In their race to leapfrog development, BRICS members India and Brazil have heavily invested in digital technologies to accelerate financial inclusion. Both have launched instant payment systems – the Unified Payments Interface (UPI) in India in 2016 and Pix in Brazil in 2020.

Our comparative data analysis of the two systems finds that both systems are rapidly adopted by financially weaker sections for payments, shown by sharply falling Peer-to-Merchant (P2M) average ticket sizes (ATS). While there are marked differences in how the two systems have been regulated, the story is loud and clear: financial technologies built on the back of expanding smartphone ownership and internet access need to be at the heart of financial deepening efforts around the developing world.

UPI and Pix: Aims and RulesUPI and Pix, although share common goals of increasing banking access, reducing cash dependency, integrating the informal economy into the mainstream and increasing payment convenience, differ in their regulatory frameworks.

UPI is run by the NPCI, a public-private partnership in India, contrasting with Brazil’s central bank-controlled Pix. India’s proactive approach to UPI adoption, characterised by minimal fees, contrasts with Brazil’s allowance of merchant fees in Pix.

The Growth Story So FarIn the two years from January 2022 to December 2023, UPI and Pix transaction volumes - meaning the total number of transactions carried out, increased. For our analysis, we only compare P2P and P2M transactions. This is because while Pix records G2G, G2P and P2G transactions, the same is not true for UPI.

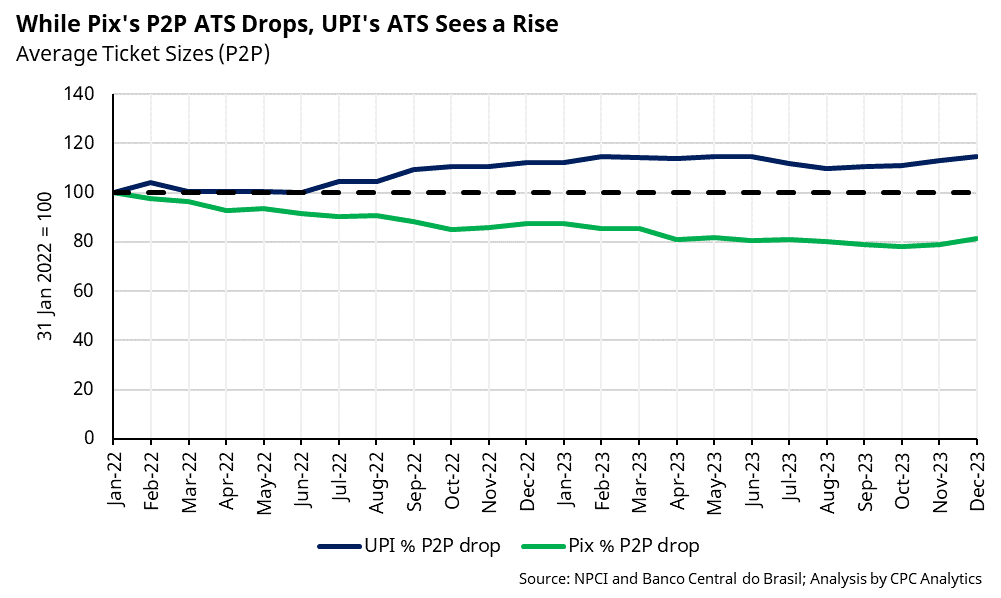

The next important metric is Average Tickets Size (ATS), meaning the average value per transaction (the division of total value by total volume), which has seen a significant drop. A decline in ATS can be inferred as people using the system for smaller transactions, meaning people from poorer sections are also now using these systems. In the two-year period, ATS on UPI dropped from Rs 1802 to 1517, and on Pix from 289 to 195 Reals.

Both UPI and Pix principally owe this drop to a strong increase in Peer-to-Merchant (P2M) transactions – meaning the use of these systems to buy items from small business establishments. Noteworthy is the sharper decline on Pix despite the system being established four years after UPI.

For Peer-to-Peer (P2P) transactions, such as for sending money to family members and for sharing expenses, India continues to witness an increase in ATS. This can be interpreted as the moneyed class using UPI for bigger sums than before, an indication of increasing trust in using UPI for sending larger amounts to peers.

What Denominations On UPI Tell UsIndia’s NPCI also releases data on the rupee denominations transacted on UPI. The sharpest fall in UPI transactions came from the Rs 0-500 P2M bracket, making this the key driving factor in ensuring the continued drop in overall ATS (Fig. 3).

We believe that the key reason behind Brazil’s faster adoption lies in its faring better on indicators such as ownership of mobile phones, access to the internet and digital literacy. Although an impressive proportion of Indians and Brazilians report having a bank or mobile account, the number of inactive accounts in India is higher than in Brazil. Not unimportantly, Brazil also does better also because it is wealthier as India has half its purchasing power.

Differences in UPI and Pix GovernanceUnlike on Pix, UPI has disallowed most charges to ensure greater adoption. Citing Brazil, critics have asserted that India could have achieved impressive results without resorting to such coercive measures, which may have stifled innovation. On the flip side, proponents insist that such measures are needed in low- and middle-income countries aiming for fast adoption and cannot wait for market forces.

We believe that while mandates have helped increase UPI adoption, the system would require a gradual introduction of merchant fees to ensure that it remains attractive to investment. Already, fintechs are lacking the resources to pump money into critical cybersecurity, with online scams becoming an impediment in building trust that is crucial for achieving the policy goal of mass adoption. Fintech lending is among the solutions suggested to crack the revenue puzzle; its success is yet to be seen.

Lessons For The Developing WorldIndia and Brazil exemplify that despite challenges like internet penetration and cybersecurity, digital payment systems are becoming the preferred method for small transactions.

Their success hinges on fundamental factors like smartphone ownership, bank accounts, and internet access, vital for countries looking to replicate the UPI and Pix model.

Om Marathe is a Research Analyst, Jayati Sharma is a Research and Data Analyst & Sahil Deo is Co-Founder at CPC Analytics, a data-driven public policy consulting firm. Views are personal, and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.