Amid August 2025's market downturn (Nifty down 1.2%), thematic PMS strategies shine with digital disruption bets delivering up to 2.84% gains. Valcreate Investment Managers' IME Digital Disruption fund topped the charts with a robust 2.84% return, fueled by heavy exposure to new-age consumer tech. Thematic and small-cap strategies led the pack, with 6 out of 10 strategies being multi cap and flexi cap.

Returns range from a high of 2.84% (Valcreate's thematic focus on digital disruption) to a low of 0.75% (Ambit's large-cap quality-oriented approach). The top half averaged ~2.34%, while the bottom half averaged ~1.17%, indicating stronger momentum in specialized or mid/small-cap tilted funds.

Valcreate Investment Managers LLP - IME Disruption: Launched on February 10, 2023, the strategy is managed by Ashi Anand. It focuses on investing in digitally native platforms that have established dominance through network effects, possess high growth potential in large addressable markets, and have a clear path to profitability through pricing power and operating leverage.

Right Horizons - Perennial: The Right Horizons Perennial Fund was launched on April 1, 2019. It maintains a focused portfolio comprising 15-25 stocks, emphasizing long-term value creation through selective equity investments. Managed by Saatwik Jain, the strategy is market cap and sector agnostic.

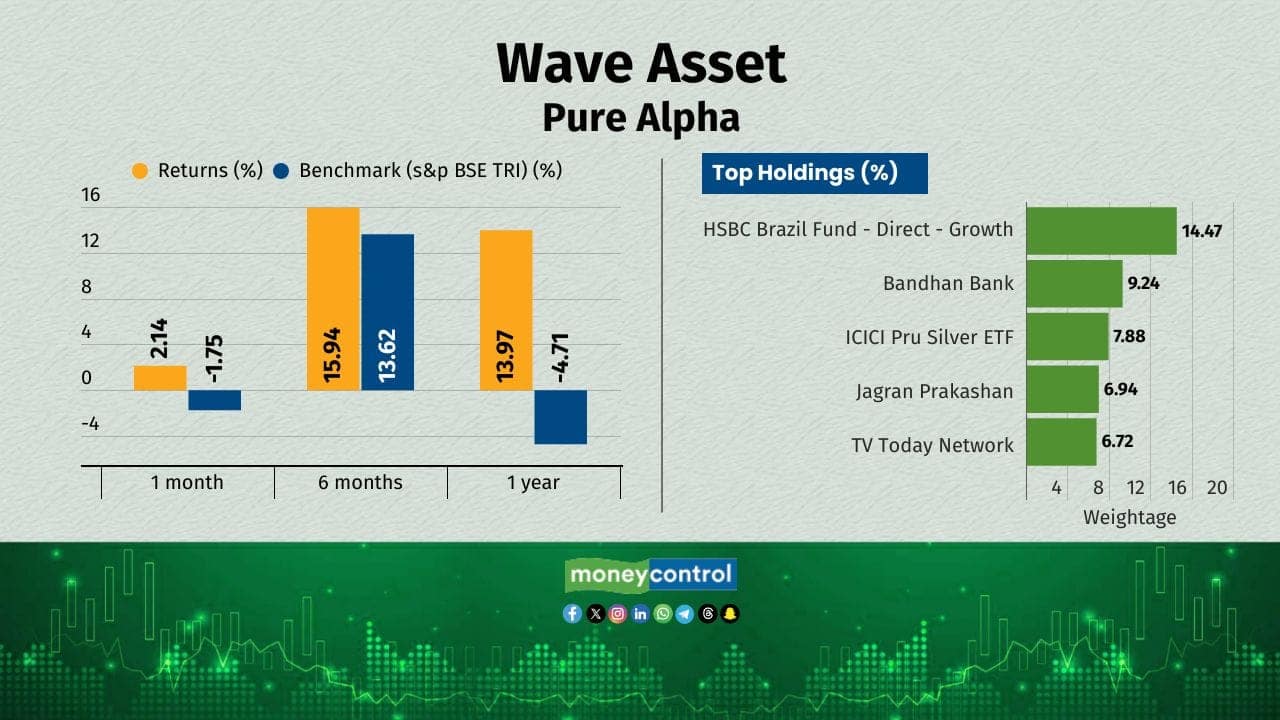

Wave Asset - Pure Alpha: By integrating bottom-up stock selection with top-down sector and regional allocation, it allocates capital based on macroeconomic trends and sector-specific opportunities. The fund is managed by Rohan Agarwal and strategically deviates from benchmark indices to minimize correlation.

File photo

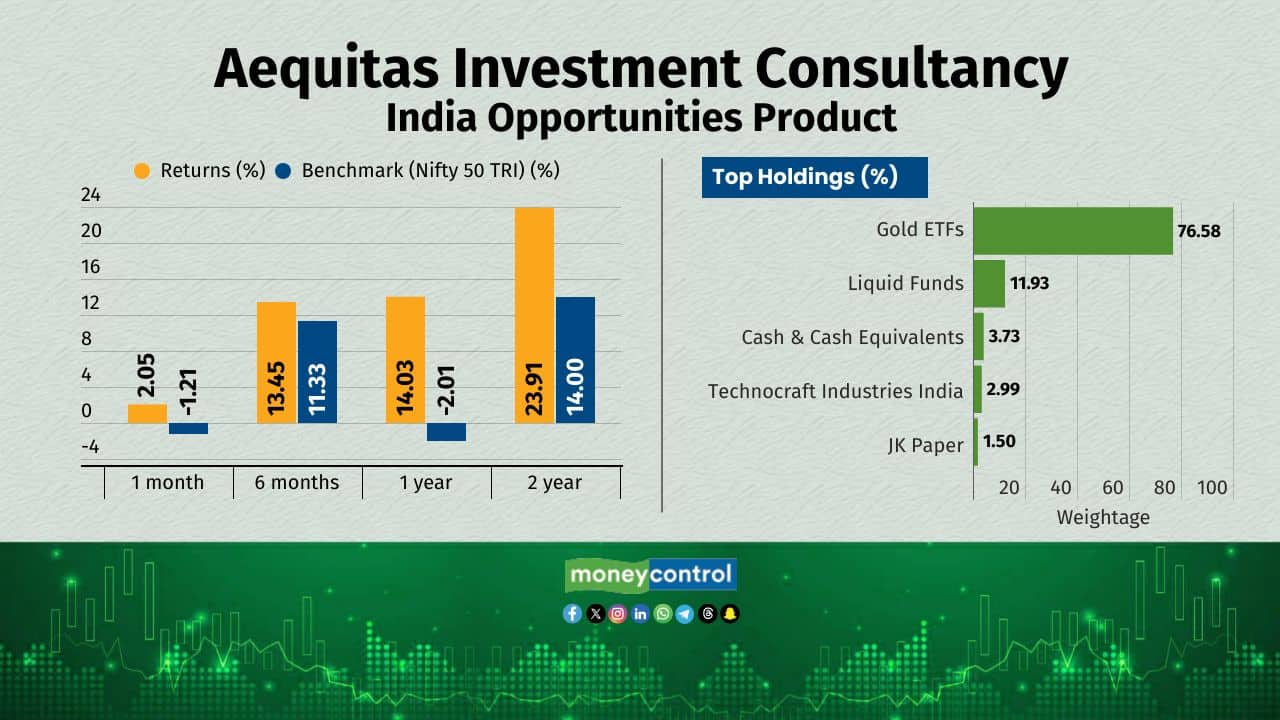

File photoAequitas Investment Consultancy - India Opportunities: Launched in February 2013, this is a high-conviction PMS targeting 120x multi-baggers in India’s small/micro-cap space. Managed by Siddhartha Bhaiya, it holds 15-20 small/micro-cap stocks, blending explosive growth (20%+ earnings), contrarian bets on shunned sectors, and value-driven picks with strong moats. It targets debt-light firms at steep discounts, using forensic research to ride 3-5 year re-ratings.

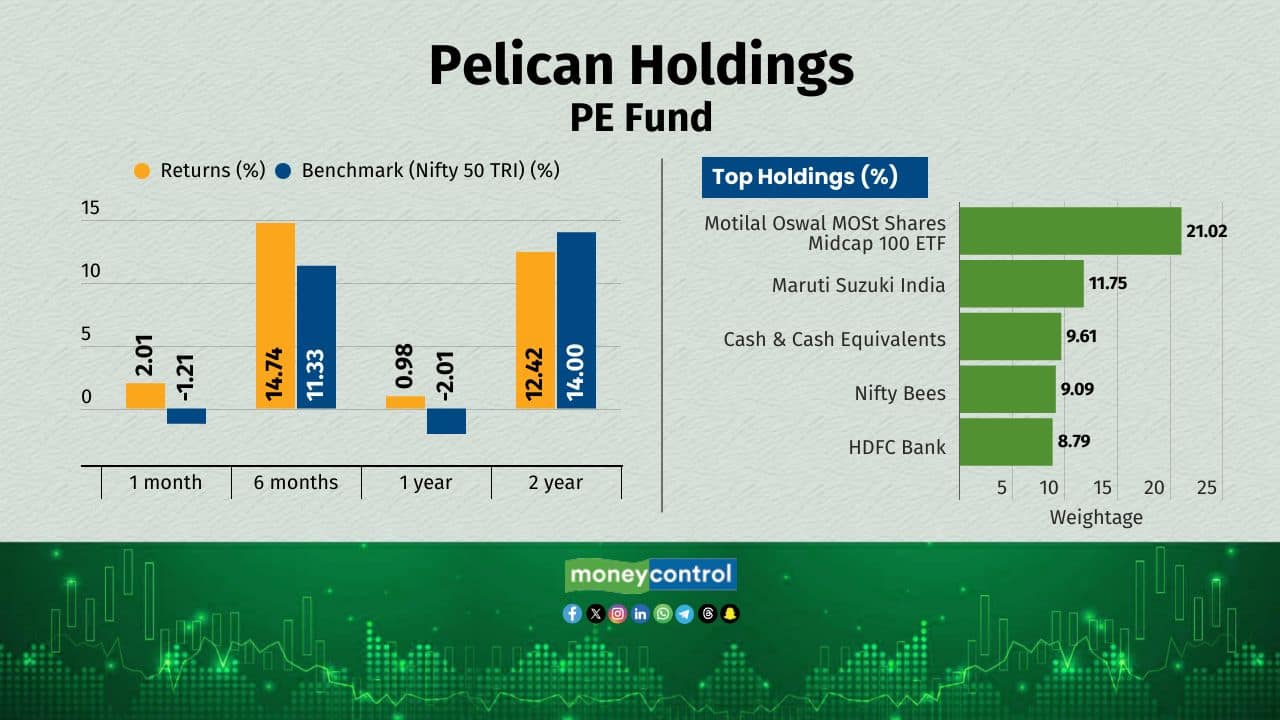

Pelican Holdings - PE Fund: It holds short-term debt until clear opportunities emerge, then buys and holds with minimal trades until a full exit at cycle peaks. Managed by Deepak Radhakrishnan, it targets 10 market leaders from the top 50 stocks by PE ratio, buys in four equal tranches to spread entry risk and holds through a bust-to-boom cycle.

Shade Capital - Value Fund: Shade Value Fund, a multi-cap PMS from Shade Capital Private Ltd, focuses on long-term capital appreciation through diversified equity investments. Managed by Mahim Mehta, it invests primarily in well-diversified equities and related securities across small, mid, and large caps, pursuing undervalued opportunities with strong fundamentals.

Envision Capital Services - India Opportunities: It is a multi-cap PMS that targets long-term growth through undervalued Indian equities with Nilesh Shah as the Founder and CEO, managing the strategy. It follows a bottom-up, value-oriented approach and is market-cap agnostic with hold over 15-20 stocks for long-term.

Sundaram Alternate Assets - SISOP: Sundaram Alternate Assets Ltd – SISOP was launched in September 2010 and is currently managed by Darshan Engineer. The goal of the fund is to generate capital appreciation across market cycle by investing in high conviction stocks. This is concentrated to 15 stocks and is skewed toward multisector and large cap stocks.

Qode Advisors LLP - Qode All Weather: The strategy is benchmarked to the S&P BSE 500 TRI. It is managed by Rishabh Nahar and employs a quantitative framework to construct a diversified ETF portfolio. The approach focuses on allocating across low-correlated asset classes such as momentum, low volatility, and gold.

Ambit Investment Advisors - Ambit Coffee Can Portfolio: It selects the top 1% of high-quality Indian companies for long-term holding, delivering ~24-25% compounded returns historically with volatility half that of the market. It follows a market-cap agnostic selection of 15-20 companies (min Rs 100 Cr market cap) with proven consistent growth, high RoCE, and robust competitive advantages — held for 10+ years with just 5-10% annual churn.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.