Despite higher valuations, the rally in the Indian stock markets is unlikely to ease ahead of the interim budget next month, given the 1 percent decline over the first seven sessions of 2024, according to analysts.

Last year, the BSE Sensex and the NSE Nifty surged as much as 20 percent, while the mid-cap and small-cap indices soared 48 percent amid strong sentiments before the election, improving macroeconomic conditions, and expectations of interest rate cuts.

While market participants expect the government to continue spending on infrastructure and attract private sector funds, analysts also predict that market volatility will increase ahead of the interim budget and the earnings season in the coming weeks.

Focus shifts to budget, earnings

The upcoming budget is expected to be modest – without any major announcements – due to its interim nature on account of an election year.

It will be the 12th budget of the BJP-led Narendra Modi government since it came to power in May 2014. Historically, budgets have had a significant impact on the markets as government policies influence private-sector investments.

Previous budget measures have helped mitigate the pandemic's impact on private sector balance sheets, resulting in considerable market gains.

Finance Minister Nirmala Sitharaman is set to present the interim budget on February 1, which is the last before the general elections scheduled to be held by May 2024.

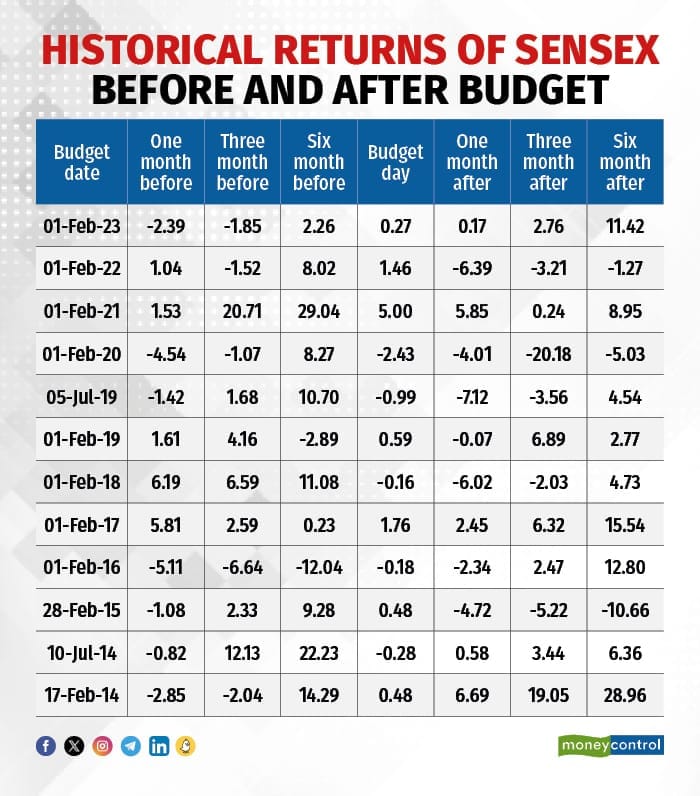

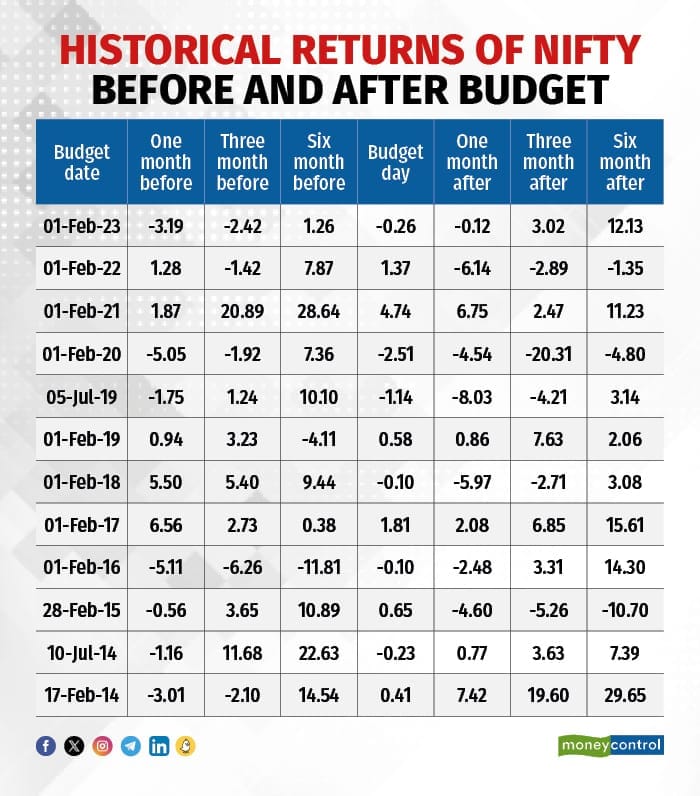

Market performance before and after previous budgets

In the past 11 budgets under the Modi government, the BSE Sensex fell five times and the Nifty dropped on six occasions, while they ended higher at other times.

Both the benchmark indices fell five times out of 11 in the three months before the budget presentation. After the budget, the Sensex and Nifty declined over three months five times out of 11.

On February 1, 2019, during the interim budget, the Sensex and Nifty yielded just a 0.5% return.

Biggest gains for Sensex, Nifty came ahead of 2021 budget

The indices gained almost 12 percent in the three months before the first budget of the Modi government in July 2014. However, the most significant gains before the budget were observed in 2021, with the Sensex and the Nifty have advanced about 21 percent as the economy emerged from the Covid aftermath and the markets anticipated strong government support.

In 2015, 2017, 2018, and 2019, there were single-digit returns for the indices before the budget, ranging from 2.3 percent to 6.6 percent. In 2016, three months before the budget, both the Sensex and the Nifty dropped 6.3 percent each. In 2020, 2022, and 2023, they declined by 1.1 percent to 1.9 percent.

Three months after the budget in 2020, the Sensex and the Nifty declined over 20 percent due to pandemic restrictions. In 2015, both benchmark indices fell over 5 percent, while in 2019 and 2022, they dropped about 3 percent.

The most gains in the three months after the budget were posted in 2017 and 2019, with increases of 6.3 percent, while in 2014, 2016, and 2023, they rose about 3 percent each.

What to expect from Budget 2024

While a full-fledged budget is expected in July, there's a possibility of populist measures, particularly before the general election.

"The current budget is a vote of account, so expecting any major announcement ahead of the forthcoming general elections seems highly unlikely,” said Sharad Chandra Shukla, director at Mehta Equities.

Nonetheless, taxpayers are eyeing populist measures such as higher basic and house rent allowance exemptions. Analysts expect a record 25 percent increase in capital expenditure allocation to Rs 12.5 lakh crore in FY25. Market experts want pro-stock market measures including removal or reduction of securities transaction tax and long-term capital gains tax.

"Any budget before elections is usually a populist budget, but looking at this government's track record for the last 10 years, we are sure they will focus on business as usual,” said Himanshu Kohli, co-founder of Client Associates.

Kohli said the government will stick to its growth- and development-oriented agenda with a focus on inclusive growth in the budget. There could be some short-term announcements to please the public, he said.

"There is a high probability that this government can come back to power and then they will present a full-year budget that will lay down detailed plans focusing on the long-term growth momentum of the country. Hence, this is more like an interim budget, which doesn't hold too much value right now. The best agenda for a government is to do what is correct from a long-term rather than a short-term perspective, and this is possible when they present the full-year budget,” Kohli said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!