Anubhav SahuMoneycontrol research

Asian Paints disappointed the street on account of lower than expected volume growth. While a surge in raw material cost was along expected lines, a moderate pickup in demand makes the task of increasing product prices a tad more difficult. It’s noteworthy that the last price hike was in May 2017 and the price of crude oil has moved up by 33 percent since then.

Quarterly result update

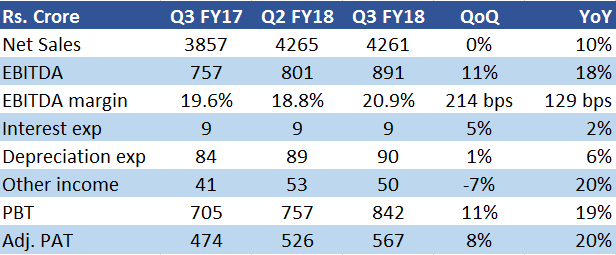

Asian Paints Q3 2018 consolidated

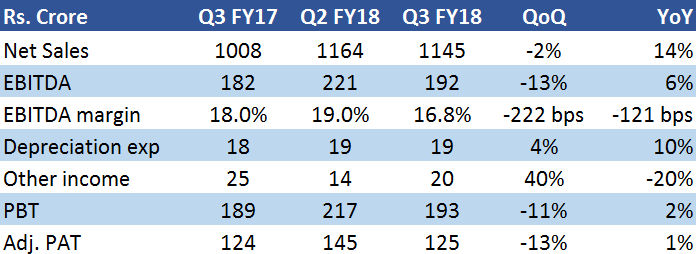

Nerolac Q3 2018

For Asian Paints, consolidated sales for Q3 FY18 (+14 percent YoY) were aided by price hikes earlier in the fiscal year (May 2017) and single digit volume growth (~6-7 percent vs ~3 percent in Q3 FY17) in the domestic decorative paints business.

While demand is clearly not back to pre-GST levels, early festive season and extended monsoon in South India also impacted sales growth.

The company's EBITDA margin improved by 129 basis points year-on-year on account of lower other expenses and cost saving measures offsetting higher raw material prices. Further, a muted rise in interest expense and higher other income led to the bottomline growing 20 percent YoY.

Below par volume growth

While the medium term volume outlook appears positive for the paints sector, aided by expected pick up in rural demand, the government’s focus on housing and shorter re-painting cycle, quarterly numbers and management commentary keep us circumspect on Asian Paints' volume growth in the near term.

The company management was guarded about calling out any trend, particularly rural demand improvement and the shift from the unorganized sector to the organized sector. Asian Paints' volume growth in the decorative segment continues to remain below its nearest peer – Nerolac.

Nerolac posted ~20 percent volume growth in Q2 and ~15 percent in Q3 FY18 in the decorative segment, while Asian Paints has been struggling with 6-8 percent growth in the segment for last two quarters. If it continues at the same rate, the company could possibly lose market share in some segments in the near future.

Oil price impacts input cost

Raw material prices (50.3 percent of Q3 FY18 sales vs 47.0 percent in Q2 FY18) have edged higher on account of a rise in prices of crude derivatives (solvents), methyl methacrylate (MMA) and butyl acrylate. A similar trend was witnessed for Kansai Nerolac (58.4 percent of Q3 FY18 sales vs 56.2 percent in Q2 FY18).

International titanium dioxide (TiO2) spot prices have softened from their peak from middle of last year. However, Asian Paints doesn’t seem to have seen any meaningful gain from the trend. In fact, in the near term, the company expects elevated prices to continue for some time.

It’s noteworthy that TiO2 accounts for around 20 percent of the raw material cost incurred by the company and is one of the most important raw materials that domestic paints companies have to deal with.

The only domestic producer of TiO2 in India is Kerala Minerals and Metals ltd (KMML). Asian Paints' management mentioned that KMML’s current capacity is limited but it has recently started working on expanding capacity, which should come on stream in two years.

International operations

Currency devaluation in Egypt and Ethiopia continued to impact performance of the company's international operations.

Revival of volume growth is the key

Key factors to watch out for in near term is the company's raw material cost pressure, a shift in market share, and recovery in the South India market.

The company's stock is not priced cheaply at the moment, trading at 45x 2019E earnings, which is similar to the median multiple for the staples (HUL at 48x and GICS Staples at 42x 2019E earnings) and ahead of Kansai Nerolac (42x). So we would wait for a revival in volume growth before getting constructive on the stock.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.