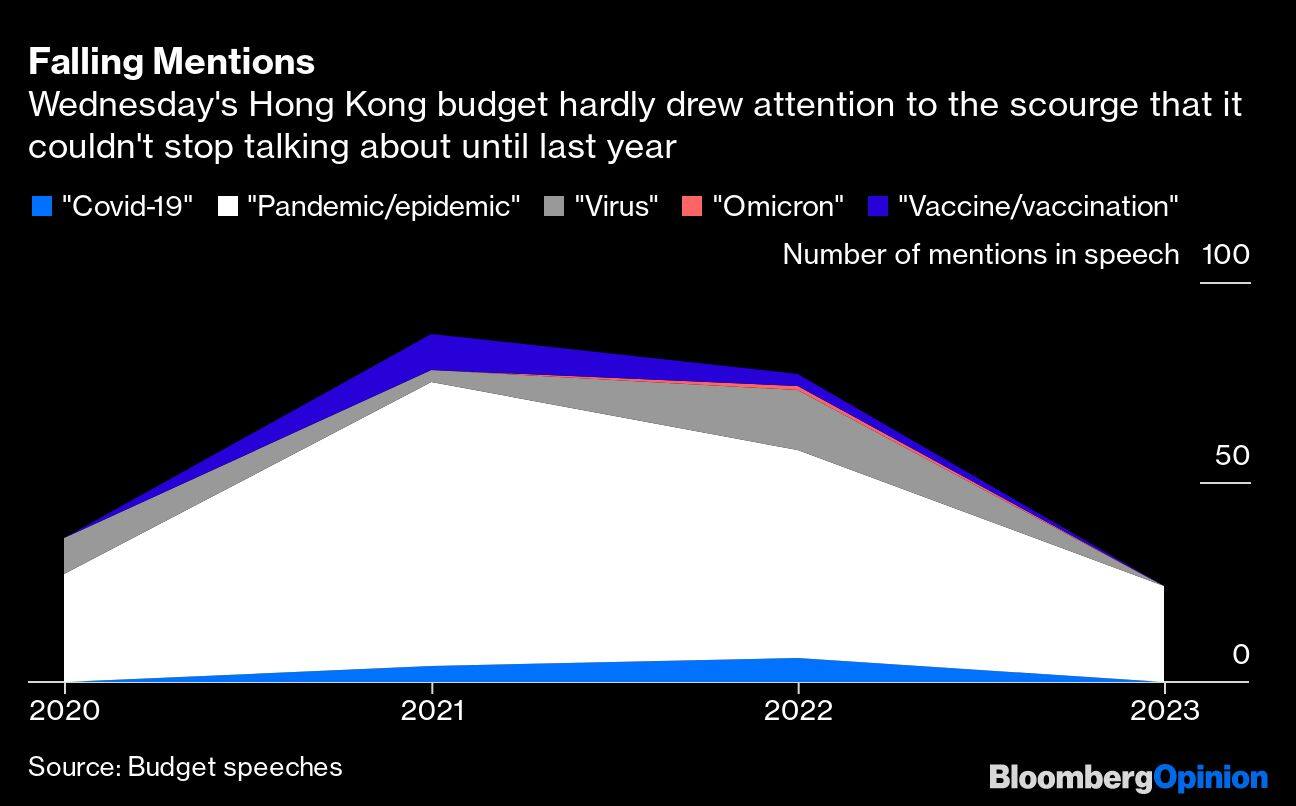

In his two-hour-long budget address Wednesday, Hong Kong’s Financial Secretary Paul Chan didn’t mention “COVID-19” once. Even if you threw in related words like “epidemic,” the count came to 24, the lowest in three years. Taking the speech as a proxy for the emphasis the city places on the pathogen, Chan did a sterling job of turning the public’s gaze away from it. The new campaign that replaces that prolonged — and eventually futile — battle to contain the scourge is titled, “Happy Hong Kong.”

Just how joyous can the Asian financial center be this year? There’s little doubt that the economic reopening will fill stores, restaurants and the airport with visitors, who’ll be lured with freebies like shopping and dining privileges. Local residents will join in the fun, too, at least to spend the $637 consumption vouchers that Chan announced for them in the budget. On the job-creation front, China’s post-pandemic revival will also benefit the special administrative region in 2023, especially its financial services industry.

But on the flipside, continuing with pandemic-era stimulus for yet another year shows that the economy’s performance is still very much tied to the government’s apron strings. This time in 2022, rival Singapore was already making plans to drop travel and social restrictions and start living with COVID-19. As a result, the city-state’s private sector slowly took the baton of growth back from massive fiscal pump-priming.

Hong Kong was also generous in opening the budget spigots during the pandemic. But it mimicked the mainland’s isolationist zero-infection policy and lost business and talent to Singapore, its main competitor in the region. There was no handover from public spending to private enterprise. Singapore’s economy grew 3.6 percent last year, even with a barely noticeable S$2 billion ($1.5 billion) budget deficit; Hong Kong’s output shrank by almost as much, despite a bloated HK$140 billion ($18 billion) fiscal shortfall.

For the coming year, Chan is still penciling in a substantial resource gap of HK$54 billion. His Singaporean counterpart, Lawrence Wong, last week forecast a deficit equal to 0.1 percent of gross domestic product. That’s already a balanced budget.

Before Hong Kong can steady its public finances, it must put some life back in its property market, a source of substantial government revenue. Chan tried to do this in his budget by cutting the stamp duty for first-time buyers of small and mid-sized residential units. This may not be enough, considering that borrowing costs are right now a bigger worry. With little consensus on how high the Federal Reserve may push interest rates, and how long it may hold them there, a sustained recovery in Hong Kong’s property market is unlikely this year. Meanwhile, the city’s builders have thousands of new homes to sell. “Developers’ ample project pipelines and probable interest-rate hikes might put more mortgage holders under water,” Bloomberg Intelligence analysts Patrick Wong and Yan Chi Wong wrote this week.

Still, Hong Kong isn’t completely out of cards. Chan announced a task force to come up with a plan for a crypto hub — something that appears to enjoy Beijing’s backing. This is an area where Singapore is starting to look weak after FTX and other debacles last year put a question mark on the adequacy of the city’s regulatory approach, especially when it came to protecting customer funds.

Another of Hong Kong’s proposals centers on health-care research, artificial intelligence, quantum technologies and microelectronics. It’s setting aside billions of dollars to pursue talent from around the world in these areas. It isn’t clear if this will reverse the hollowing out of the city’s human capital that began with the Beijing-imposed national security law and was aggravated by the COVID-19 crisis. Those who were expecting tax breaks for expats and other sops to boost Hong Kong’s international standing would be disappointed.

However, the resident population is more optimistic now than it has been in the past several years. This may be a good time to invest in new fields while deepening capabilities in industries where Hong Kong is already strong, such as private banking, asset management and family offices for the wealthy.

“I now see many happy faces around,” Chan said in his speech. It’s still not possible to see those faces in public, as everyone is still wearing masks. But yes, the misery quotient has gone down considerably with the recent dismantling of travel and social-distancing restrictions. Given how badly Hong Kong wants to be back in the contest with Singapore, maybe the mandated face-coverings will also go soon.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services in Asia. Views are personal, and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.