The Reserve Bank of India released a policy statement on November 16, increasing the risk weight of consumer loans and bank credit to non-banking finance companies.

Over the past few months, growth in credit to consumers and NBFCs has risen significantly, creating concerns over a credit bubble building up, which could lead to financial instability. The RBI’s measures are an attempt to control this growth.

In his October bi-monthly monetary policy statement, RBI governor Shaktikanta Das raised red flags over the high growth in certain segments of retail credit. He said overall credit growth is broad-based, but certain categories of personal loans are “recording very high growth.”

He added that the RBI is monitoring credit growth rates in these categories and advised banks and NBFCs to strengthen their risk management.

In a post-monetary policy interaction with the press, one question asked was why the RBI had just issued a warning and not taken any action about the high growth in personal loans. The RBI governor responded by saying the first line of defence is preparing banks and NBFCs against the emergence of risks. By issuing the policies one and a half months later, the RBI has acted on the second line of defence as well.

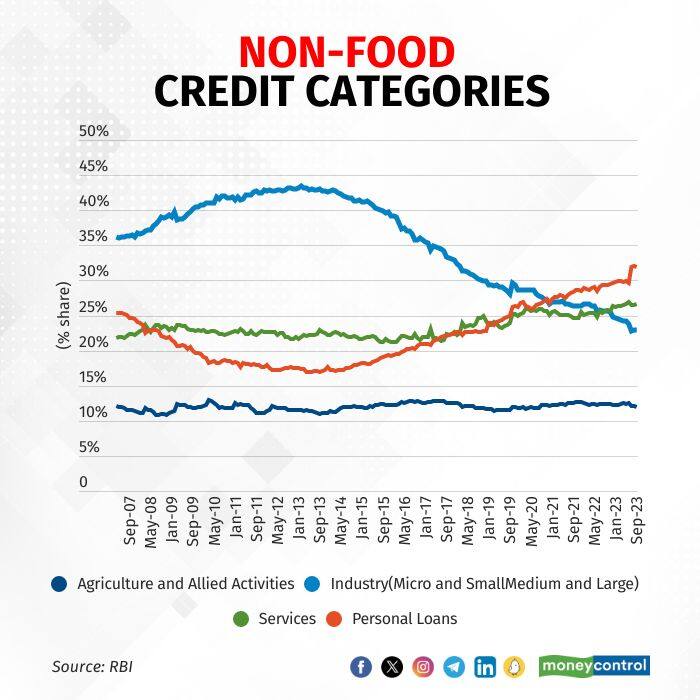

Growth TrendsBefore looking at the RBI’s policies, let us look at the trends in various categories of non-food credit from 2007 to September 2023 (as data is available from 2007 onwards).

The period can be divided into two phases. The first phase is from 2007 to 2013, when the share of personal loans declined from 25 percent in 2007 to 17 percent in 2013. In this period, the share of industrial credit rose from 36 percent to 43 percent. The share of agriculture and services in credit remained little changed at 11-13 percent and 22-23 percent, respectively.

The second phase is from 2013 to 2023, when the share of industrial credit halved to 22 percent in the 10-year period. This came after the surge in industrial credit also led to a rise in non-performing assets, which led banks to reduce their credit share to industries. In the same period, the banks shifted their portfolios to personal loan categories and its share doubled to touch 32 percent.

The share of agriculture remained flat at around 12 percent whereas the share of services rose from 22 percent in 2013 to 26 percent in 2023.

The data showed how growth in personal loans surged during the past 10 years. The decadal average growth (2014-23) in non-food credit was 10.2 percent, whereas the decadal average growth in personal loans was 17.3 percent. Within personal loans, growth rates were 20-plus percent in credit card loans, consumer durable loans and vehicle loans. Housing credit (including priority sector housing) registered a decadal average growth of 16 percent.

Global banking regulators analyse credit trends very carefully these days. The 2008 Global Financial Crisis was due to nothing but the boom and bust in personal housing loans.

Before 2008, the general view was that personal loans were safer and carried low levels of risk. The US financial system gave housing loans on a large scale. The non-banks and global financial system also took exposure to the US housing markets. Once prices in housing markets declined, it led to not just a crisis in the US but enveloped the global financial system.

Major LessonsThe major lesson from the 2008 crisis was that all types of loans carry risks and if there is exuberant growth in one category of loans, it usually leads to a crisis that spreads to the entire financial system. The events led to the development of a macroprudential bank regulation policy where the idea was to curb excessive financial growth by imposing reserves and risk weights on the entire banking system.

The RBI did not heed the lesson as it did not take any major action when there was a lending boom in the industrial sector in the 2008-13 period. The boom eventually became bust, leading to large scale NPAs and a major banking crisis. It is surprising that the RBI missed these trends as the regulator had taken measures to restrict growth in housing loans even before the 2008 crisis.

The recent RBI policies are targeted at controlling growth in specific categories of personal loans. The RBI has prescribed that the risk weights in respect of consumer credit exposure of commercial banks and NBFCs be increased from 100 percent to 125 percent. This applies to both outstanding as well as new loans and includes personal loans, but excludes housing loans, education loans, vehicle loans and loans secured by gold and gold jewellery.

For bank credit card loans, the risk weights have been increased from 125 percent to 150 percent, whereas for NBFCs, the risk weights have been increased from 100 percent to 125 percent. The RBI has also increased risk weights for loans to NBFCs with lower credit ratings.

Further, the regulator has asked all regulated entities to strengthen their credit standards and review limits on consumer credit and categories of consumer credit. The regulated entities should focus on unsecured credit exposure. The RBI said that all the top-up vehicle loans should be treated as unsecured loans.

To sum up, the RBI’s actions to tighten growth in consumer credit is based on both global and local lessons. The regulator is curbing excessive credit growth by throwing sand in the consumer credit wheels.

Amol Agrawal teaches at Ahmedabad University, and is the author of 'History of Private Banking in South Canara district (1906-69)’. Views are personal, and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.