Anubhav SahuMoneycontrol Research

In a largely expected tit-for-tat move, China retaliated to the United States' proposal to impose duties on Chinese high-tech goods by imposing a 25 percent tariff of its own on 106 US products.

While the United States is now targeting high-tech items from China, and had its eyes on metals coming from China before that, China is targeting items coming from US' manufacturing and farming economy like soybeans, chemicals, automobiles, aircraft.

Also read: Trade war: Weak risk sentiments can provide opportunities

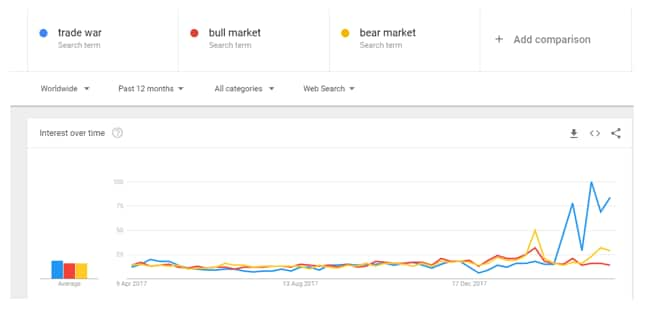

Chart: Trade war gets an elevated mention in google searches

Source: Google Trends

Counterproductive impacts

Soybean planters in Midwestern states (Illinois, Indiana, Iowa, Ohio, the Dakotas, Kansas, Michigan, Missouri, Minnesota, Nebraska and Wisconsin) are likely to be among those impacted the most by Chinese tariffs.

China buys a third of US' soybean crop, and the Midwestern states, which account for most of America's soybean production, also constitute President Donald Trump's political heartland.

The move can eventually prove to be beneficial for Latin American countries, who also produce soybean in large quantities. In fact, five of the top 10 producers of soybean in the world are Latin American countries.

On the flip side, China could end up scoring an own goal with these tariffs because they could lead to a significant increase in the cost of feed for pigs, which could in turn result in food inflation surging.

Similarly, US tariffs on Chinese pharmaceutical companies could impact generic drug makers in the United States who source their raw material from China.

US probably has its eyes on China's 'Made in China 2025' initiative

The US has put out a list of around 1,300 product categories on which it plans to impose tariffs. The list focuses on high-tech products and industrial machinery that China exports.

This has given rise to widespread belief that it is actually China's 'Made in China 2025' initiative that US actually has its eyes on. The initiative was announced in 2015 and highlighted 10 sectors that would help China become a major manufacturing power in the world.

The initiative is being used to engineer the transfer of foreign technology to China and provides massive subsidies to high-technology manufacturing industries.

US' trade deficit with other Asian countries is actually narrowing

While the focus is on China, for obvious reasons, US' trade deficit with India fell 6 percent in 2017 to USD 22.9 billion, partially aided by India’s higher import of aircraft and parts worth USD 4.24 billion from the United States.

Similarly, South Korea has also bridged its trade gap with the US by importing more American-made semiconductor machinery. Of course, these developments may have also been because of continued negotiations (ref: Trump’s Korea visit in Jan’17).

Political compulsions make the rhetoric a more constant phenomenon

One thing we must not forget while assessing the situation at hand is the upcoming United States elections, scheduled for November this year, when all 435 seats of the House of Representatives and 34 of the 100 seats in the Senate will be contested.

To be sure, it is not just in the United States that political rhetoric will play a part. Chinese President Xi Jinping is expected to become even more assertive as the limits on presidential elections were recently lifted by the Chinese parliament, effectively making him President for life.

Negotiation is the next step

While the headlines may be screaming TRADE WAR, the actual situation seems to be entirely different.

Assertions from Commerce Secretary Wilbur Ross, and White House Economic Adviser Larry Kudlow, and from Chinese Ambassador in the USA, Cui Tiankai, suggest that negotiation is the next logical step for both countries, and that both of them appear to have braced themselves for it.

So retaliatory actions are ironically a signal that both parties may soon be sitting across a table from each other. The market appears to be drawing comfort from this realization, with leading equity indices bouncing back from their important support levels.

It’s noteworthy that recent US announcements are still proposals and are contingent on public feedback.

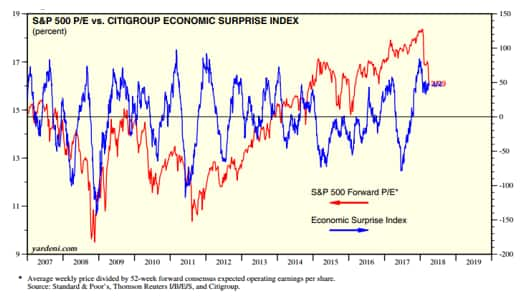

Chart: US economic surprise index vs. S&P P/E

Source: Yardeni.com

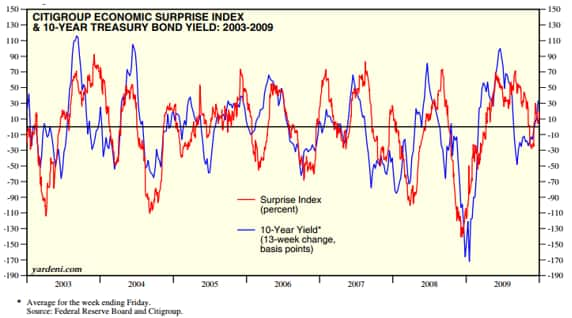

Chart: US economic surprise index vs. Change in UST 10 year yield

All in all, although speculation about a trade war or retaliatory moves on tariffs may continue for some time till political compulsions and negotiation benefits arrive, markets may gradually be all ears to signals from the earnings season, which is just around the corner.

Also, recent central banks commentaries have reiterated a positive macroeconomic scenario and data flow has also been better than expected, as reflected by the economic surprise indicator.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.