The market snapped a six-day uptrend and formed Bearish Engulfing candlestick pattern on the daily charts, hence experts feel there is a possibility of some profit booking as well as consolidation at higher levels, but given the continuation of higher highs, higher lows formation, overall the bulls are still in a healthy mood, who after this correction may lift Nifty 50 to new highs again.

According to experts, the Nifty 50 may take a support at 21,750 level and on the higher side, in case of bounce back, it may face resistance at 22,300 mark.

On February 21, the benchmark indices corrected for the first time in last seven consecutive sessions. The BSE Sensex fell 434 points to 72,623, while the Nifty 50 was down 142 points to 22,055.

"A long bear candle was formed on the daily chart, that has engulfed the positive candle of previous session. Technically, this pattern signals a formation of Bearish Engulfing at the highs. Normally, such formation after a reasonable up move indicates short term top reversal pattern for the market," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

He feels the bullish chart pattern like higher tops and bottoms continued as per daily timeframe chart and Wednesday's swing high of 22249 could now be considered as a new higher top of the sequence.

Hence, short-term weakness could be expected and the next lower supports to be watched at 21,850-21,750 levels, he said.

According to Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas, until record high of 22,249 (seen on February 21) is not taken out, the Nifty can expect consolidation in the near term.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 22,005, followed by 21,945 and 21,849 levels, while on the higher side it may see immediate resistance at 22,197 followed by 22,256 and 22,352 levels.

Meanwhile, on February 21, the Bank Nifty also saw profit booking after six-day run up, falling 75 points to 47,020 and formed bearish candlestick pattern on the daily scale, but continued higher highs, higher lows formation for six straight sessions.

"The Bank Nifty index experienced a volatile trading session during the weekly expiry and encountered resistance around the 47,300 levels. Currently stuck in a broad range of 46,500-47,500, the index faces limitations on further upside until it surpasses the 47,300 mark," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

The immediate support stands at 46,800, and a breach below this level could intensify selling pressure, potentially pushing the index towards 46,500, he feels.

As per the pivot point calculator, the Bank Nifty is expected to take support at 46,908, followed by 46,795 and 46,613 levels, while on the higher side, the index may see resistance at 47,272, followed by 47,384 and 47,566 levels.

On the weekly options data front, the 22,500 strike owned the maximum Call open interest with 1.39 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,200 strike, which had 1.38 crore contracts, while the 22,300 strike had 1.05 crore contracts.

Meaningful Call writing was seen at the 22,200 strike, which added 85.79 lakh contracts followed by 22,500 and 22,300 strikes adding 85.03 lakh and 64.93 lakh contracts, respectively.

The maximum Call unwinding was at the 23,200 strike, which shed 3.06 lakh contracts followed by 23,300 and 21,800 strikes, which shed 2.25 lakh and 1.88 lakh contracts.

On the Put side, the maximum open interest was seen at 21,500 strike, which can act as a key support level for Nifty, with 98.43 lakh contracts. It was followed by 22,000 strike comprising 74.72 lakh contracts and then 21,800 strike with 68.53 lakh contracts.

Meaningful Put writing was at 21,500 strike, which added 43.84 lakh contracts, followed by 21,900 strike and 21,800 strike, which added 19.09 lakh contracts and 18.17 lakh contracts.

Put unwinding was seen at 22,100 strike, which shed 31.5 lakh contracts, followed by 21,000 strike, which shed 20.02 lakh contracts and 21,400 strike which shed 15.38 lakh contracts.

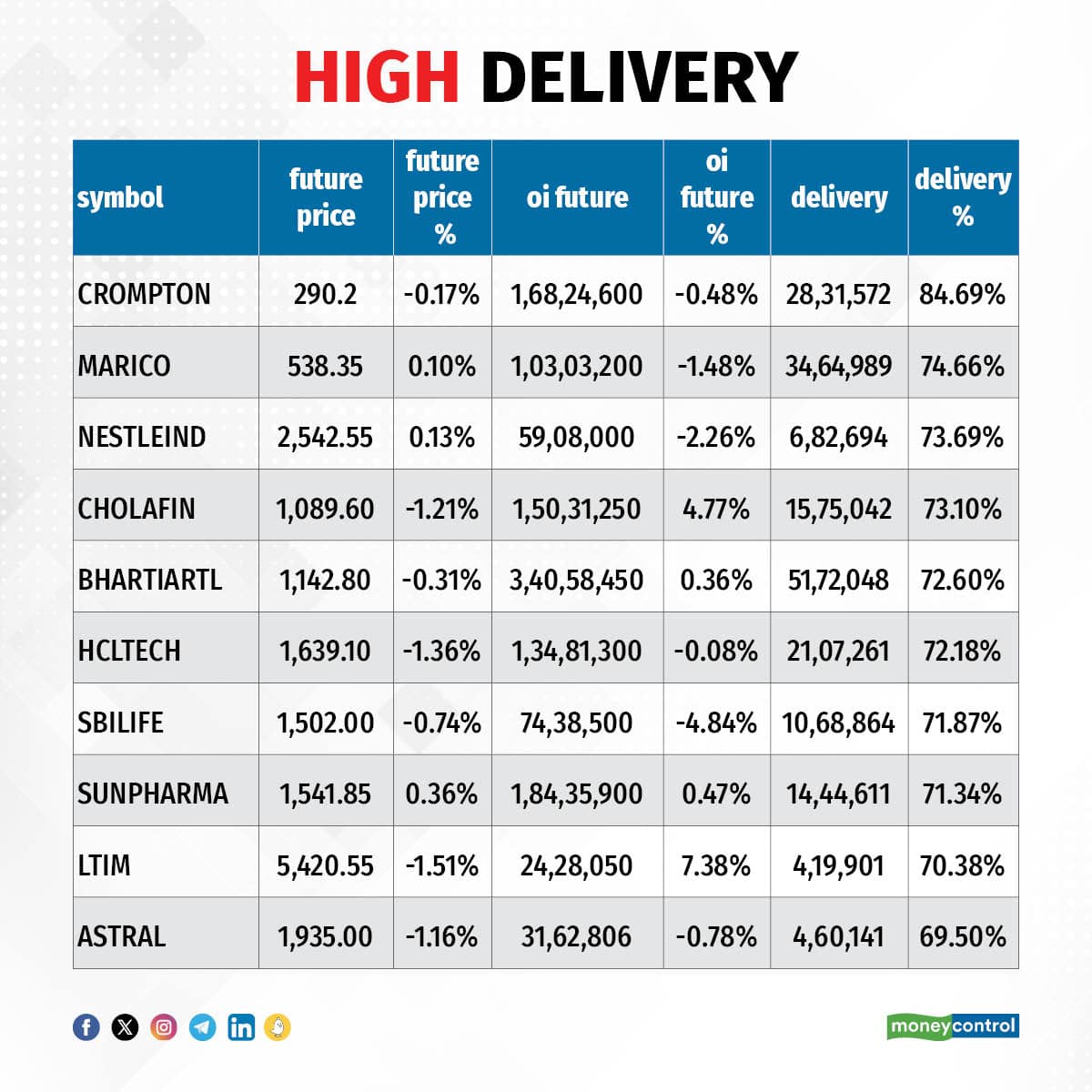

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Crompton Greaves Consumer Electricals, Marico, Nestle India, Cholamandalam Investment & Finance, and Bharti Airtel saw the highest delivery among the F&O stocks.

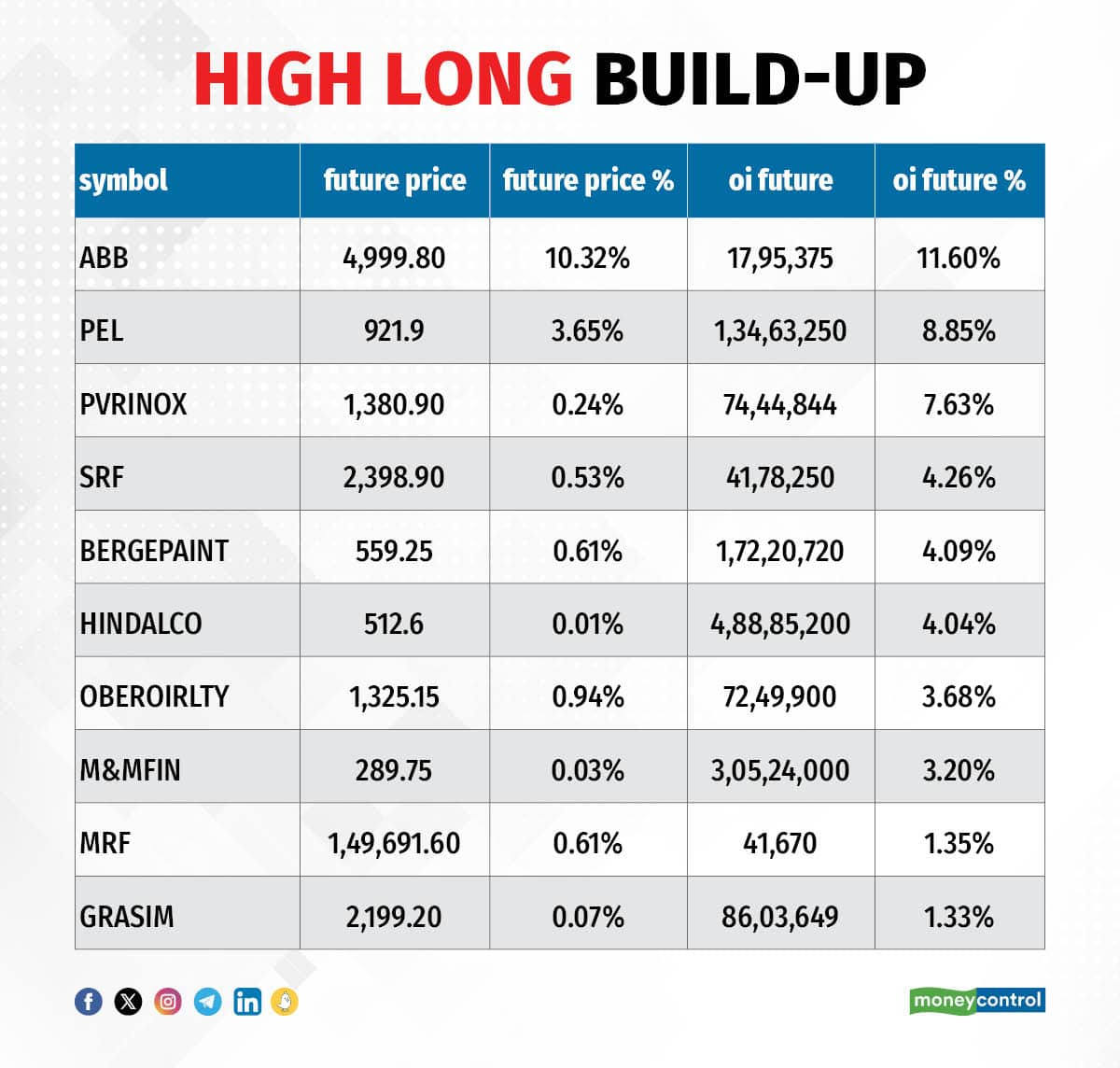

A long build-up was seen in 17 stocks, which included ABB India, Piramal Enterprises, PVRINOX, SRF, and Berger Paints. An increase in open interest (OI) and price indicates a build-up of long positions.

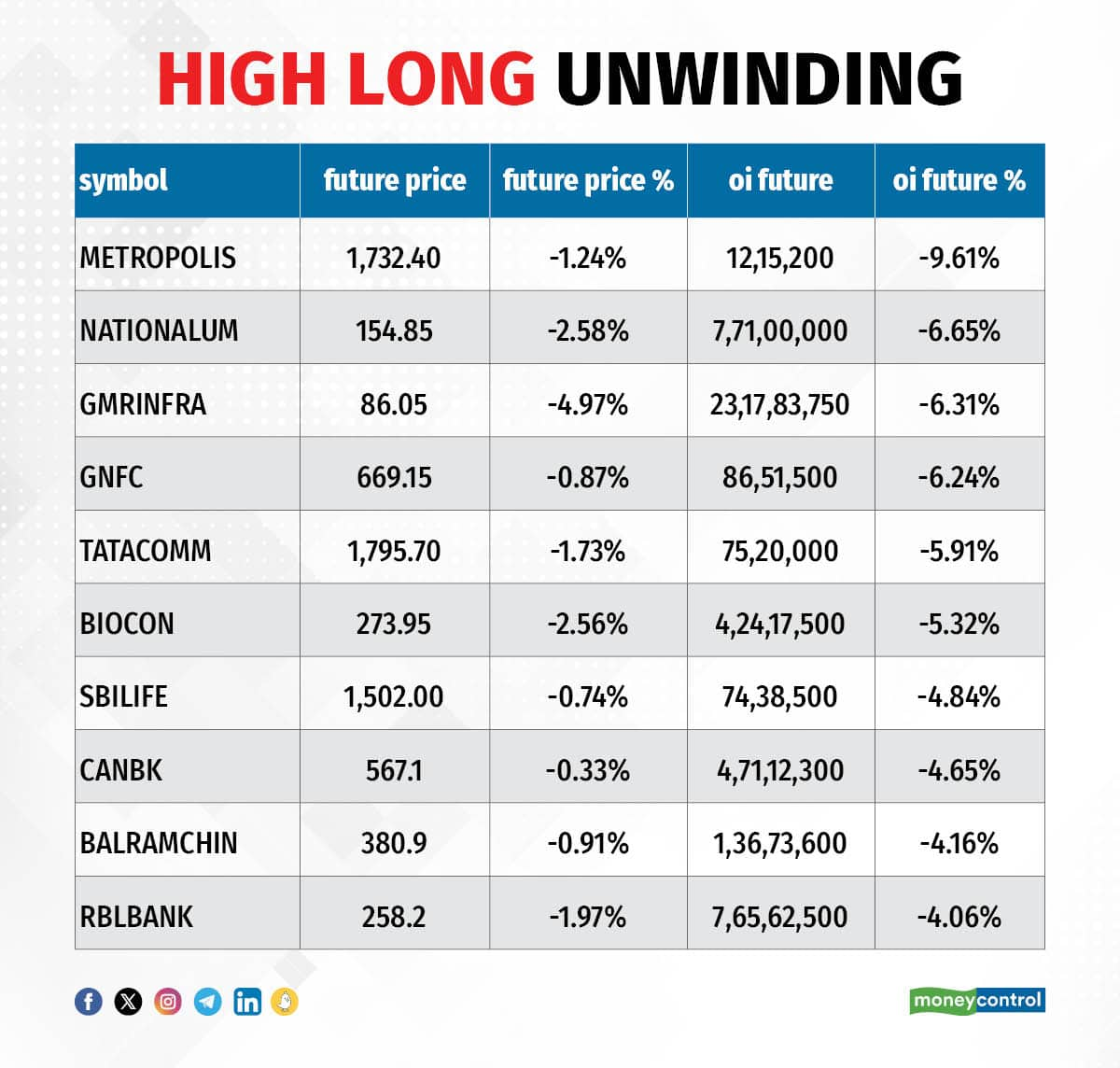

Based on the OI percentage, 74 stocks saw long unwinding including Metropolis Healthcare, National Aluminium Company, GMR Airports Infrastructure, GNFC, and Tata Communications. A decline in OI and price indicates long unwinding.

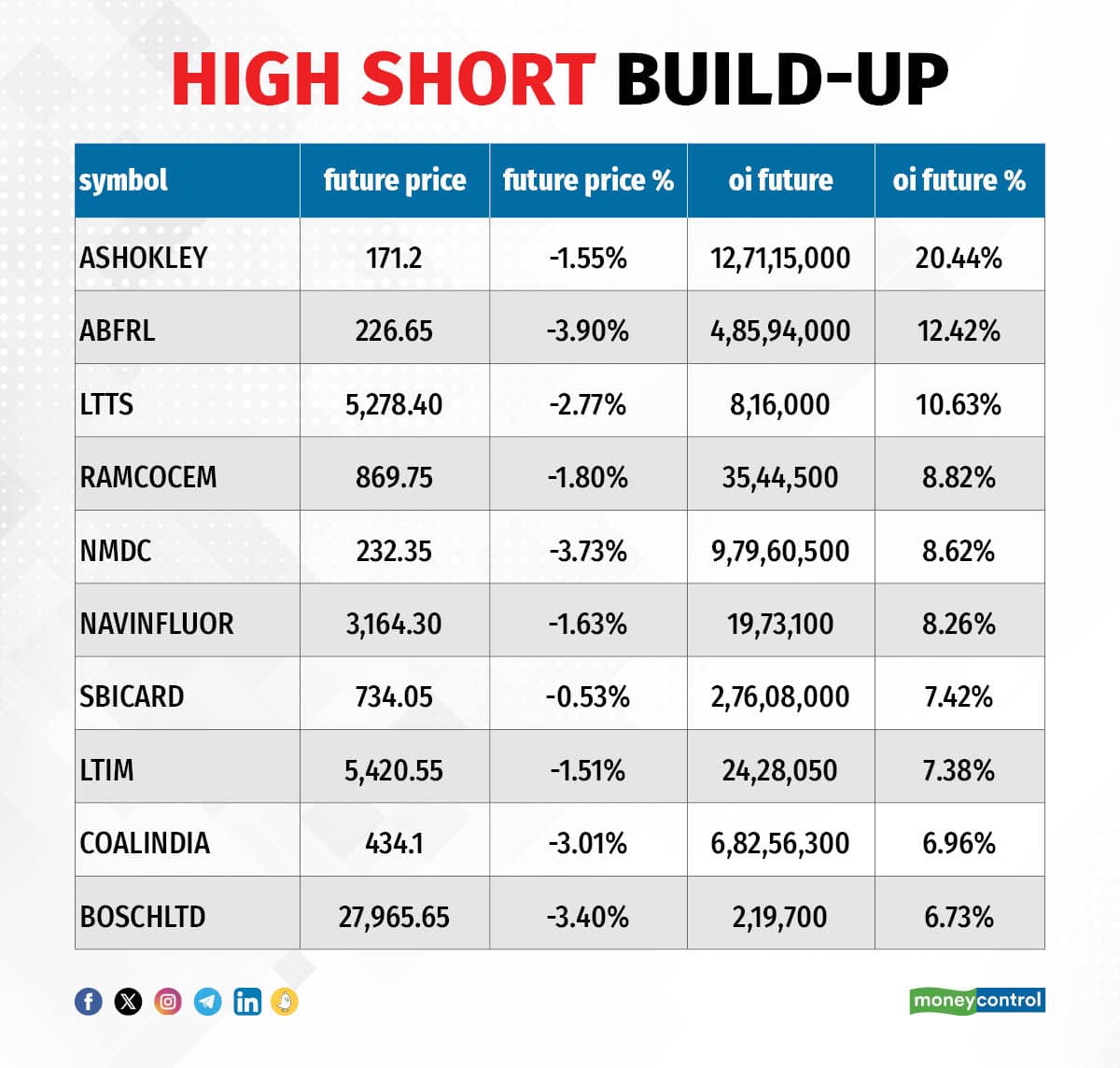

72 stocks see a short build-up

A short build-up was seen in 72 stocks including Ashok Leyland, Aditya Birla Fashion & Retail, L&T Technology Services, Ramco Cements, and NMDC. An increase in OI along with a fall in price points to a build-up of short positions.

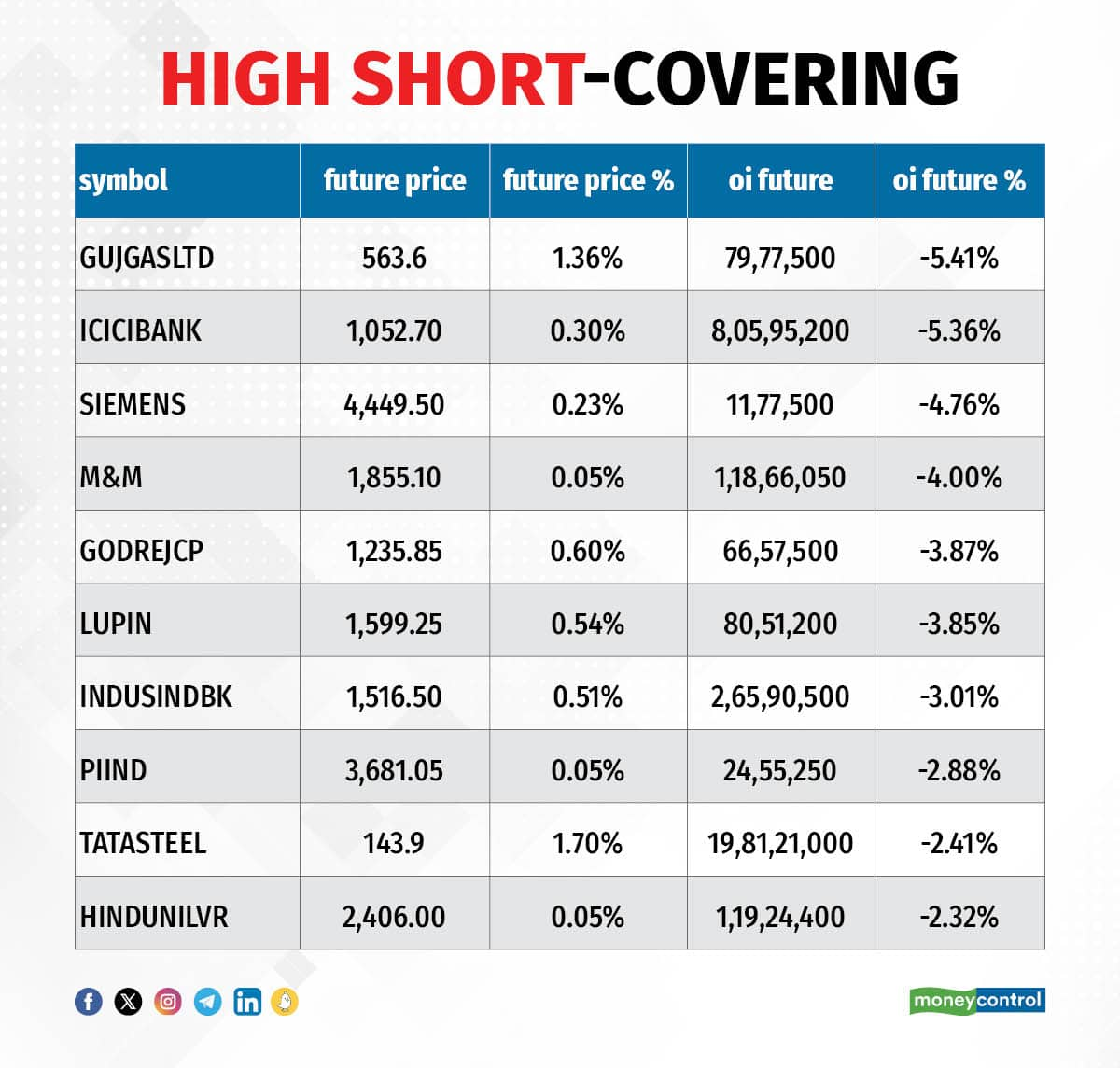

Based on the OI percentage, 23 stocks were on the short-covering list. This included Gujarat Gas, ICICI Bank, Siemens, M&M, and Godrej Consumer Products. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, declined to 0.85 on February 21 against 1.24 levels in the previous session. The PCR below 1 indicates that the trading volume of Call options is higher than the Put options, which generally indicates increasing bullish sentiment.

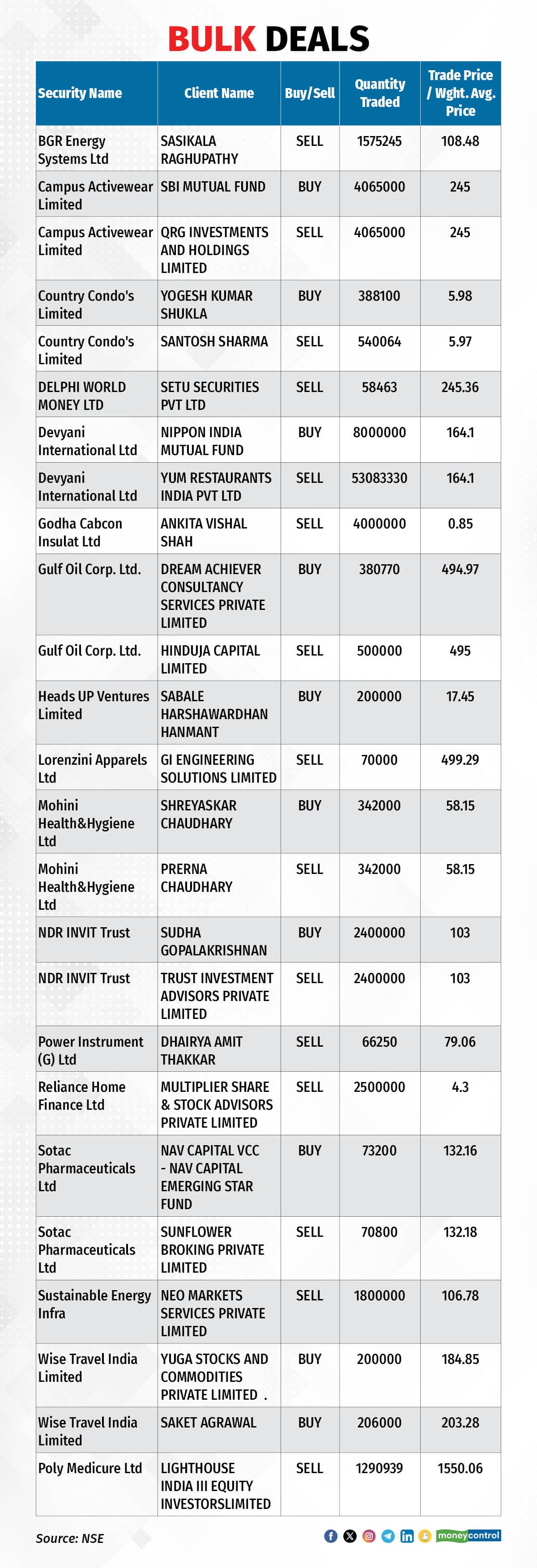

For more bulk deals, click here

Stocks in the news

Eureka Forbes: Sources told CNBCTV-18 that Eureka Forbes' promoter Lunolux is likely to sell up to 12 percent stake or 2.3 crore shares through block deals. Floor price of the deal is set at Rs 494.75, a discount of 3 percent and the deal size is at Rs 1,150 crore.

Homefirst Finance: The company received Corporate agent (Composite) license from IRDAI for soliciting life, general and health insurance. The Company will be able to solicit insurance products to its customers as a Corporate Agent.

Apollo Microsystems: The company announced that SBI sanctioned Rs 110 crore term loan for the company. The funding will be used for the establishment of the Integrated Plant for Ingenious Defence Systems (IPiDS) at Hardware Park, Hyderabad.

Brigade Enterprises: The company signed a joint development agreement with PVP Ventures to develop a 2.5 million square feet, high- rise residential project, spread across 16 acres in Perambur, Chennai with a revenue potential of about Rs 2,000 crore.

LTI Mindtree: The company has signed MoU to set up Gen Al & digital hubs in Europe & India. The facilities will be developed in Poland, Europe and Mumbai. Eurolife FFH will set up Generative Al and Digital Hub in Athens to develop innovative solutions for insurance businesses in Greece and LTIMindtree will provide deep domain expertise and support from its dedicated facilities in Poland and Mumbai.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 284.66 crore, while domestic institutional investors (DIIs) sold Rs 411.57 crore worth of stocks on February 21, provisional data from the NSE showed.

Stocks under F&O ban on NSE

The NSE has added Ashok Leyland, Piramal Enterprises, and PVR INOX to the F&O ban list for February 22, while retaining Balrampur Chini Mills, Bandhan Bank, Biocon, Canara Bank, GMR Airports Infrastructure, GNFC, Hindustan Copper, India Cements, Indus Towers, National Aluminium Company, RBL Bank, and Zee Entertainment Enterprises to the said list. SAIL was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.