The market extended its northward journey for third day in a row, supported by rebound in late trade on March 8. Weak Asian peers weighed on the sentiment, but the buying in banks, auto, oil & gas, and FMCG aided the recovery.

The BSE Sensex advanced 124 points to 60,348, while the Nifty50 climbed 43 points to 17,754 and formed bullish candlestick pattern with long lower shadow on the daily charts, with above average volumes.

Technically, this pattern indicates a buy on dips opportunity in the market.

"After reacting down from a crucial overhead resistance of 17,800 levels (opening downside gap of February 22 and weekly 10 and 20 period EMA - exponential moving average) on Monday, the market subsequently showing upside bounces post small correction could be a positive indication," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He feels the market could make an attempt to retest the key resistance again around 17,800 levels in the short term. Such repeated testing of the hurdle could eventually result in decisive upside breakout of the hurdle in the near term, he said, adding an immediate support is at 17,600 levels.

The broader markets also traded higher with the Nifty Midcap 100 and Smallcap 100 indices rising 0.5 percent and 0.2 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the Nifty has support at 17,645, followed by 17,606 and 17,543. If the index moves up, the key resistance levels to watch out for are 17,770, followed by 17,809 and 17,872.

Banks provided the key support to the Nifty50, as Bank Nifty rose 227 points to 41,577, and formed Bullish Engulfing kind of pattern on the daily charts, but negated the higher highs formation of previous seven consecutive sessions.

The Bank Nifty bulls came back strong and the index managed to hold the support of 41,000 on the downside. "The index is likely to trade in the range of 41,000-42,000 but within the range, the undertone remains bullish and one should keep a buy-on-dip approach with immediate support at the 41,200 levels," Kunal Shah, Senior Technical Analyst at LKP Securities said.

He feels the resistance of 42,000, if taken out, will open up the gates for a further up move towards 43,000 levels.

The important pivot level, which will act as a support, is at 41,234, followed by 41,110 and 40,909. On the upside, key resistance levels are 41,635, followed by 41,759, and 41,959.

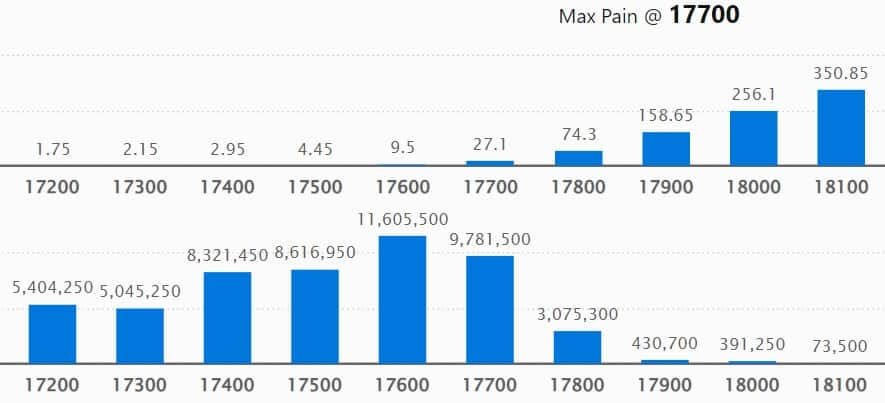

On a weekly basis, we have seen the maximum Call open interest (OI) at 17,800 strike, with 1.12 crore contracts, which may remain a crucial resistance level for the Nifty in the coming sessions.

This is followed by a 17,900 strike, comprising 1.01 crore contracts, and a 18,000 strike, where there are more than 97.56 lakh contracts.

Call writing was seen at 17,800 strike, which added 30.11 lakh contracts, followed by 17,900 strike, which gave an addition of 26.14 lakh contracts, and 18,000 strike which saw 20.25 lakh contracts addition.

We have seen Call unwinding at 18,300 strike, which shed 13.35 lakh contracts, followed by 17,400 strike which shed 3.97 lakh contracts, and 18,400 strike which shed 3.27 lakh contracts.

On a weekly basis, the maximum Put OI was seen at 17,600 strike, with 1.16 crore contracts, which is expected to act as a crucial support zone for the Nifty50 in coming sessions.

This is followed by the 17,700 strike, comprising 97.81 lakh contracts, and the 17,500 strike, where we have 86.16 lakh contracts.

Put writing was seen at 17,600 strike, which added 53.87 lakh contracts, followed by 17,700 strike with 42.87 lakh contracts, and 17,200 strike with 18.34 lakh contracts.

We have seen Put unwinding at 17,000 strike, which shed 2.86 lakh contracts, followed by 17,900 strike which shed 1.34 lakh contracts, and 18,200 strike which shed 91,850 contracts.

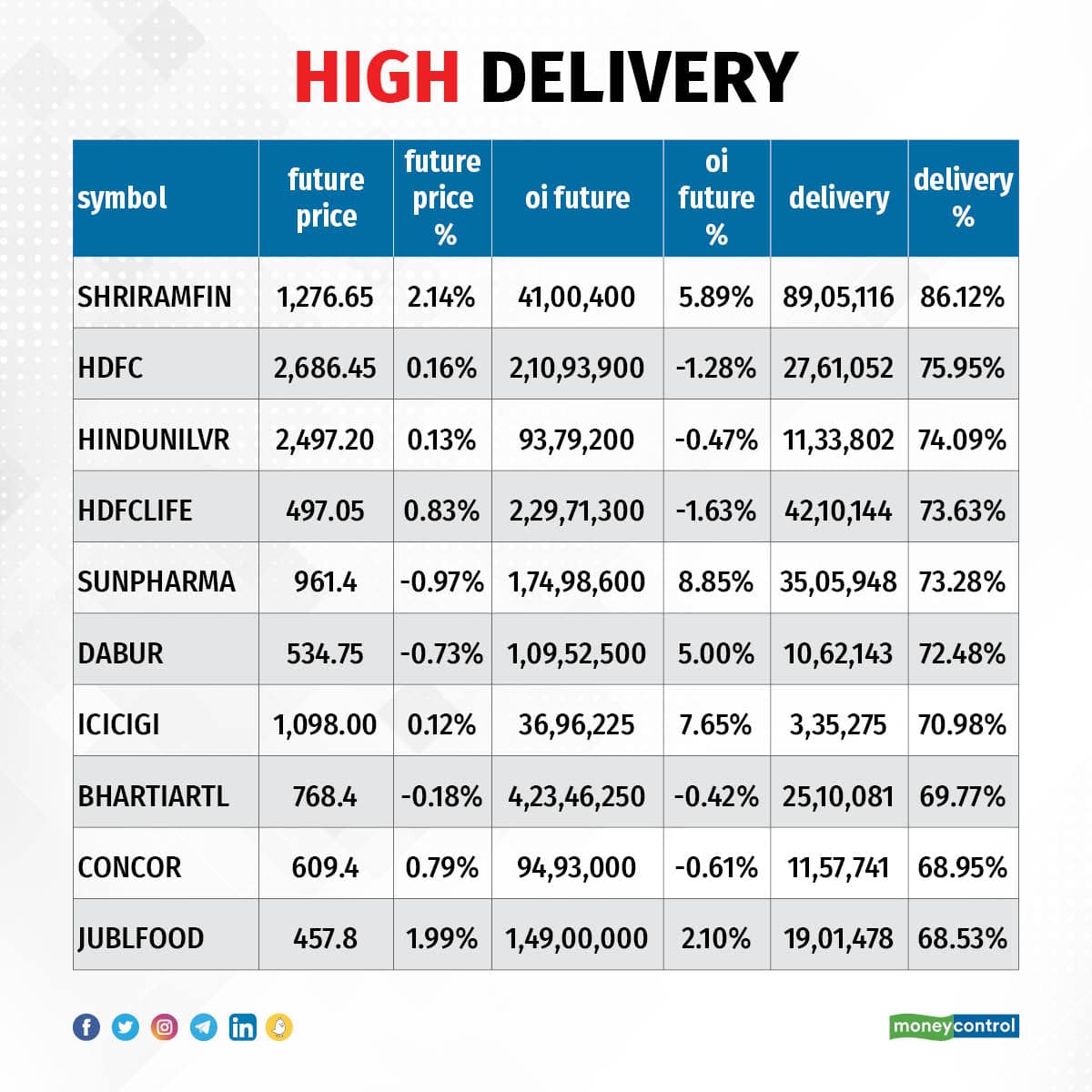

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Shriram Finance, HDFC, Hindustan Unilever, HDFC Life Insurance Company, and Sun Pharmaceutical Industries, among others.

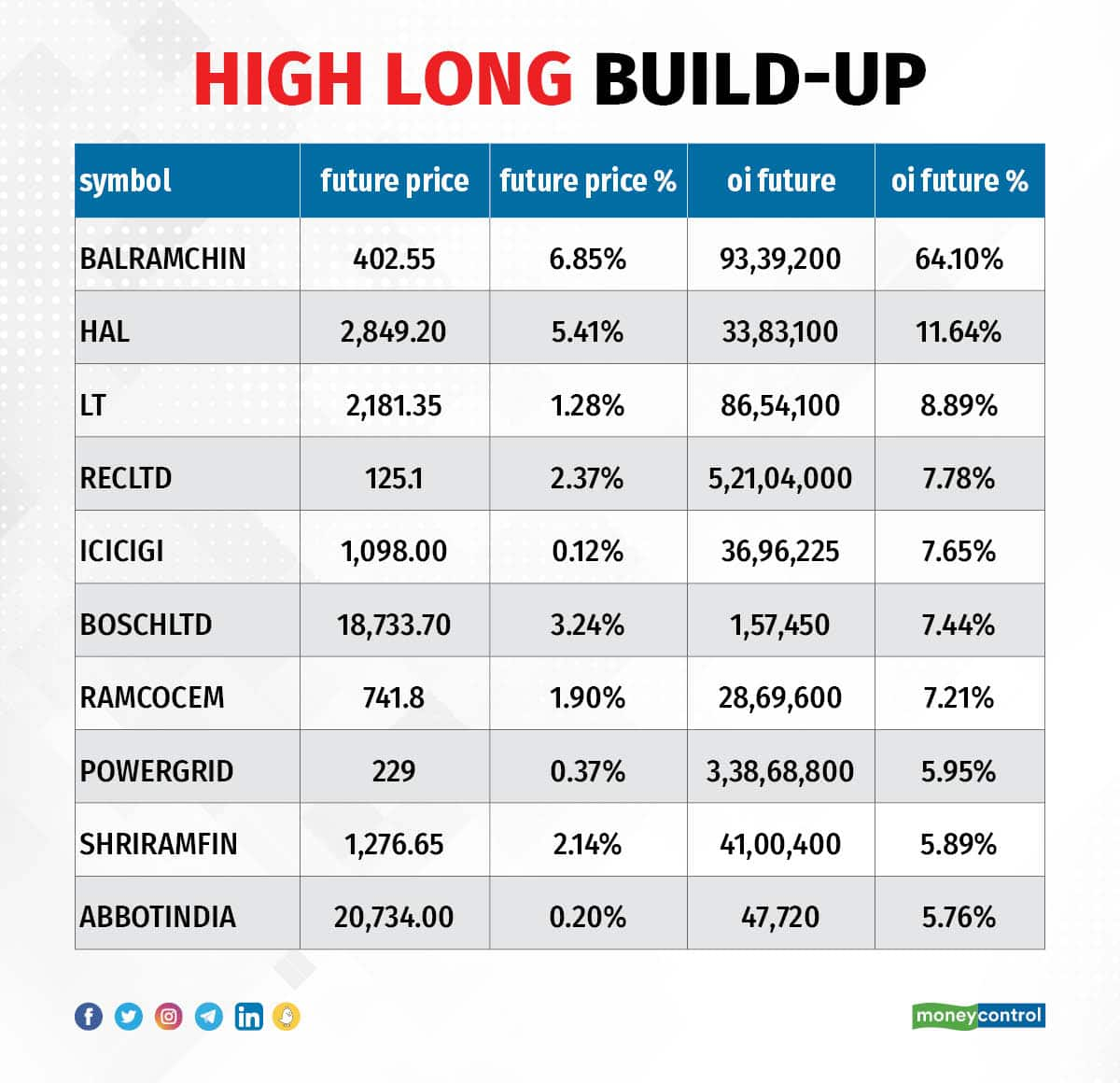

An increase in open interest (OI) and an increase in price mostly indicate a build-up of long positions. Based on the OI percentage, 72 stocks including Balrampur Chini Mills, Hindustan Aeronautics, Larsen & Toubro, REC, and ICICI Lombard General Insurance Company, witnessed a long build-up.

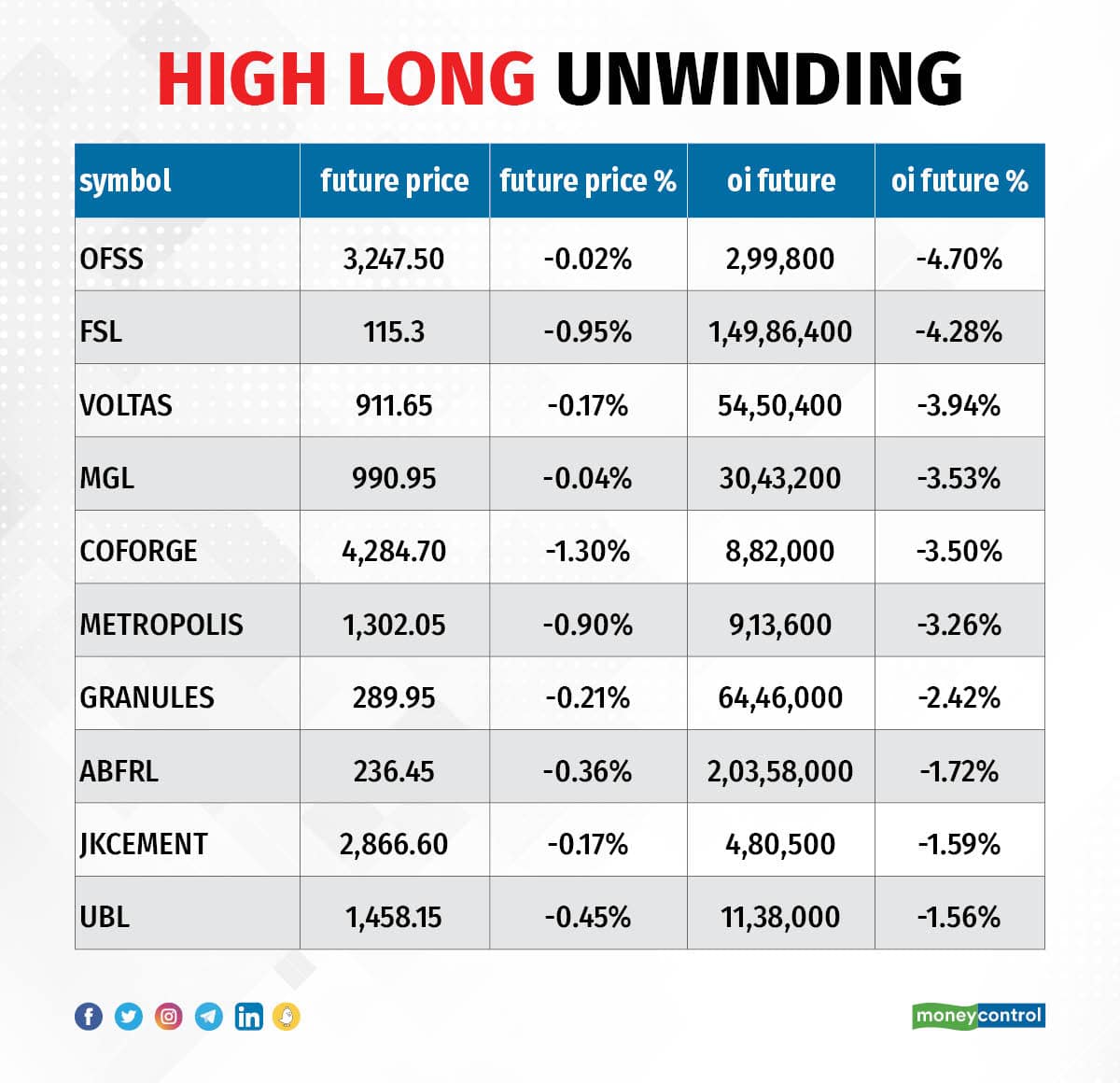

A decline in OI and a decrease in price, in most cases, indicate long unwinding. Based on the OI percentage, 25 stocks including Oracle Financial, Firstsource Solutions, Voltas, Mahanagar Gas, and Coforge, witnessed a long unwinding.

54 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicates a build-up of short positions. Based on the OI percentage, 54 stocks including Sun Pharmaceutical Industries, Max Financial Services, Crompton Greaves Consumer Electricals, Dabur India, and RBL Bank, saw a short build-up.

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 42 stocks were on the short-covering list. These included UltraTech Cement, Honeywell Automation, Navin Fluorine International, Godrej Consumer Products, and Chambal Fertilizers.

Jindal Stainless: iShares Core MSCI Emerging Markets ETF has bought 33.69 lakh equity shares (0.64 percent stake) in the stainless steel company via open market transactions, at an average price of Rs 309.42 per share. These shares are worth Rs 104.3 crore

Kirloskar Oil Engines: A total of 10 investors have picked 13.65 percent stake in the engineering, power generation and solutions company via open market transactions, at an average price of Rs 322 per share, amounting to Rs 636 crore. However, three promoters have offloaded 17.7 percent stake in the company. Franklin Templeton Mutual Fund, The Nomura Trust and Banking Co Ltd as the Trustee of Nomura Indian Stock Mother Fund, Nippon India Mutual Fund, Motilal Oswal Mutual Fund via Motilal Oswal Midcap 30 Fund, Max Life Insurance Company, HSBC Mutual Fund, Cybage Software, DSP Mutual Fund, BNP Paribas Arbitrage, and Birla Sunlife Insurance Company bought 1.97 crore shares, whereas promoters Jyotsna Gautam Kulkarni, Ambar Gautam Kulkarni, and Nihal Gautam Kulkarni sold 2.56 crore shares, amounting to Rs 825.06 crore.

Shriram Finance: Small Cap World Fund Inc and New World Fund Inc purchased 70.98 lakh shares in Shriram Finance via open market transactions at an average price of Rs 1,225.1 per share, amounting to Rs 869.8 crore. However, Dynasty Acquisition (FPI) sold 83.5 lakh shares at an average price of Rs 1,225.41 per share, and Arkaig Acquisition (FPI) offloaded 24.98 lakh shares at an average price of Rs 1,225.01 per share.

(For more bulk deals, click here)

Investors' meetings on March 9

Asian Paints: Company's officials will be meeting with Tata Mutual Fund, and Sundaram Mutual Fund.

Tata Communications: Officials of the company will participate in ICICI Securities Corporate Roadshow in US.

One 97 Communications: Company's officials will participate in Citi’s 2023 EM FinTech Forum.

Arvind: Senior management of the company is attending Digital investor meeting with Mahindra Manulife AMC for discussing business strategy.

V-Mart Retail: Company officials will interact with Laburnum Capital and Sharekhan BNP Paribas.

DCX Systems: Officials of the company will meet Roha Asset Managers.

Nippon Life India Asset Management: Company officials will interact with SGA.

Persistent Systems: Officials of the company will meet White Oak.

Eicher Motors: Company officials will interact with Baillie Gifford and Nippon India Mutual Fund.

Allcargo Logistics: Officials of the company will participate in non-deal roadshow to meet investors and analysts.

Mahanagar Gas: Conference call is scheduled to be held to discuss the proposed acquisition of Unison Enviro.

Pidilite Industries: Company officials will interact with Hermes Investment Management.

PVR: Officials of the company will participate in a group investor meeting organised by UBS Securities India.

Stocks in the news

Bharat Forge: The leading forging company has announced its E-bike manufacturing facility at MIDC Chakan, Pune, through its wholly owned subsidiary Kalyani Powertrain. The facility has a production capacity of 60,000 units per annum and scalable to 1 lakh units per annum, will undertake assembly of E-bikes for Tork Motors, wherein 64.29 percent owned by Kalyani Powertrain.

SeQuent Scientific: The company has terminated the share purchase agreement to acquire 100 percent shareholding in Tineta Pharma. in November 2022, it had announced acquisition of Tineta Pharma, but now the said transaction has not materialised. Therefore, the company will not acquire Tineta and the Share Purchase Agreement entered by the company with Tineta and its promoters stands terminated.

Shoppers Stop: Headquartered in Singapore, Shiseido Asia Pacific Pte Ltd signed a strategic distribution partnership agreement with Global SS Beauty Brands, a subsidiary of Shoppers Stop, to expand its brand footprint in India. Through the partnership, Shiseido Group will launch its global make-up brand, NARS Cosmetics (headquartered in New York), in second half of 2023 in key cities in India.

Ramkrishna Forgings: The forging company has incorporated a wholly owned subsidiary - RKFL Engineering Industry - on March 6, to implement the resolution plan under Corporate Insolvency Resolution Process (CIRP) for acquisition of JMT Auto. RKFL Engineering is going to engage in the business of forging, pressing, stamping, and roll forming of metal and powder metallurgy.

ISMT: R Poornalingam has resigned as an independent director of the company, with effect from March 8. He resigned due to personal reasons.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 3,671.56 crore, whereas domestic institutional investors (DII) sold shares worth Rs 937.80 crore on March 8, the National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has added Balrampur Chini Mills on its F&O ban list for March 9. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.