Anubhav Sahu Moneycontrol Research

The US-China trade tariff tussle has reached the next level where post tariffs on metals and new announcements have been made which could impact Chinese imports worth ~USD 60 billion (USD 375 billion trade deficit) to US. China has retaliated with tariffs on import of goods worth USD 3 billion.

Not surprisingly, market’s risk sentiments have worsened with equity markets correcting further and CBOE VIX, the US market implied volatility indicator, spiking to the levels where liquidity inflows generally takes a pause.

Also Read: India's metal sector to ride on global cues, US-China trade spat not a deterrent

While high volatility regime appears to be the norm, base case remains that trade war may not escalate to the level which may jeopardize fragile economic recovery. Going by Trump’s own record and the series of exemptions given, trade negotiations are expected to attain center stage soon.

Having said that risk sentiments have reached levels wherein historically they been a contra indicator for market performance i.e. in the past, investment in such times have been rewarding for the investors. Hence, the current consolidation phase should be closely tracked from that point as well.

Volatility regime – moderately high volatility regime is back

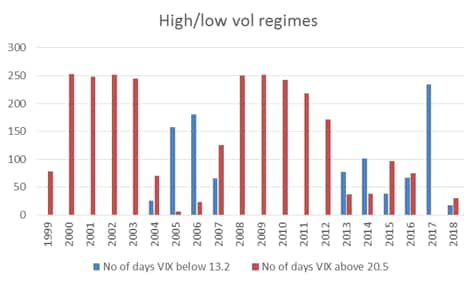

One simplistic way to check volatility regimes is to see number of days in the year, CBOE VIX is above or below certain thresholds. If we see in such terms, a certain pattern emerges – financial crises period was (2007-12) was high volatility regime followed by moderately low volatility regime. Current year, so far, is indicating that higher volatility period can be expected as the geopolitics (trade tensions) has taken central stage and central banks are inching towards normalizing monetary policy.

Economic uncertainty – mainly with trade policy component

Central bankers, particularly, Fed and ECB are increasingly positive on the economic outlook. However, there is a worry about trade tensions which have so far not been factored into the growth outlook.

Policy uncertainty indices as devised by the research house, PolicyUncertainty.com, provides some clue. Policy uncertainty, in general, have ebbed to lower levels, recently. In particular, monetary policy path is more assuring in terms of providing market guidance. While overall economic policy context is getting sanguine, elevated uncertainty in trade policy has got some attention.

US tariff war – revisit to 2002-03 period

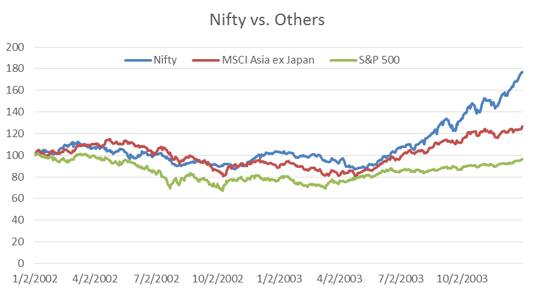

Now quick visit to market performance during last such trial by US in terms of higher tariffs suggest that equity market may enter sideways phase, post correction, before coming out of it.

In March 2002, US had imposed tariff on steel which was subsequently lifted in December 2003. Equity markets had undergone consolidation phase, wherein Nifty, interestingly had a decent outperformance in the year after.

Inflation and growth worries can emerge

Our base case remains that trade war may not escalate and countries involved would come back to negotiation table. However, if trade war escalates and lengthens then there could have an implication for global growth and inflation.

Having said that, market risk sentiments are quickly reaching a level, where markets have historically given double digit returns in 12 month basis. If we assume CBOE VIX as a risk barometer and slice the readings in to five ranges and look for performance of equity indices for next 12 months, then inferences are interesting.

We looked at last twenty years data, in the low volatility regimes (up to VIX reading of 16.3), market performance have been positive gaining partially from the low equity risk premium. In the moderately higher volatility phases (16.3 to 25.3) equity performance have been muted. However, the elevated volatility scenario (25 and above) may not necessarily be unsuitable for investment. Historically, they have been amongst the best time to invest, particularly when the global growth indicators are robust.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.