Anubhav SahuMoneycontrol Research

Hurricane Harvey had a huge impact on the US refining capacity and the downstream petrochemical industry. With about 16 percent of refining capacity still shut down and expected to start functioning only after a hiatus, GRM (gross refining margin) is expected to remain high in near future. Indian petrochemical prices have recently firmed up which could impact plastic processing industries. In the meantime, stocks of the petrochemical manufacturers have benefitted from the tightness in the market.

Harvey impact and elevated GRM

IHS Markit estimates that about 60 percent of US ethylene capacity was hit by Hurricane Harvey. Current estimates suggest that about 54 percent (16.2mmtpa) of the total US ethylene capacity is still off the market. Within the refinery space, 60 percent of capacity hit by Harvey is still offline which is about 16 percent of US refining capacity.

Industry participants suggest that it might take another month or so for the pre-Harvey capacity to be fully operational.

For the time being regional GRM remains elevated. Singapore GRM is at 9.3 USD/ bbl, up 27 percent from the July numbers. Petrochemical prices have also surged with a lag. For instance, SE Asia polyproplene prices are up by about 5 percent.

Petrochemical market in India: Varied import dependence

While looking at some of the oil derivatives which were impacted by Hurricane Harvey, it may be pertinent to look at the demand-supply gap. In case of ethylene, India is nearly self-sufficient. In fact, for this product it is imperative to have it locally available as the transportation cost is high and require additional safety norms due to its inflammability.

In case of petrochemicals, as per the data from CPM ( Chemicals and Petrochemicals Manufacturer’s Association, India), net imports as a percentage of consumption is higher for LDPE (Low Density Polyethylene), PVC, and HDPE (High Density Polyethylene) at 70 percent, 50 percent and 22 percent, respectively. In case of Polypropylene and Poly Styrene, India is nearly self-sufficient.

Though there is a variance across product categories as far as supply demand dynamics in India are concerned, price increase for the petrochemicals have been felt across the board due to the global dynamics.

Polymer prices up by 5-7 percent

Major petrochemical players in India raised their petrochemical prices by 5-7 percent in last two weeks. Interestingly, in the June quarter, some key refineries were shut down for a considerable period leading to a tight supply situation resulting in hardening of petrochemical prices. As these refineries are back to optimum operational capacity, some easing or at least stabilization of petrochemical prices was expected.

Pricing trend for polymers (Rs/MT) for Ahmedabad grade

Source: RIL

However, Hurricane Harvey has changed the pricing dynamics for current quarter and prices are expected to remain elevated till the US oil downstream industry is back to pre-Harvey stage.

Petrochemical manufacturers gained

Not surprisingly, in last one month, petrochemical manufacturers of the country benefitted from the improved product spread. DCW has gained the most as it is not only a key manufacturer for PVC but also for caustic soda which is also one of the chemicals most impacted by the hurricane.

Price performance for the key chemical manufacturers

Source: Capitaline

Down stream plastic processing industry earnings

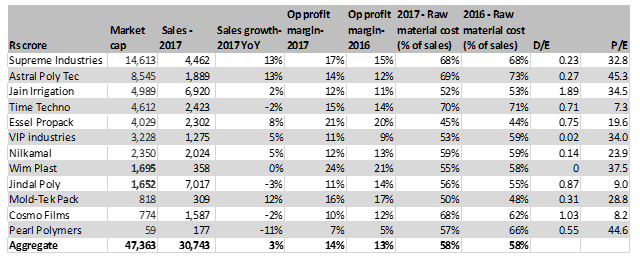

Downstream plastic processing industry have been resilient so far. Interestingly, raw material (largely petrochemicals) constitute a large proportion in terms of sales (about 58 percent). Hence, any sustained increase in petrochemical prices would weigh on earnings.

Price performance for the key plastic manufacturers

Source: Capitaline

Our back-of-the-envelope calculation suggests that 5 percent increase in raw material costs can impact the earnings of plastic processing industry by 20-25 percent during a given time period. Recent price hikes in petrochemicals, even if sustained for a month, can weigh on the annual earnings of plastic processing companies by 3-4 percent.

Given this context, stocks of plastic processing industry can adversely react if US oil downstream industry doesn’t get operational soon. Further, recent price hikes from the Indian petrochemical manufacturers weighs on the near term operational profitability of the plastic processors.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.