By beating the Street estimates marginally, Tata Consultancy Services has set the tone for the IT sector earnings through its second quarter performance. And, all eyes are now on Wipro and HCL Tech’s numbers.

The two IT giants are expected to come up with their scores tomorrow. Analysts expect Wipro to deliver a constant currency growth of 4 percent on a quarterly basis, with broad-based growth across sectors.

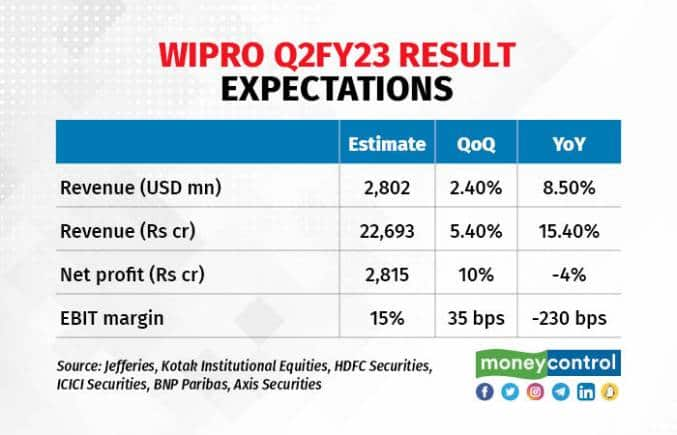

Consolidated profit after tax (PAT) for Wipro may jump 10 percent on a sequential basis but decline 4 percent on-year to Rs 2,815 crore in the second quarter of FY23 (July-September). Consolidated revenue is expected to increase 15.4 percent on-year to Rs 22,693 crore, according to an average of estimates of six brokerages polled by Moneycontrol.

The company had recorded a consolidated net profit of Rs 2,931 crore during the corresponding period of last financial year when its consolidated revenues stood at Rs 19,668 crore. Wipro had registered a PAT of Rs 2,560 crore during April to June 2022 period on revenue of Rs 21,528 crore.

Also Read | TCS hits out at moonlighting after Infosys and Wipro, says against core values and culture

CC growth and Rizing acquisition

While the company had guided for 3-5 percent CC growth in Q2FY23, analysts expect constant currency growth of 4 percent on a quarterly basis, which is at the mid-point of the range.

Jefferies sees an inorganic contribution (to revenue growth) of 100 bps from Rizing and Convergence acquisitions, while Kotak Institutional Equities has factored in 130 bps contribution from Rizing, and ICICI Securities at 150 bps.

To scale up its SAP consulting capabilities, Wipro had announced 100 percent stake acquisition in Rizing Intermediate Holdings for about $540 million in an all-cash deal on April 27 this year. For the first time after acquisition, Rizing will be contributing a full quarter revenue to Wipro.

Also Read | IT Sector Q2 Preview | Robust revenue likely, all eyes on management views

Growth will also be driven by large deal ramp-ups, believe analysts. In rupee terms, the company is expected to report 5 percent QoQ growth, aided by rupee depreciation. In dollar terms, revenue growth will come in at 2.4 percent QoQ, after factoring in cross-currency headwinds of 170 bps QoQ.

Margins and Q3FY22 guidance

The Street believes IT companies’ margins have bottomed out for now and will improve sequentially for all the bluechips. Jefferies expects Wipro Q2FY23 margins to expand by 20 bps QoQ as “impact of 1-month wage hike, supply side pressure and higher travel costs will be offset by pyramiding, operating leverage and some pricing benefit.”

ICICI Securities expects 30 bps sequential improvement in margins, on account of some tailwinds such as moderation of subcontractor costs, utilisation improvement and control on variable payouts.

When it comes to the December quarter, analysts believe the company will guide for a muted 0-2 percent revenue growth. “High furloughs across many verticals can impact growth potential” says Kotak Institutional Equities.

HDFC Securities and BNP Paribas are a bit more bullish on the December quarter guidance. The former believes Wipro’s Q3 growth guidance is likely to be 1-3 percent CC QoQ while the latter is expecting 2-4 percent.

Factors to watch out for

Apart from revenue guidance for Q3, investors will be closely monitoring the management’s commentary on recent mergers and acquisitions, deal wins/pipeline and clients’ IT budget.

BNP Paribas is awaiting updates on core geographies and top-10 accounts, while Kotak Institutional Equities says the main focus is on impact of recession, especially in Europe which accounts for one-third of Wipro’s total revenue.

Commentary on Capco is also being monitored since 30 large global financial clients account for 79 percent of Capco’s revenue. Wipro had acquired the company in March 2021 for $1.45 billion, making it one of the largest end-to-end global consulting, technology and transformation service providers to the banking and financial service industry.

Investors are also watching out for comments on attrition and ‘moonlighting’. Wipro Chairman Rishad Premji, who termed the practice of moonlighting as ‘cheating’, said on September 21 that the IT major found 300 people working directly for one of their competitors in the last few months.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.