Anubhav Sahu Moneycontrol Research

Indian snacks industry is a secular growth story aided by demographics and changing food habits. There are a limited number of players riding on this theme and Prataap Snacks appears to be in the “right place at the right time” but not quite at the right price.

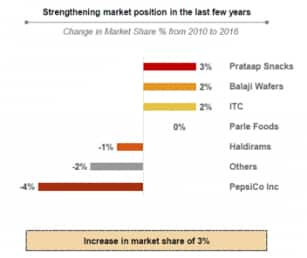

In recent years, with its above industry average growth rate and its product positioning it has not only gained market share from the existing market leaders. It has also forayed into regions which were earlier outside the ambit of organised snacks market.

The company’s focus on market-share maximizing strategy works well for the topline growth but at the cost of earnings. As the company moves up the value chain, margin profile would improve, but with a time lag. Therefore, given the pricing of the issue, short-term upside is limited. However, long term investors can still benefit from this proxy of consumption growth story in the hinterland.

Background

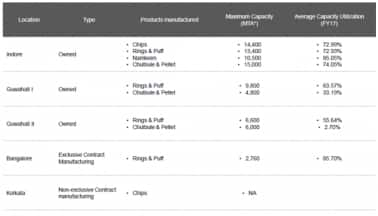

Prataap Snacks (incorporated in 2002) is one of the top six Indian snack food companies. It offers a wide range of snacks food under its “Yellow Diamond” brand. It has three self-owned manufacturing facilities (1 plant in Indore and 2 plants in Guwahati ) with a combined capacity of 80,500 MTPA. In addition, the company has two facilities on a contract manufacturing basis at Bengaluru and Kolkata.

IPO issue size and usage

Prataap Snacks’ IPO (size: Rs 482 crore) consists of a fresh issue of up to Rs 200 crore and an offer-for-sale of up to 3,005,770 equity shares. At the upper end of the IPO price band (Rs 938-930), offer for sale amounts to Rs 282 crore. Post IPO, stakes of Sequoia Capital (61.8 percent) and founders (31.1 percent) would stand reduced to about 48 percent and 23 percent, respectively.

Fresh issue proceeds

Secular consumption market growth

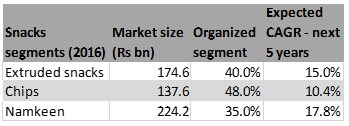

The Indian snacks market is estimated to be about Rs 550 billion wherein the organised market constitutes about 40 percent of the total. As per estimates of Frost & Sullivan, the organized snacks market has grown at the CAGR of 16.2 percent during (2010-16) and is expected to grow by 15 percent in the next five years.

Indian snacks market segments

Prataap Snacks: Among top 6 snacks companies

As per Frost & Sullivan, the company has a market share of about 4 percent in the organised snacks food market (Rs 220 billion). It is the third largest player in the extruded snacks market with about 8 percent market share. DFM Foods is one of the closest competitors in this segment with a market share of 4 percent. Prataap Snacks' market share in the chips segment is 3 percent and competes with Pepsi co and Balaji wafers.

Value proposition

The company had consciously targeted tier 2 cities, semi-urban and rural areas for their products. Such a strategy helped it to capture market share from the unorganised sector in the fragmented market in the hinterland. Further, the company derived value proposition through product innovation and relatively higher grammage. (Rs 5 SKUs offers up to 25 percent more grammage per pack vs competitors).

Robust supply chain & strategic location of manufacturing facilities

Prataap Snacks has a pan-India presence through 205 super stockists and 3400 distributors. While executing its distribution strategy, the company tapped unorganized grocery stores and petty shops for the majority of its SKUs as 75 percent of industry sales happen through these channels. It is noteworthy that petty shops usually stock the smallest SKU product (Rs 5 SKU). Therefore, it comes as no surprise that Rs 5 SKU forms a majority part of their revenue.

Prataap Snacks has three owned manufacturing facilities and two contract manufacturing facilities (~8 percent of FY17 revenue) at geographically advantaged locations from the point of view of logistics benefits, sourcing raw material and catering to key markets.

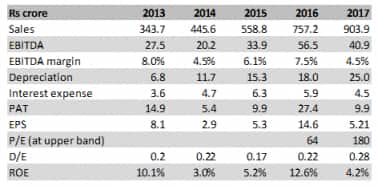

Financials: Robust topline growth but earnings moderate

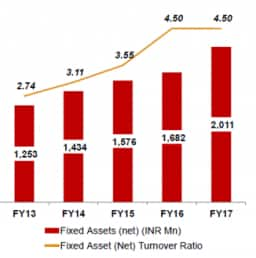

Backed by robust distribution and value positioning, Prataap Snacks witnessed a strong topline growth of 27 percent CAGR during 2013-17. Its fixed asset turnover has improved over the years from 2.74x (FY13) to 4.5x in FY17. However, company’s profitability growth has been relatively inconsistent. EBITDA CAGR for 2013-17 has been 10.4 percent. However, excluding last year, operating profit has shown CAGR growth of 27 percent.

FY17 earnings had been impacted by macro events like demonetization along with higher marketing and brand promotion expenses. To improve profitability, the company has reduced distributors' margins and increased offerings to higher SKU/premium segments (7 Wonders series).

Risk factors – low profitability compared to competitors

The company is focusing on a market share maximization strategy which though has worked well for topline growth may not necessarily result in similar earnings growth in near term. Its presence in tier 1 cities and the product share in the premium segments is minimal and would take time to scale up. Volatility of raw materials (69-74 percent of sales) and sourcing strategy is another factor which can lead to variability in earnings.

Valuation: expensive bet on a high growth company

Based on earnings multiple, valuations are rich. Even if we normalise the earnings of the last fiscal year as per margin profile of FY16, P/E comes to be about 53x which is in line with the FMCG sector average.

However, for a company in a steep growth phase relying on increasing market share and establishing its manufacturing and distribution network, a look at P/S multiple would be relevant as well, in our view.

Compared to its peers, DFM Foods, in particular, Prataap Snacks' implied price/sales multiple is at a discount. While at the same time, Prataap Snacks’ cash flow generation (from operations) is at 38 percent CAGR (FY13-17) vs 11 percent for DFM Foods.

Given the well-established manufacturing capacity backed by pan-India presence through its distribution chain, IPO offers participation in the volume-led growth of organised snacks industry. Long-term investors can benefit from this proxy of consumption growth story in the hinterland.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.