September 21, 2023 / 11:14 IST

The RBI data showed that household financial savings were at 5.1 percent of GDP, almost a 40-year low.

The Reserve Bank of India (RBI) recently released data on household financial savings which created a stir in the markets. The data showed that household financial savings were at 5.1 percent of GDP, almost a 40-year low.Foundational courses on macroeconomics stress how savings lead to investments, which in turn leads to economic growth. This relationship can be seen in India’s economic growth trajectory as well. India’s savings and investments as a percentage of GDP increased steadily since 1950-51. We can also see that investments have been higher than savings, which implies that the economy was getting savings from abroad. The percentages jumped significantly during the 2000s when savings and investments touched a high of 37 percent and 40 percent of GDP, respectively. Since then, the share of savings and investments in GDP has declined to about 30 percent, levels last seen in the early 2000s. The decline in savings and subsequently investments has been a cause of concern and a point of discussion for economists.

Story continues below Advertisement

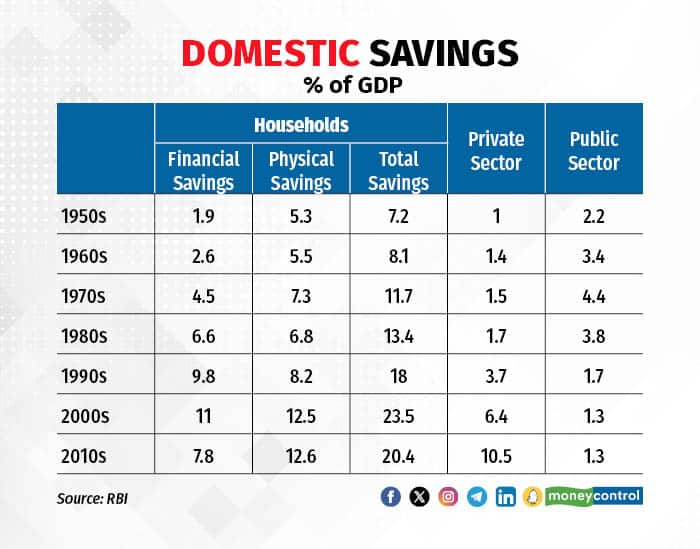

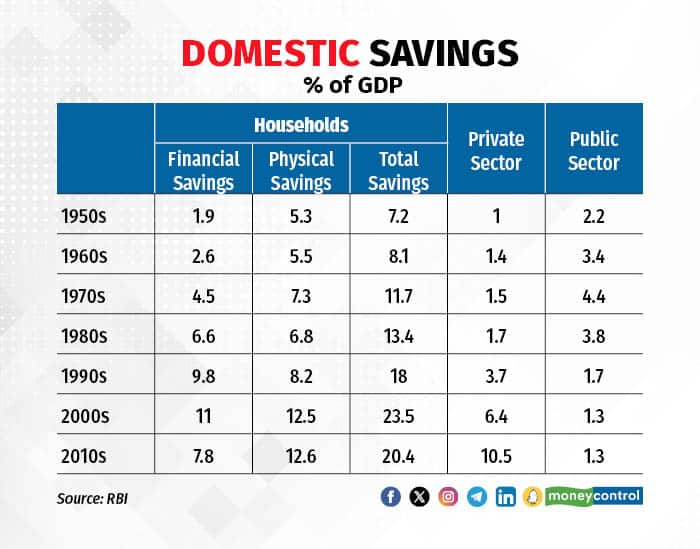

Given the declining trends of savings and investments ratio, the recent data on financial savings is a cause for concern. Households, the private sector and the government sector (including the public sector) contribute to savings. The data shows that households contribute a bulk of the savings. Since 1950, the contribution of households to total savings has averaged 70 percent. However, the trend has been volatile. The share of households in total savings declined from the 1950s to the 1970s and then rose till the 2000s before declining again in the decade of 2010s. The decline in household savings was matched by an increase in savings by the public sector in the 1950s to the 1970s. The recent decline in household savings was matched by a rise in savings of private sector. Was the rise in private sector savings due to corporates increasing their savings due to falling household savings or their unwillingness to invest given weak economic prospects?

Within household savings, we see that the share of financial savings rising (currency, bank deposits, shares, etc) steadily over the decades to become equal to physical savings (land, gold, etc) in the 1980s. The share of financial savings was higher than physical savings in the 1990s and then it declined from the 2000s.The above data analysis leads us to make the following observations about the recent trend of savings in India. First, savings as a percentage of GDP has declined. Second, within savings, the share of household savings has declined. Third, the share of financial savings in household savings has declined compared to physical savings. Why have the financial savings of households declined recently?

The reason is that financial liabilities (mainly loans from banks and financial institutions) have increased compared to financial assets (investments in bank deposits, shares, etc) in the recent period. The average growth of financial assets and liabilities in the period 2000-22 was 12.4 percent and 21.6 percent, respectively. The difference between financial assets and financial liabilities is financial savings. With financial liabilities growing faster than financial assets, we are seeing a slower growth in financial savings.

The RBI also shares data on the breakup of financial assets of the households. The growth in financial savings since the 1970s was driven by bank deposits. This was due to government policies to push branch expansion and banking services post-bank nationalisation in 1969. The share of bank deposits as a percentage of GDP started to decline in the decade of 2010s when real interest rates fell. The share of life insurance has increased in the same period but it has not matched the fall of bank deposits. The share of shares and debentures had increased in the 2010s but it is still a tiny fraction in the savings space.

What does the above analysis imply? Going back to the basic macroeconomics relationship mentioned above, it implies that the slowdown in financial savings is leading to overall lower savings, which in turn has led to lower growth in investments and in turn, slowed economic growth. Households mainly invested in bank deposits due to relatively assured returns. However, as interest rates fell and avenues to invest in safer investment products declined, households shifted back towards physical savings. Physical savings are not available to corporate investors, and that led them to rely on their own savings. It is quite a circular trap of low financial savings leading to many problems in the economy.The government and the financial sector regulators have to think together to promote financial savings by households. Mutual funds have emerged as an alternative product but it requires financial literacy and is also open to market risks. Investors seek investment funds which have safe and stable qualities of a bank deposit. The Pension Fund Regulatory and Development Authority’s minimum assured return plan and National Pension Scheme (NPS) could be some of the possible solutions to bridge the gaps. However, they also require intensive communication outreach to spread financial literacy around these products.

Amol Agrawal teaches at Ahmedabad University, and is the author of 'History of Private Banking in South Canara district (1906-69)’. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!