By MD Ranganath and Karthik Swaminathan

Global equity markets are sharply down due to the tariffs imposed by President Trump, and Indian markets have not been immune to this decline. While the 90-day tariff pause temporarily provided some relief to the markets, the escalating trade war between the US and China led to further market corrections in the latter part of this week. The VIX index, which is the “fear indicator” in the markets, nearly doubled in April. The core hypothesis for the market’s reaction is that American tariffs will disrupt global trade significantly and lead to a global economic slowdown.

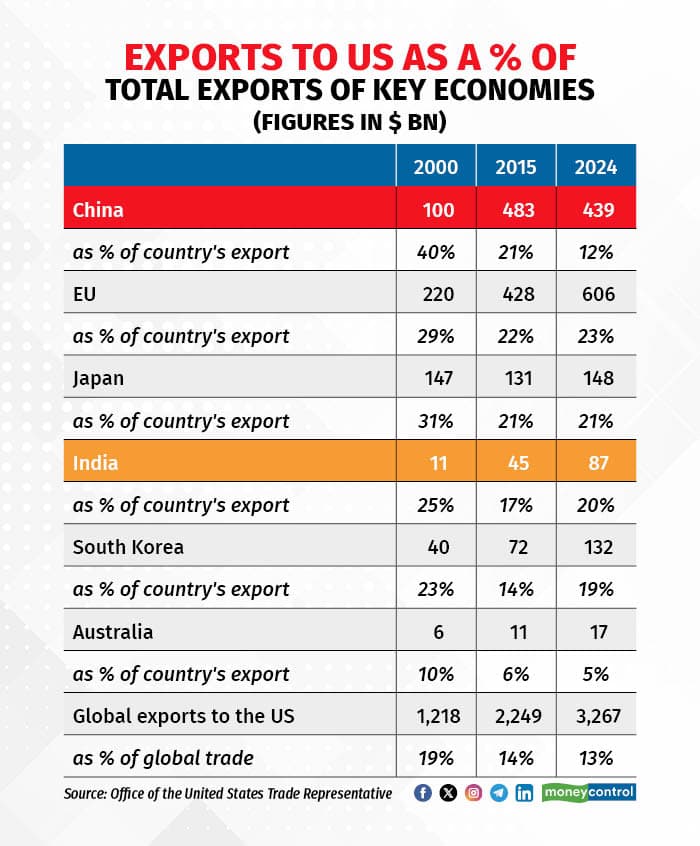

If we step back and look at global trade data over the last 25 years, it is evident that the US is no longer the centre of global commerce it once was. In 2000, US imports accounted for around 20% of global trade. This steadily decreased to 13% in 2024. In the same period, China’s entry into the WTO has made it a ‘factory for the world’ and has replaced the US as the top trading partner for 145 countries globally.

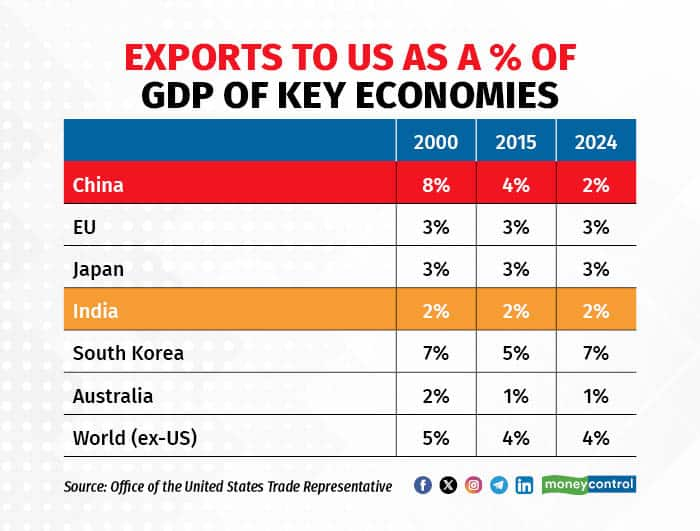

The tables above show how major economies have been reducing their dependence on the USA as a market for their exports. China’s goods exports to the US accounted for 40% of their total exports in 2000. This reduced to 21% in 2015 and just 12% in 2024. Exports contributed to less than 20% of China’s GDP in 2024, and exports to the USA contributed just 2% to its GDP. If, in the worst-case scenario, China’s exports to the USA were to go down to zero, China’s GDP could still grow at 4% per annum.

For Europe and Japan, their goods exports to the USA were around 20% of their total exports in 2024 and constituted 3% of their GDP. Given that their economies are growing at just around 1% per annum, any fall in exports would be impactful.

India’s goods exports to the US account for 20% of its total goods exports, but they constitute just 2% of India’s GDP. India earns its foreign exchange largely from the exports of services and remittances from Indians abroad. India’s IT services exports of around $200bn accounted for 5% of GDP in FY24. President Trump has not imposed any tariffs on the IT sector so far, and even the 2025 H-1B lottery, India’s traditional pressure point, was completed on schedule and without disruption. Money sent home by India’s diaspora ($106bn in FY24; 3% of GDP) also remains untouched by tariffs.

In addition, commodity prices have been moderating. Oil prices have fallen by around 30% over the last year. For a large oil importer like India, a $10 drop in crude oil would reduce the current account deficit by $11bn (which was $23bn in FY24).

The Reserve Bank of India holds $676bn in reserves and has shown that it will defend the currency around the mid-80s to the dollar. Forward markets price only a gentle depreciation over the next year.

The China+1 strategy, set in motion over a decade ago and fast-tracked by the pandemic, has gained renewed momentum due to the difference in tariffs imposed on India and China. Global firms are increasingly choosing India as their alternative manufacturing hub, drawn by a growing roster of marquee names establishing operations here. Complementing this shift, the Indian government is investing heavily in world-class infrastructure to bring down logistics costs and boost competitiveness. We believe India’s potential as a hub for precision manufacturing exports remains strong.

The income tax cuts in the Union Budget for 2025, moderating inflation, and lower interest rates will put more disposable income in the hands of the Indian middle class, boosting domestic consumption.

While President Trump’s tariffs add to market volatility, the world is no longer as dependent on the USA as it was even 10 years ago. For India, resilient IT services exports, cheaper energy, healthy foreign exchange reserves, and a supportive monetary policy should more than offset the drag from a modest dip in goods exports to the US, if any. The impact on India’s GDP and the earnings growth of companies is minimal, making the market’s reaction to the tariffs appear overdone. Hence, we expect markets to recover from here.

(The authors are MD Ranganath, Chairman of Catamaran, and Karthik Swaminathan, Associate Vice President at Catamaran.)

Views are personal, and do not represent the stance of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.