The endeavour of the Union Budget presented by the finance minister on February 1 is to create opportunities for citizens in an inclusive manner, with emphasis on growth and job creation, along with strengthening the macroeconomic stability. It aims to provide a further impetus to India’s growth story by introducing new tax measures which will, certainly, uplift the entrepreneurial spirit and will provide relief to the citizens.

Decoding Tax Sops For IndividualsBattered by rising inflation, India had high expectations from this Budget, especially when it comes to tax payments and reforms. Currently, those with income up to Rs 5 lakh do not pay any income tax. This rebate has been increased to Rs 7 lakh in the new tax regime, which means that individuals earning up to Rs 7 lakh do not have to pay any tax.

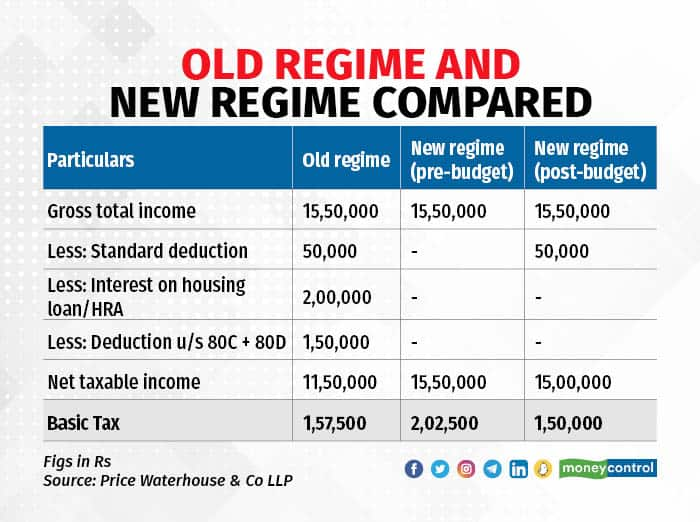

To further promote this new tax regime, the government has reduced the number of tax slabs from six to five and increased the exemption limit to Rs 3 lakh from Rs 2.5 lakh. Additionally, a standard deduction of Rs 50,000 has been extended in this regime. However, there is no change in slab rates for individuals opting for the old scheme. This may lead to confusion as to which regime individuals should opt for. The following analysis may help put things in perspective.

Whilst it may appear that vis-a-vis the old regime, savings are not substantial, it needs to be appreciated that all individuals may not avail of housing loans or house rent allowance (HRA). Sometimes, it may also be difficult to take full benefit of the investment-linked deductions due to liquidity challenges. However, these savings get exacerbated when we compare the new regime (post vs pre-Budget). Accordingly, the new regime, post the Union Budget, may become the preferred choice for India’s burgeoning middle class.

Also, the tax exemption of Rs 3 lakh on leave encashment of private sector employees will be increased to Rs 25 lakh. This will, in turn, help in alignment with today’s market scenario.

It’s interesting to see how Budget 2023 not only favours the middle-income household but also thinks for investors and individuals in the higher tax bracket by reducing the surcharge from 37 percent to 25 percent.

Catch all the LIVE updates on Budget 2023

Earlier, as an anti-avoidance measure, money above Rs 50,000 received by non-residents as gifts from Indian residents was made taxable. Now, such gifts made to ‘not ordinarily residents’ would also be taxable. This may have an impact on the Indian diaspora living abroad who receive money from India as gifts (excluding specified relatives).

- Exempt Income Under Life Insurance Policies (other than ULIP)Tax exemption on the sum received under a life insurance policy is a social welfare measure. However, high networth individuals (HNIs) enjoy this exemption by investing in policies having large premiums. Accordingly, it is proposed that only income from policies having aggregate annual premium up to Rs 5 lakh shall be exempt. However, the sum received on the death of the insured, and on policies issued till March 31, 2023, would continue to be exempt.

- Limiting Long term Capital Gains (LTCG) exemptionCurrently, LTCG on the transfer of residential houses/other assets is tax exempt if such gains/net consideration is reinvested in a residential property. These exemptions shall be capped to residential property valued up to Rs 10 crore and will impact HNIs.

Tax Reforms For MSMEsWhilst recognising the contribution of micro, small and medium enterprises (MSMEs) in job creation and creating an Atmanirbhar Bharat, a slew of measures have been proposed, such as increasing the threshold limits of presumptive taxation to Rs 3 crore and Rs 75 lakh for micro-enterprises and specified professionals, respectively. This will reduce compliance obligations, simplify tax computations, and will enable MSMEs to focus on core competencies. Also, to improve the cash liquidity of MSMEs, it is proposed to allow tax deductions to their customers only on the actual payment of dues.

Tax Measures For StartupsStartups have been instrumental in promoting entrepreneurship, job creation, and fostering a culture of innovation. To further propel the startup engine, the sunset date of incorporating eligible startups for garnering tax exemption has been extended to March 31, 2024. Unabsorbed tax losses of eligible startups do not lapse when there is a change in shareholding by more than 51 percent. This relaxation is available for losses incurred within a period of seven years from the incorporation and has now been extended to 10 years.

Currently, if a closely held company receives consideration from a resident for the issue of shares at more than the fair market value (FMV), it is treated as the ‘other income’ of that company. This provision has now been extended to cover non-resident investors, as well. Many non-resident investors infuse money into start-ups above the FMV, keeping in mind the growth potential and other parameters. Though it’s an anti-abuse provision, this amendment may even impact bonafide transactions. Accordingly, the government should consider bringing some relaxation, especially for startups.

Overall, this has been a pragmatic budget which, on one hand, strikes a delicate balance by focusing on inclusive development, supporting small businesses, boosting income for the middle class, reducing compliances and promoting entrepreneurship. On the other hand, it incorporates measures to restrict tax concessions not intended by the government and clarify its position on certain issues.

(With contributions from Rahul Gupta, partner, Price Waterhouse& Co LLP) Sanjay Tolia is partner, Price Waterhouse& Co LLP. Views are personal and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.