The gentle upswing in manufacturing should be welcomed rather than

scoured for caveats. The good news is that the global economy appears to have avoided a protracted downdraft, something that looked like a reasonable outcome last year. The US doesn’t have to carry the world on its shoulders, at least not quite to the same degree.

Nations that are important nodes in factory supply chains enjoyed an acceleration in March. While the Institute for Supply Management’s gauge came in too hot for some traders’ liking, don’t let that crowd out a very solid performance from production lines and wharves in Asia. If that region can do better than the so-so performance turned in last year, it can make a real contribution to a prolonged global expansion.

This is worth applause rather than despair. Yes, the first expansion in US manufacturing since 2022 pushed back estimates of how much the Federal Reserve will juice the economy and when that modest easing may commence. Some policymakers had already expressed misgivings about the Fed's projection of several interest-rate cuts in the lead-up to the ISMreport on Monday. The unexpectedly strong American number doesn't have to be a major setback. The central bank's leaders have stressed for a while that there's no rush.

The US economy has been performing well, given the rapid monetary tightening that characterized 2021 and 2022. The big power getting a lot of bad press has been China. That makes upbeat data on manufacturing particularly welcome. Hours before the ISM report, figures showed China's closely watched purchasing managers index rose more than forecast in March. Factory activity has expanded for five months. Among other encouraging signs, exports are picking up and the longest streak of deflation since the 1990s was broken in February.

None of this means China's struggles are over. The property collapse is still weighing on growth, consumer sentiment is languishing, companies are reining in spending, and further stimulus will likely be required. But compared with the bad vibes and China-is-done narrative, it would be churlish not to acknowledge pleasing news when it comes. There may now be too much negativity toward the world’s second-largest economy.

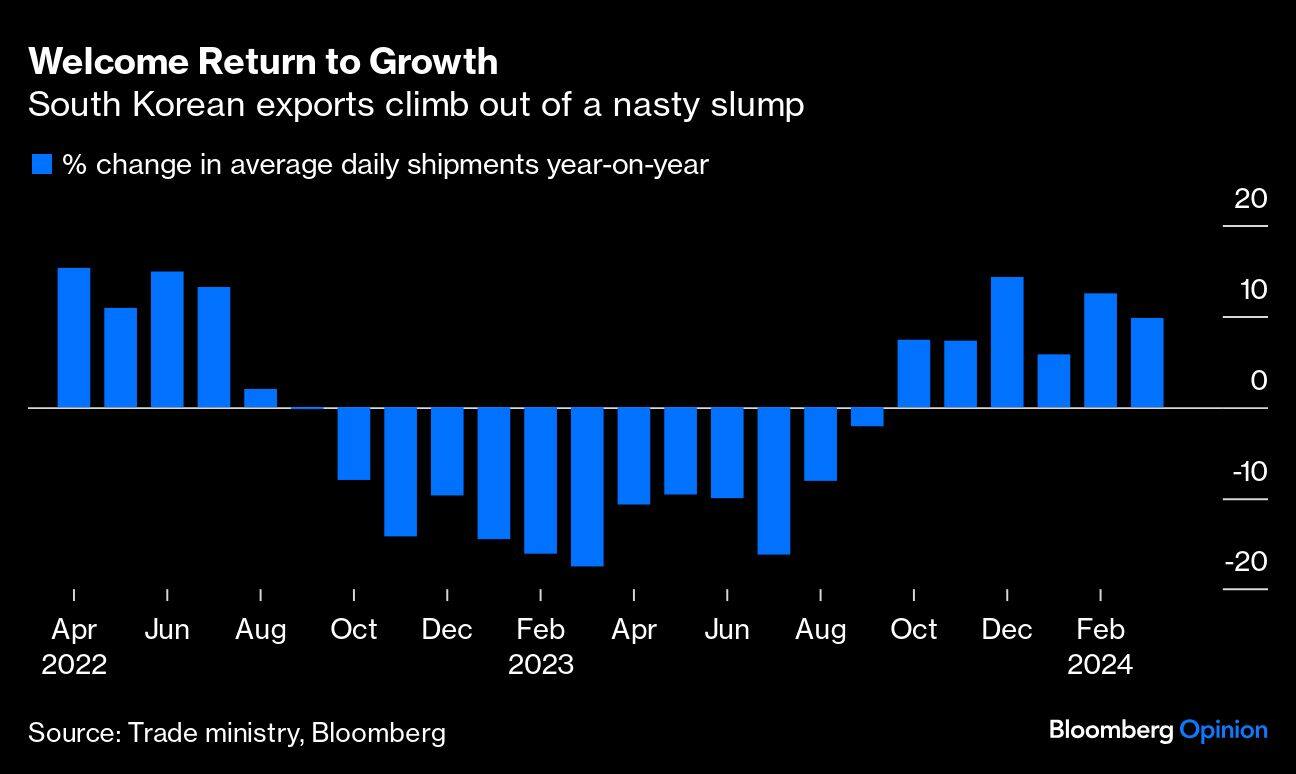

Manufacturing also had a worthy month in Japan and Taiwan. A disappointing outcome in South Korea was tempered by a robust export performance; semiconductor shipments jumped 36 percent from a year earlier. There's a lot to like here.

Nor does it mean industrial output has hit a sweet spot. The World Trade Organization is dour about prospects. Let's take some succor, though, from what's going right. It's not long ago that a global recession looked like a reasonable bet. After all, central banks were scrambling to constrain the expansion and there is often an overshoot. Authorities tend not to realize until too late that restrictive policy has worked. The concern was particularly prevalent in the euro area and the UK. Expansions in Asia didn't come to an end, but were muted by China's travails. Only the US looked perky enough to carry the load.

That concern is dissipating. It's too soon to turn cartwheels, but some important bellwethers of the global economy are looking better. Don't let the perfect become the enemy of the good. Something happened in March, for the better.

Daniel Moss is a Bloomberg Opinion columnist covering Asian economies. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.