American entrepreneur Sam Altman, the chief executive officer of OpenAI, was the first person to get a golden visa from Indonesia, a win for President Joko Widodo, who has been keen to attract foreign investments. In late August, his government introduced a new program that allows wealthy foreigners to remain in the southeast Asian nation for an extended period of time.

Under the new scheme, those wishing to stay in Indonesia for five years must invest a minimum $2.5 million in a local venture. Alternatively, one can be a passive investor, committing $350,000 to buy shares in local public companies, Indonesian government bonds, or depositing it into savings accounts.

It’s obvious why Indonesia is joining the booming golden-visa bandwagon

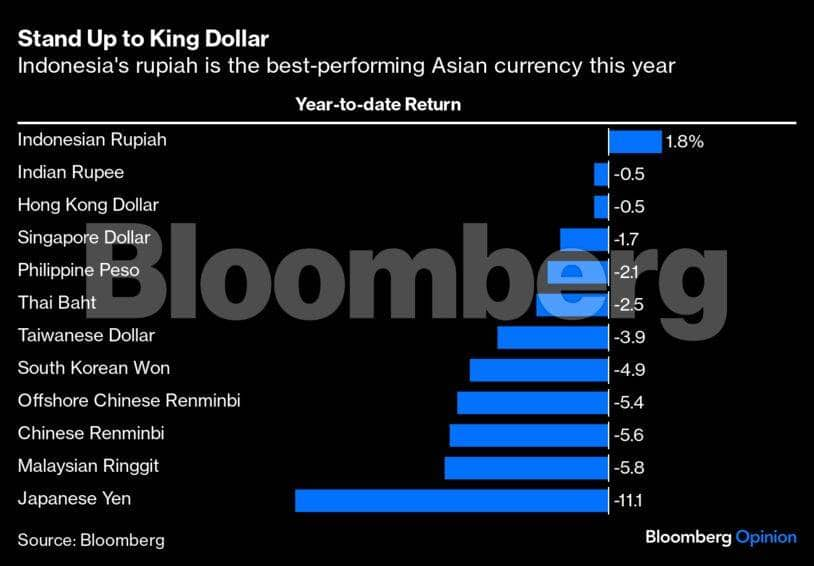

now. For the first time in two years, its current account fell into a deficit, mainly due to weaker exports from falling commodity prices. To stabilise the rupiah, the central bank has been selling short-term bonds to push up yields. For a country once considered a member of the Fragile Five, Indonesia is especially cognizant of the power of foreign money and how fast flows can move. To this day, foreigners own about 15 percent of government bonds.

The more interesting question is why Americans would want a golden visa from Indonesia — other than that the nation does not have an extradition treaty with the US. They are not short of choices, including Portugal, Malta, Montenegro, to name a few. Despite calls from politicians to get rid of them, many European countries are still happily accepting golden-visa applications.

People seeking these special documents often want a Plan B. In this sense, Indonesia is anything but American, starting with its attitude toward debt.

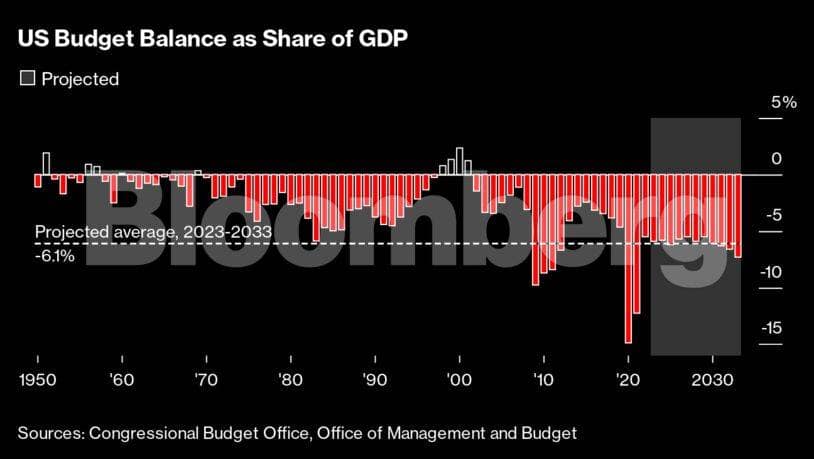

In recent weeks, investors have become more vocal in their concerns over unchecked US government borrowings, amid a sovereign credit ratings downgrade and a Treasury bond rout. The Congressional Budget Office doesn’t see Washington go on a diet. Instead, it forecasts the fiscal deficit to average at 6.1 percent of gross domestic product over the next decade. Already, the government spends 14 percent of its tax revenue on net interest payments, the highest level since 1998. “Long-term investors should no longer own Treasury bonds,” noted Jefferies’ equity strategist Christopher Wood.

In this global context, buying $350,000 worth of local government bonds looks like a safer bet. Indonesia still maintains fiscal discipline, perhaps in no small part because of the capital outflows it suffered during the Global Financial Crisis. These days, Jakarta adheres to a 3 percent self-imposed limit on its fiscal deficit, even at the expense of slower growth. The latest projection for 2024 is 2.29 percent of GDP.

This conservative attitude is a refreshing narrative in a world awash with leverage. From China to the European Union and the US, investors worry how much debt is too much, and when a full-blown financial meltdown will arrive. In Indonesia, on the other hand, household debt accounts for only 9 percent of GDP — in fact, less than 60 percent of its young population of 274 million have a bank account.

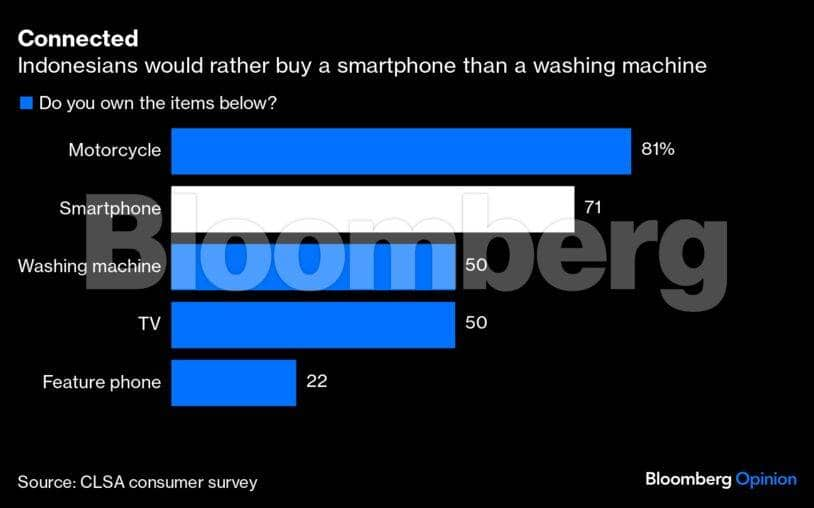

This balance-sheet landscape presents a great opportunity for tech entrepreneurs who want to be more than passive investors and dabble in fintech and financial inclusion. Mobile devices are ubiquitous — people would rather own a smartphone than a television or a washing machine. Meanwhile, social media platforms, such as TikTok, are influential channels for Gen-Z. Indonesians are connected, but also insulated from the chaotic debt-fueled world.

And let’s not forget Bali, the sub-tropical surfing and yoga haven. Last summer, when I was doing a meditation retreat there, I saw young digital nomads typing furiously on their laptops in trendy cafes, while fueling up on kombucha. I was envious. I wish I could move there. Indonesia’s golden visa sure deserves a good look.

Shuli Ren is a Bloomberg Opinion columnist covering Asian markets. Views are personal, and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.