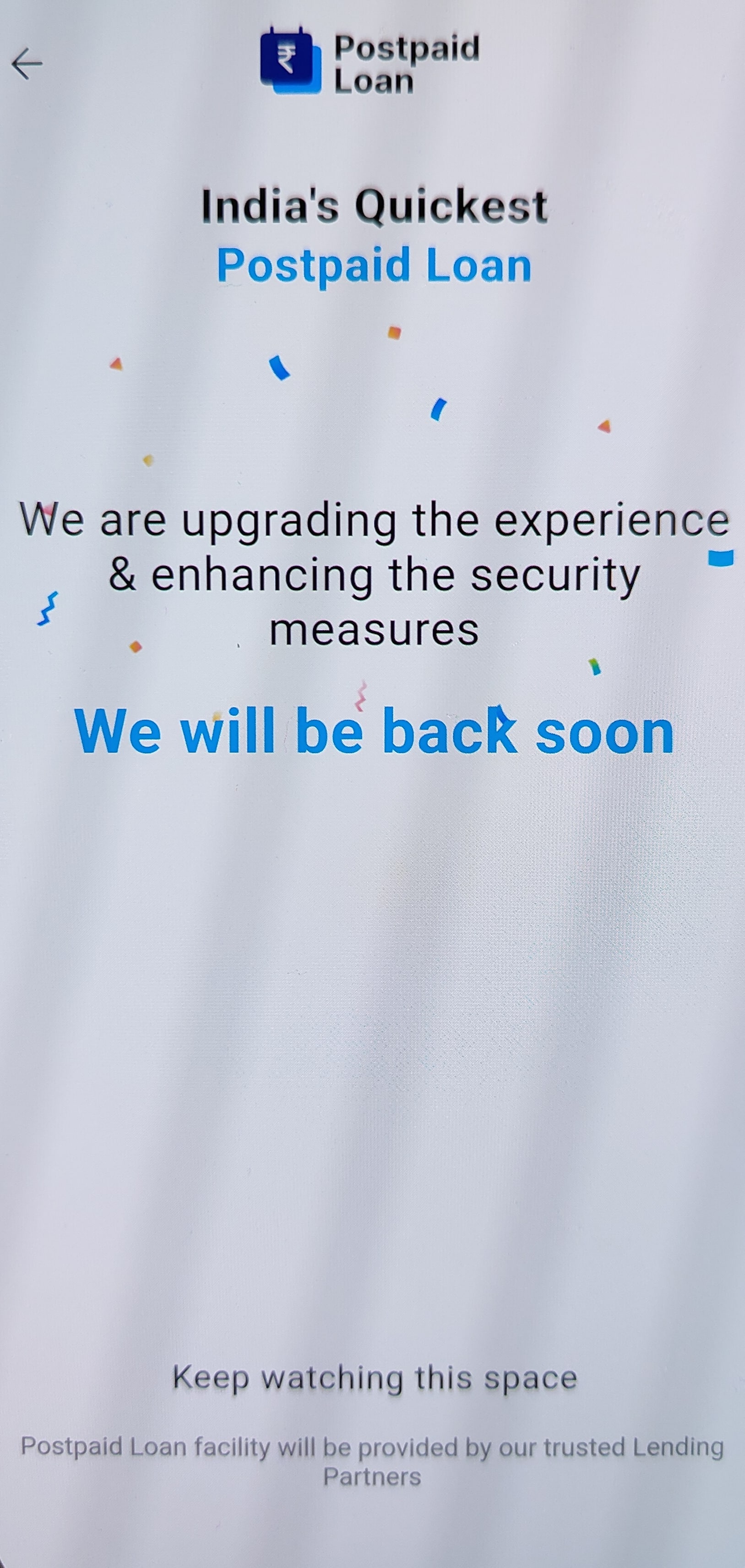

Moneycontrol got in touch with some users, who said they found this message appearing for them, "We are upgrading the experience and enhancing security measures. We will be back soon."

Paytm Postpaid

Paytm Postpaid

Paytm facilitates lending on its platform through its partnership with lenders such as Aditya Birla Finance Limited (ABFL), Piramal Finance, Shriram Capital and Tata Capital among others. Paytm earns commissions as well as collection charges for the loans provided on its platform.

Since the RBI tightened the norms for unsecured consumer loans by raising the risk weight for banks and non-banking finance companies (NBFCs), some of the loan accounts seem to have been stopped. The lending division contributes to a quarter of Paytm's revenues.

News reports suggest that ABFL has fully or partially suspended the lending facilities on Paytm and other fintech platforms. It is not clear whether other lending partners have done the same.

Some users have been told by Paytm, "Your Postpaid loan facility was sanctioned by ABFL at their sole discretion. Currently, this facility is closed by them. We shall keep you updated when you can reapply for the facility again."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.