The Reserve Bank of India’s (RBI) Centre for Advanced Financial Research and Learning (CAFRAL) released its India Finance Report (IFR) on November 7, 2023.

CAFRAL has pitched IFR as its flagship report. It’s a new report, which is going to be annual, and is going to be theme-based.

This year’s theme is the non-banking financial sector, focusing on its role in financial inclusion, rapid digitisation and its implications, and emerging stresses in the non-banking financial sector.

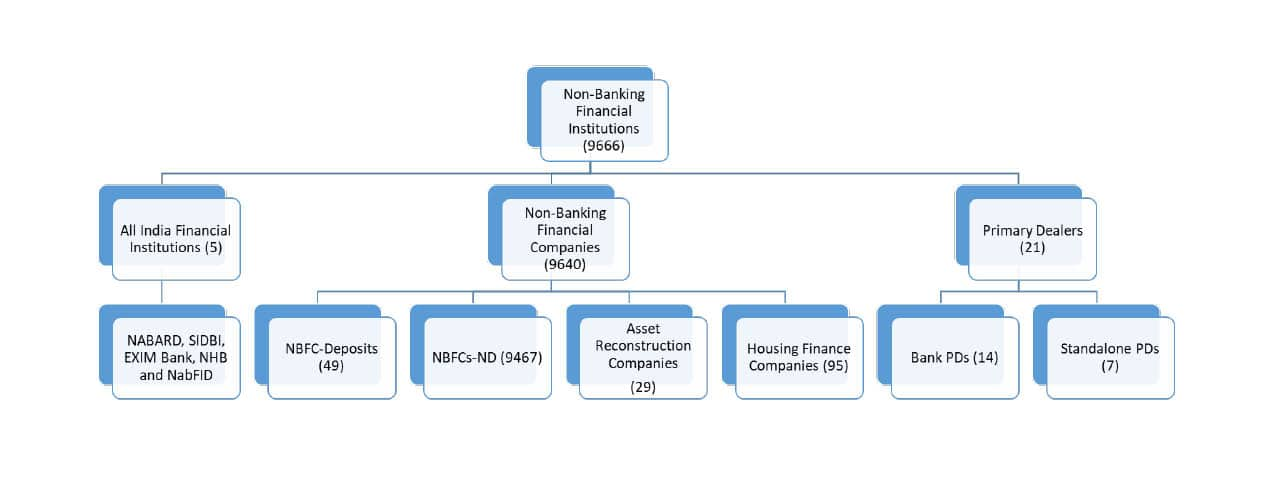

India’s non-banking financial sector is a maze of many types of companies. The report points out that there are 9,666 non-banking financial institutions (NBFIs) , classified into different categories.

Within NBFIs, the largest number consists of non-banking finance companies (NBFCs). Given the sheer dominance of NBFCs in the NBFI world, the report focuses on NBFCs.

Within NBFCs, we have both deposit taking and non-deposit-taking NBFCs. The deposits of NBFCs are not insured and the RBI has discouraged deposit-taking NBFCs and their number has declined from 784 in 2002 to 49 now. The NBFCs are also classified in terms of investment activity. Here, there are 11 types of investment activity.

The RBI has segregated NBFCs into four layers, based on their size, activity and riskiness (see Table 1). Most (95 percent) NBFCs are in the middle and upper layers.

What Are The Findings Of The Report?

Given this maze of type and regulatory structure of NBFCs in India, let us focus on the findings of the report.

The first finding is the transformation of NBFCs in the last 10 years. The phase – from 2013 to 2018 – was high growth, with NBFCs’ credit-GDP ratio increasing from 8.6 percent to 11.5 percent.

The credit-GDP ratio of banks declined from 59.1 percent to 51.2 percent in the same period. The period 2018-19 were stress years when a large NBFC, IL&FS, defaulted.

The RBI does not provide liquidity directly to NBFCs and depend on banks for liquidity needs. The crisis spread to NBFCs and NBFCs were not able to borrow from banks and mutual funds also avoided investing in securities issued by NBFCs.

Nearly 1,900 NBFCs cancelled their registrations. The crisis led to several regulatory measures to improve the governance and functioning of NBFCs.

The third stage of transformation was the pandemic years when NBFCs faced a sharp decline but recovered later, thanks to the measures taken by the RBI. Two notable developments of the period were the regulation of the housing finance companies (HFCs) shifting from the National Housing Bank (NHB) to the RBI and the introduction of scale/layer-based regulation.

The second finding of the IFR is that the NBFCs have played a role in deepening financial inclusion.

The NBFCs cater to low-income borrowers with lower credit ratings. NBFCs act as complementary to the traditional banks which mainly lend to high credit-rated borrowers.

Over the last decade, retail lending by NBFCs has grown by 223.2 percent by leveraging technology and smartphone access, improved digital literacy, and net banking.

FinTech NBFCs have been at the centre of this surge in retail lending. The report shows that NBFC loans have a large impact on consumption. The inter-linkages imply that a negative shock to the NBFC sector will adversely impact consumption of low-income households. This means balancing growth and regulation of NBFCs go hand in hand.

The third finding is that the inter-linkages of NBFCs with banks have increased significantly over the years. The risks in NBFCs, especially those with larger assets, have increased over the years. The report also discusses the transmission of the RBI policy rates on the balance sheets of NBFCs.

If the RBI increases interest rates, one sees the rise of risks in the balance sheet of NBFCs. On the assets side, there is a decline in secured loans and rise in unsecured loans. On the liabilities side, there is a fall in secured borrowings and rise in unsecured borrowings.

Overall, the IFR shows that NBFCs have helped address the last-mile gap in financial inclusion by leveraging technology. There is a series of rich tables and charts which show the inter-linkages and last-mile connectivity of NBFCs. But NBFCs also lead to higher financial risks, which need to be constantly monitored and regulated.

Will The IFR Be Different?

The release of the IFR raises one question.

There are already quite a few financial sector reports released by the RBI: Trend and Progress Report on Banking in India (annual), Financial Stability Report (bi-annual), and Currency and Finance Report (annual thematic report).

How will the IFR be different? Going forward, IFR should shape up to be a different one and add to the missing knowledge on India’s financial sector.

Amol Agrawal teaches at Ahmedabad University, and is the author of 'History of Private Banking in South Canara district (1906-69)’. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!