Sounak Mitra

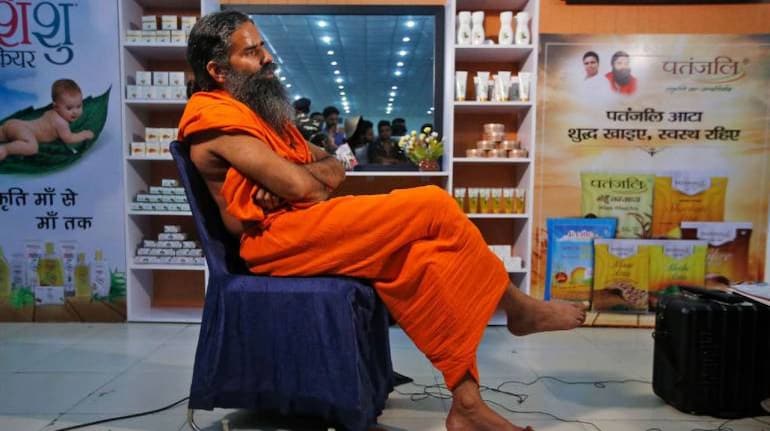

Patanjali Ayurved is still trying to buy debt-laden Ruchi Soya Industries. The Baba Ramdev-promoted firm has agreed to revise its offer even as some reports say Adani Wilmar has moved out of the race. Earlier, Patanjali had moved the bankruptcy court against the lenders’ decision to choose Adani Wilmar as the preferred bidder. Adani Wilmar had offered to pay Rs 5,474 crore for Ruchi Soya, of which Rs 4,300 crore was to go to lenders. At that time, Patanjali offered to pay Rs 5,765 crore, of which Rs 4,065 crore was to go to lenders. Things will become clearer once the issue comes up for hearing at the National Company Law Tribunal (NCLT) on January 15.

Why is Patanjali so desperate to buy Ruchi Soya?

There are clear reasons. According to available data, Ruchi Soya is the second-largest edible oil company in India with around 14 percent market share while Adani Wilmar is the largest with a 19 percent share. Despite the fact that Patanjali too has an edible oil brand, its presence is still negligible. Buying Ruchi Soya will not only make Patanjali the country’s second-largest edible oil company but also give it ownership of popular brands such as Nutrela, Mahakosh, Sunrich, Ruchi Gold and Ruchi Star.

Besides, Ruchi Soya is among the top exporters of value-added soy products. Export is a weak spot for Patanjali.

Ruchi Soya has 19 manufacturing locations. This will supplement Patanjali’s ongoing expansion where the Haridwar-based packaged goods firm is setting up more than a dozen factories which will start commercial production in the next few years. Moreover, Ruchi Soya also has 129 depots across the country, its products reach 1.15 million retail outlets. It will come with a strong distribution network across general trade and modern retail, an area that Patanjali has been struggling to streamline. With Ruchi Soya in its bag, Patanjali’s retail reach will increase from its current estimated one million stores (including its core arogya kendras and chikitsalayas).

The Ramdev-founded company has been struggling to grow during the past year, especially after the implementation of the Goods and Services Tax (GST), coupled with lingering effects of demonetisation. Its revenues declined about 10 percent to Rs 8,148 crore in fiscal 2018, primarily because of its inability to adapt in time to the GST regime and develop supply chain infrastructure.

Thus, Ruchi Soya’s acquisition will not only expand its current business but also be a vital component in Ramdev’s ambitious plan of doubling revenue, which the company failed to do in fiscal 2018.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.