Shubham Agarwal

Trading activity has always been crucial for us traders in building expectation for future price action. Two such indicators of trading activity Volume and Open Interest (OI) can be used to identify probable big move. Let us look at both to understand the importance and application of each one of them.

Futures Volume

Volume has been looked at as a strength identifier for decades by traders. This is because volume means participation. More participation means consensus opinion of the expectation. A move with higher volume has been historically sustained more than a move with lower volume.

Let us go one step further though. What if we plotted the price-interval wise volume instead of time-interval wise volume?

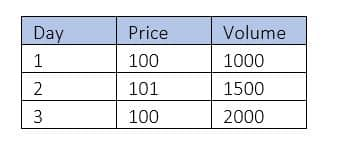

For Example:

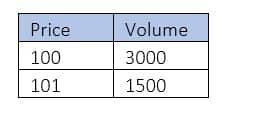

So, instead of day wise volume, can we also not look at this as:

This will now help us in finding out the price intervals where there was big volume. The importance of this volume identified price can also be looked as Decisive Price. Easiest way to read this is by comparing volume at 100 over 101. This indicates that lots of trades took place around 100. This makes 100 as the starting point of the expected move journey.

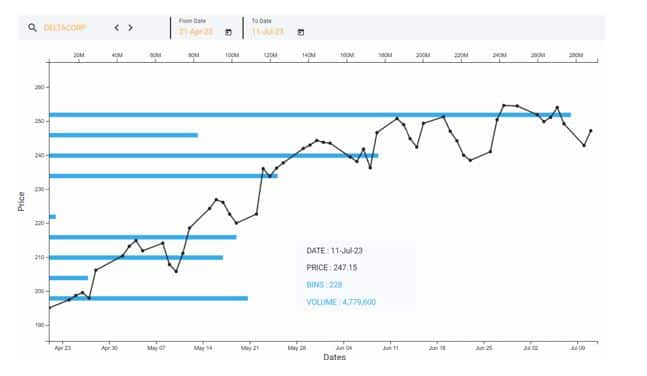

Let us look at a recent example to make this clearer

The chart above belongs to Delta Corp. As we can see ~252 was Decisive Price with huge volumes traded in and around 250 till 11th July.

So, the starting point was clear now ~252. However, the direction and the trigger are missing. Meaning, it is important to figure out when and where it could move. Generally, as soon as the price distances itself from the Decisive Price, it could trigger the move. To define distances itself, we need to turn to Options Open Interest.

Options Open Interest

Historically, we have seen 2 things:

1. Highest Call OI acts as upside hurdle while Highest Put OI acts as downside hurdle

2. Crossover of Higher OI either Call or Put triggers Upside or Downside move

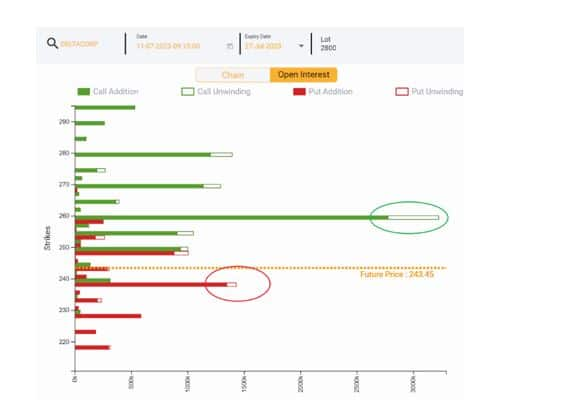

Following is the chart of Delta Corp options OI on 11th July. With this can we safely say that trading beyond Highest Call OI of 260 or Lower Put OI of 240 could qualify as distances itself. There by giving us not only the time but also the direction of the trigger.

What happened after that can explain the impact of High Volume in Futures + Options OI.

Few things to note here are:

Few things to note here are:

1. Ensure that the Highest Volume Decisive Price has reasonably higher volumes than other prices.

2. There is a possibility of false alarm. So, for risk management if after breaking the highest OI strike level, if the price does not sustain it is always best to exit and re-evaluate.

Finally, Price wise Volume analysis and Options Open Interest is easily available in majority of Options Analytics applications.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.