While the Budget can impact various personal finance, taxation and sectorial parameters, in this research article we have tried to analyse the impact of the Budget on the Nifty 50 as an Index.

In this article we have done a quantitative analysis on the impact of the Union Budget on the stock market performance.

2023 was a bullish year for the Indian stock market. As we move into 2024, investors are eyeing key events like the Union Budget and the General Elections.

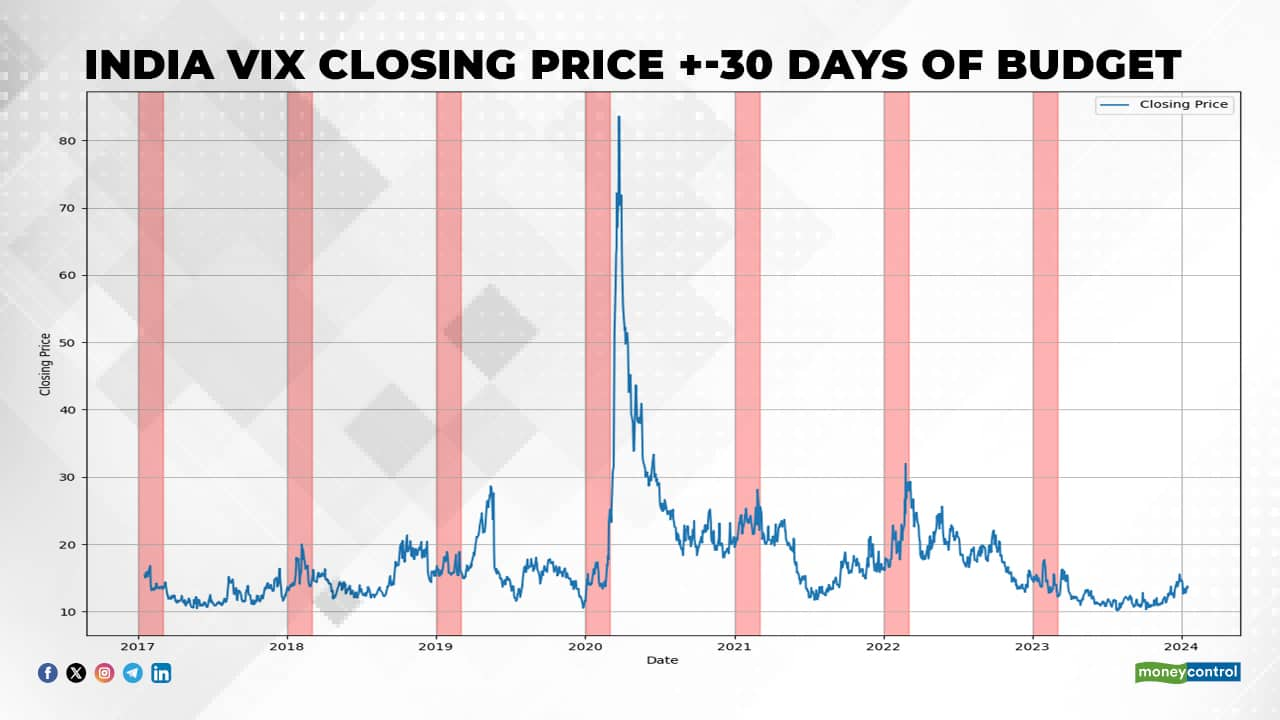

Even though there is no significant impact of the Budget on the Index, investors are often more active around this time. This generally increases the overall volatility during Budget periods as shown in the below chart.

The blue lines are daily returns since 2015. The pink band is a 30-day period before and after the Budget.

The India VIX also rises during such periods as highlighted in the pink bands.

2020 was an outlier year due to the pandemic. However, generally the markets are quite volatile around the Budget period.

If you are waiting for the Budget to decide the market direction then historically speaking there is little room to add alpha. The market discounts news in advance unless there is a major surprise.

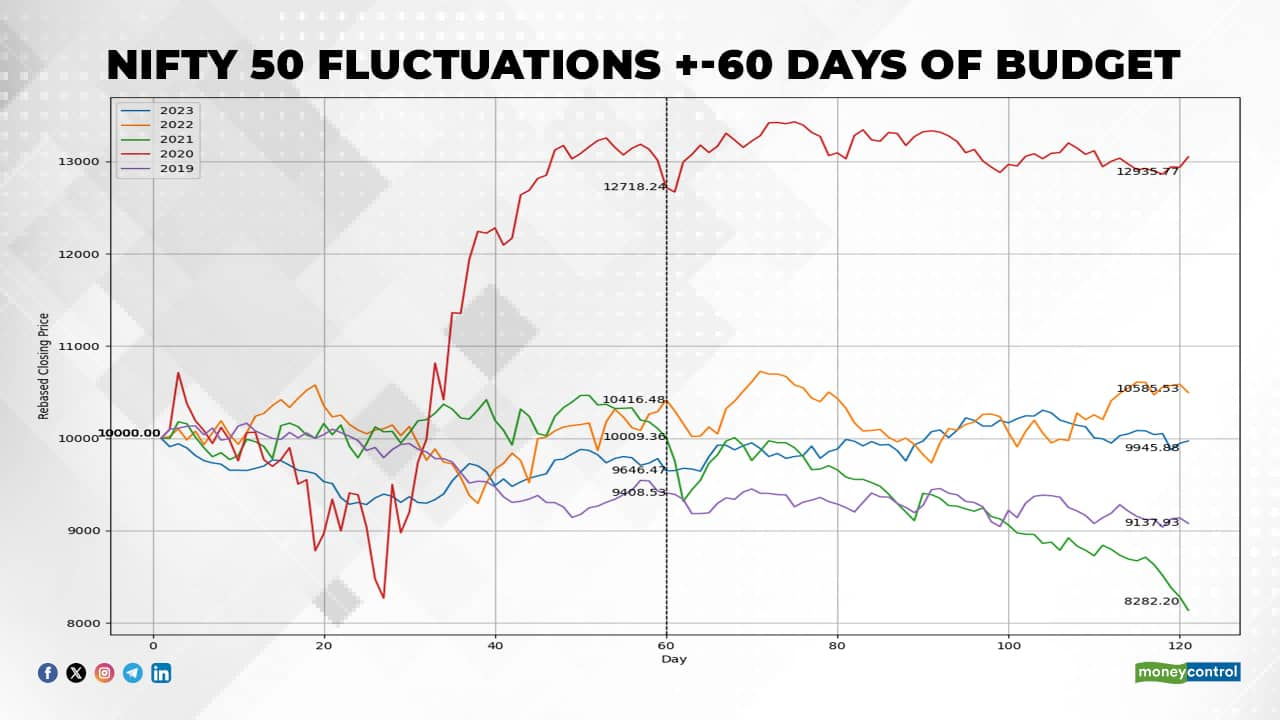

The chart above shows the market direction 60 days before and after the Budget each year separately. The line in the middle is the Budget Day for each year.

Historically, on Budget day the markets are choppy however it picks up in the short term only to eventually consolidate after a 30-day period.

Read | Budget 2024: Fin Min may assume 10.5% nominal GDP growth for FY25 fiscal math

While correlation is not causation it is important to note that no single parameter in isolation would impact the stock market Index.

The summary of these data points is to illustrate that overall there is no significant impact of the Budget on the price of the Index in the short term however the overall volatility picks up during this period.

Rohan Borawake is Co-Founder & CEO, Sabir Jana is Co-Founder and Head of Quantitative Research, at FinSharpe Investment Advisors. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!