Anubhav Sahu Moneycontrol Research

Chinese President Xi Jinping’s statement about a "new phase of opening up" at the Boao Forum for Asia was a refreshing change in an environment clouded by trade protectionism.

The proposals announced at the forum were aimed at increasing imports (reduce trade deficit with the USA by USD 50 billion), reduce import tariffs on vehicles, lower foreign-ownership limits and focus on protection of intellectual property and investment environment.

While the context appears positive for risky assets, trade hawks are not pleased with China’s support to 'Made in China 2025' initiative.

Opening up of financial sector

In addition, to defusing trade tariff tension, the People's Bank of China (PBOC) laid out a much-awaited timetable to open up the financial sector to foreign investment.

The measures announced include allowing foreign investors to enter its financial leasing, automobile finance, consumer finance and trust sectors, and doing away with foreign ownership limits for financial asset investment companies and wealth management companies set up by commercial banks, by the end of 2018.

The central bank has also accelerated its commitment for foreign investment in the insurance sector. China said it would raise the foreign ownership limit to 51 percent in the next few months and scrap the restriction altogether in three years (which was five years earlier).

'Made in China 2025'

Also read http://english.gov.cn/2016special/madeinchina2025/

However, a major setback for potential trade negotiations was China's decision to reject US President Donald Trump’s demand to stop subsidising hi-tech industries (robotics, biotechnology, new-energy vehicles, aerospace, software, etc).

Here, the USA holds China responsible for misusing the policy to compel companies into transferring technology in areas like robotics and artificial intelligence.

For China, the 'Made in China 2025' initiative is seen as one of the main steps towards becoming one of the leading economies in research and development-intensive areas, from the largely-commoditised manufacturing hub that it currently is.

Walking the talk

While the Chinese proposal to narrow the trade deficit by USD 50 billion seems like a considerable step towards rapprochement with the USA, the market will only look at effective actions in that direction, in our view.

It is reported that China might target importing more liquefied natural gas (LNG), agricultural products, semiconductors and luxury goods to bridge the deficit.

Source: The Observatory of Economic Complexity/ The MIT Media Lab

Source: The Observatory of Economic Complexity/ The MIT Media Lab

The noteworthy part is that China witnessed a record import of natural gas last year (+68.6 million tonnes, up 27 percent YoY) on account of the government’s push for cleaner fuel, particularly in north China.

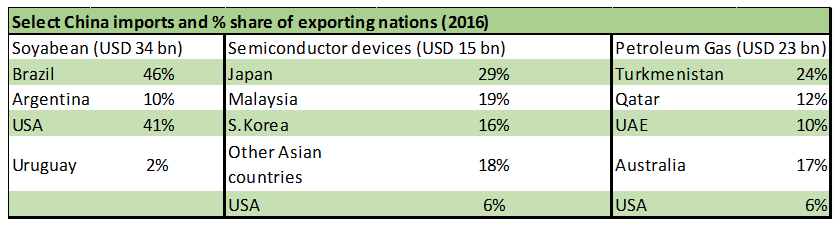

While a good part of the gas imported came from Central Asian countries like Turkmenistan (24 percent of petroleum gas import), Qatar (12 percent) and Australia (17 percent), the USA is also emerging as an important source for petroleum gas imports, accounting for 6 percent of China's imports this year.

In fact, in November 2017, the USA and China signed some preliminary agreements for LNG imports from USA and thereby participate in China’s natural gas demand surge, which is expected to more than double by 2030, according to Bernstein.

While this looks promising, Gazprom’s Power of Siberia pipeline (Russia) is expected to start gas supply at the end of this year, and is seen meeting around 10 percent of China's natural gas demand.

A discussion on a second pipeline is already underway. China’s import of LNG from South East Asian nations like Indonesia and Malaysia has exceeded that from the United States in the recent past.

Therefore, although China may reach out to USA for its natural gas needs, whether this would become a significant source of supply would depend on alternate available sources, pricing, logistics and strategic interest.

Even in other categories, how far the needle would move is difficult to say at this juncture. On the agriculture imports front, USA contributes 40 percent of China's total soybean import, which is already a substantial chunk.

In case of semi-conductor devices, 82 percent of China's imports come from Asian trade partners that are optimally placed in terms of both technology and pricing.

Even if the quantum of the above-mentioned products imported from USA is doubled in the near future, ceteris paribus, China's trade deficit with the United States will be reduced by around USD 16 billion.

Although we have not accounted for luxury goods and other agriculture products here, the analysis above suggests that a reduction of trade deficit to that extent is a tall ask.

So even if US-China trade tensions appear to be dissipating and the two nations seem to be moving towards reconciliation, geopolitical brinkmanship would keep uncertainty elevated in the near term.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.